Auxly Cannabis Presents A Misleading Report Of Its Q3 Financial Results

Auxly Cannabis Group Inc. (TSX.V:XLY; OTCQX:CBWTF; CUSIP#: 05335P 11 7) reported its Q3 financial results on Friday (Nov.22) for the 3 months ended Sept. 30/2019 in a manner which presented a positive spin on the quarter's performance.

"This has been an incredible quarter for Auxly" according to CEO, Hugo Alves - but, upon close examination, it is hardly reflective as to how the company has been doing of late.

No where in the quarterly report did management compare the company's performance with that of the previous quarter (Q2/2019) but instead, for the sake of appearances, did so with the results of 12 months ago (Q3/2018). Had they reported their financials sequentially it would have revealed a much more informative, albeit much more negative, picture of the financial health of the company as it stands today.

This article compares the latest quarter (Q3/2019) with the previous quarter (Q2/2019) to provide a more accurate picture as to how the company's performance is trending in real time - and the results are not very impressive, as follows:

2019 Financial Picture: Q3 vs. Q2 (All currency amounts are in Canadian dollars)

- Revenue DECLINED 41.7% to $1.6M

- Expenses INCREASED 42.2%

- Gross Loss IMPROVED 91.8% to a loss of only $1.152M

- Net Loss INCREASED 23.6% to a loss of $17.3M

- Net Loss per Share INCREASED 50% to a loss of $0.03

- Cash & Equivalents INCREASED 56.6% to $186,526

- Total Assets INCREASED 29.1% to $568,090

- Total Debt INCREASED 94% to $187,443

Q3 Operational Highlights

In late July, Imperial Brands PLC (OTCQX:IMBBY) signed a $123M investment deal with Auxly that includes a research and development partnership and:

- gives Vancouver-based Auxly the global licences to the British tobacco giant's Nerudia vapor innovation business and becomes Imperial's exclusive global partner for future cannabis products and, in return,

- gives London-based Imperial Brands a 19.9% stake through a debenture convertible into Auxly equity, with a conversion price of $0.81/share and

- gives Imperial the right to convert the debt into stock at any time during the next 3 years with the obligation to repay the debenture in full at the end of the term if Imperial does not undertake the conversion.

Highlights Subsequent to Quarter End

- The company paid off $98.79M of its outstanding convertible debentures that were to come due January 17, 2020 with $80.0M in the form of cash while $16.0M was converted into common shares of the issuer significantly cleaning up the company's balance sheet as it heads into Q4.

- Hugo Alves, former President of Auxly and one of its co-founders, succeeded Chuck Rifici as Auxly's new CEO on August 27. Rifici continues in his role as chairman of Auxly’s board of directors.

Outlook/Guidance

The Company:

- is ready to enter the Cannabis 2.0 market on December 16, 2019 when provinces begin accepting orders from licenced producers (LPs),

- expects revenues to increase throughout 2020:

- as new consumers are attracted to their new product formats,

- as existing consumers transition from dried cannabis to derivative cannabis products,

- as provincial retail infrastructure continues to develop and expand and

- believes that, "Over the long-term...shareholders will benefit from the higher profitability and anticipated strong growth of the derivative cannabis product market."

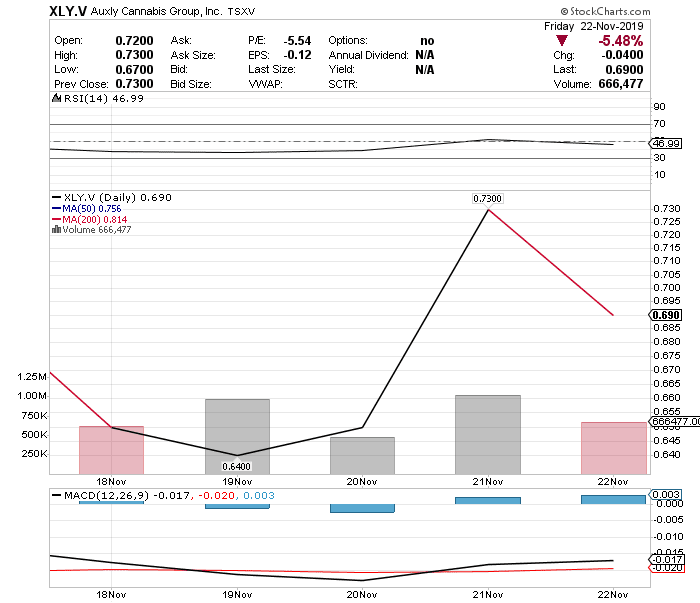

The Auxly stock moved up sharply (12.31%) on Thursday, November 21st with the announcement that a committee of the U.S. Congress had agreed to advance the Marijuana Opportunity, Reinvestment, and Expungement (MORE) Act bill to a full vote in the House where, were it to pass, it would end federal cannabis prohibition (see exclusive TalkMarkets article here). However, despite the release of its Q3 report, the stock price closed down 5.5% on Friday as seen below: