August And YTD Asset Class Performance

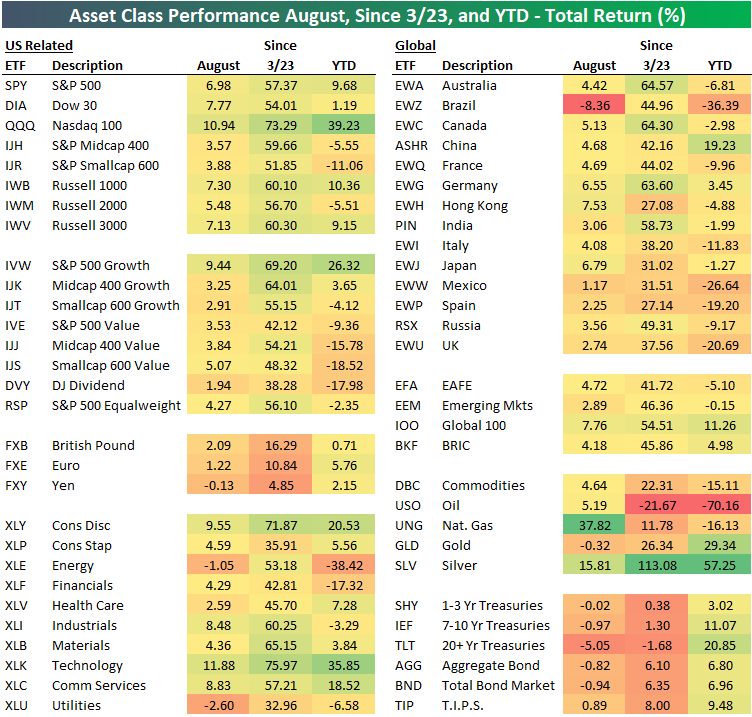

Below is a look at the recent performance across asset classes using key ETFs traded on US exchanges. All performance numbers represent total returns. The S&P 500 (SPY) gained 6.98% in August, but the Dow (DIA) and the Nasdaq 100 (QQQ) did even better with gains of 7.77% and 10.94%, respectively. The tech-heavy Nasdaq 100 has been the biggest winner by far across global index ETFs. It’s up 39.23% year-to-date and 73.29% since the March 23rd low made after the COVID Crash.

While everything is up off the March lows, there is wide performance disparity on a year-to-date basis across sectors, size, and themes like value and growth. Large-cap ETFs are now up solidly on the year, while small-cap ETFs like IWM and IJR are still in the red. Mid-cap value (IJJ), small-cap value (IJS), and the Dow Jones Dividend ETF (DVY) are all still down 15%+ on the year.

Looking at sectors, we saw Technology (XLK), Consumer Discretionary (XLY), Industrials (XLI), and Communication Services (XLC) gain 8%+ in August, while Utilities (XLU) and Energy (XLE) both declined during the month. Year-to-date, Tech (XLK) is up 35.9% while Energy (XLE) is down 38.4%.

Outside of the US, every country ETF tracked in our matrix was up in August with the exception of Brazil (EWZ), which actually fell 8.4%. Year-to-date, EWZ is still down 36.4%, while countries like Italy (EWI), Mexico (EWW), Spain (EWP), and the UK (EWU) are down double-digit percentage points as well. Germany (EWG) is the one European country in our matrix that’s up on the year. China (ASHR) is up 19.23%, which is 10 percentage points better than the S&P 500 (SPY).

Commodities have been all over the map in 2020, with the oil ETF (USO) down 70% YTD while silver (SLV) is up 57%. The natural gas ETF (UNG) had a banner August with a gain of nearly 38%, but it’s still down 16% YTD.

Fixed-income ETFs had a rough August as interest rates moved higher, but across the duration spectrum, Treasury ETFs are still up solidly on the year.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more