Argentina: Bracing For More Volatility

Argentina’s economy remains marked by high inflation, recession, and restricted debt-market access. A clearer macro outlook should emerge following the October 27 election, when we should know more about the likely strategy for debt renegotiations and FX policy. That strategy will present both upside and downside risks for asset prices.

Source: www.buenosairesfotogenica.com

Fiscal sustainability in question

As Argentineans head for the ballot box to elect its President on October 27, financial markets should brace for more volatility. We expect election results to confirm the return of the Kirchnerist opposition to power. As indicated by the primary results and as suggested by polls, opposition candidate Alberto Fernandez is likely to be Argentina’s next president, with former president Cristina Kirchner as his vice president.

With some investors still cautiously expecting an electoral turnaround by President Macri, it’s likely that election results could result in more volatility as Fernandez’s victory becomes fully priced.

But the transition should also add to market volatility as Macri’s policy incentives should remain short-term in nature. This could, for instance, result in continued fast depletion of FX reserves, which helps with near-term FX stability but is detrimental to long-term macro sustainability. Fernandez is worried and has questioned the current government’s strategy. The long transition also delays a resolution for the heavy debt-amortization scheduled for next year.

(Click on image to enlarge)

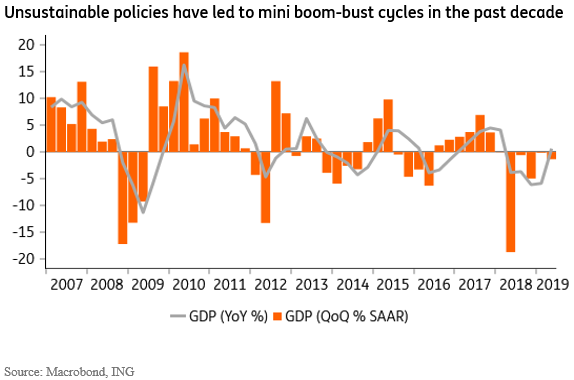

n any case, Argentina’s challenging domestic outlook, marked by high inflation, trending in the 40-60% yearly range, recession, with GDP expected to contract an accumulated 5% in 2019-20, restricted debt-market access and questionable policy credibility, suggests that a debt renegotiation is likely inevitable next year.

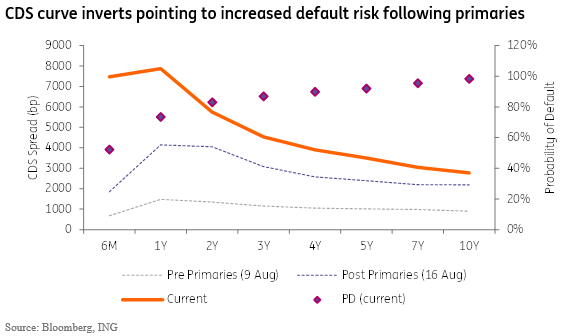

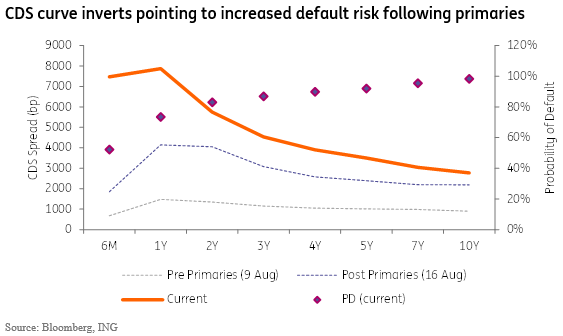

CDS spreads, the cost to protect against a default on Argentina’s external sovereign debt, also soared following the primaries. Current levels reflect the market view of a nearly certain default over the next few years, rising to around 90% in a five-year horizon.

(Click on image to enlarge)

In any case, Argentina’s challenging domestic outlook, marked by high inflation, trending in the 40-60% yearly range, recession, with GDP expected to contract an accumulated 5% in 2019-20, restricted debt-market access and questionable policy credibility, suggests that a debt renegotiation is likely inevitable next year.

CDS spreads, the cost to protect against a default on Argentina’s external sovereign debt, also soared following the primaries. Current levels reflect the market view of a nearly certain default over the next few years, rising to around 90% in a five-year horizon.

(Click on image to enlarge)

A “market-friendly” debt-reprofiling may be quick, but insufficient

It appears that Fernandez would prefer to limit the market fallout by opting for a quicker and more “market-friendly” debt renegotiation process. The focus would be on maturity-extension and not a haircut. For the candidate, the 2003 Uruguayan debt-rescheduling would be the ideal template to follow, with a haircut deemed unnecessary.

But we would take those statements with great caution. Uruguay’s economic and political situation in 2003 was considerably stronger than Argentina’s situation is likely to be next year. In Uruguay’s case, the country could credibly and successfully implement a sharp fiscal consolidation effort in the subsequent years, which proved to be sufficient to re-anchor its fiscal trajectory. In Argentina’s case, such a drastic and credible fiscal consolidation program seems, in our view, improbable.

In order for Argentina’s fiscal situation to stabilize, Fernandez would have 1) to adopt a deep policy tightening, including stronger fiscal balances, high-interest rates, and strong-ARS policies; and 2) to improve investor perception by rejecting his unorthodox economic-policy credentials and keeping the IMF program in place. These would, ultimately, revive market appetite towards Argentinean assets.

Given the politically costly nature of this agenda, it seems, arguably, unrealistic to expect it from a Fernandez administration. It would likely require not only tax increases, such as higher export duties, and higher taxes for corporates and individuals, but also legislative changes to reduce spending on pensions and social programs.

Market participants are also doubtful: US$-denominated external sovereign bonds have seen their prices falling from US$75-90 ahead of the primaries to currently around US$45-50, reflecting recovery values that, according to media reports, range around US$25-50. Policy choices by the upcoming administration implies that bond prices are both subject to downside and upside risks. In particular, the choice between a debt “restructuring” and an Uruguay-style “re-profiling” could result in a wide range of recovery rates for bondholders.

Next year’s financing program is the key near-term priority

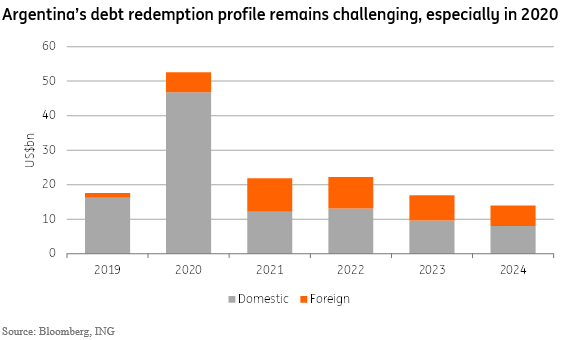

The debt amortization schedule, consisting of principal and interesting payments, is elevated over the next few years, mainly consisting of domestic law bonds over the next year before foreign law bond redemptions pick-up.

(Click on image to enlarge)

In particular, difficult prospects for government financing in the coming months suggest that heterodox arrangements involving central bank financing are likely to be implemented, to cover the fiscal deficit and repay ARS-denominated debt. Moreover, the plan appears to be to address the resulting inflationary pressure via price control mechanisms (“social pact”).

The repayment of FX liabilities should, meanwhile, continue to result in the depletion of FX reserves.

IMF relations may also suffer. Judging by recent statements, the Fernandez administration would likely maintain a more adversarial stance against the Fund. But the Fund’s incentives should also alter when compared to last year, when it approved a US$56bn Standby Agreement.

The Fund’s previous leader, Christine Lagarde, and the support of the Fund’s largest stakeholder, the US, were instrumental in pushing for that deal. As a result, given the new leadership at the Fund, and a less amicable relationship between Fernandez and the US, the terms of any new agreement may be less lenient.

Given this, it appears that one possibility is that Fernandez does not seek an understanding with the Fund right away. The initial focus would be to reach an agreement with private bondholders, before seeking the IMF’s stamp-of-approval.

Bondholders may welcome that, as some fear that the IMF would demand that Argentina extracts a large haircut from private investors. That concern is reasonable, given that debt-sustainability exercises conducted by the Fund, similar to the one included in the Fund’s June 2019 Article IV report, should likely conclude that, at current levels, Argentina’s public debt trajectory is unlikely to stabilize in the foreseeable future.

In June, the Fund concluded that “Argentina’s debt is sustainable, but not with a high probability”. And given the deterioration in macroeconomic dynamics since June, the assumptions used in that analysis look quite optimistic now. As a result, the Fund’s assessment likely became considerably direr.

Rush to re-open debt-market access

Fernandez appears to want to re-open debt-market access to Argentina relatively quickly, and that’s one reason why the administration would consider no-haircut options for its debt renegotiation.

The assumption is that a no-haircut debt-rescheduling would limit the risk of holdouts and could be relatively quickly accepted by bondholders, avoiding a prolonged negotiation process. According to local press reports, foreign investors are already reaching out to Fernandez’s team, with proposals involving a 4-year debt-maturity extension, ie, the length of a presidential mandate, and no haircut.

That option could be attractive to bondholders, as it could result in significant appreciation in bond prices from current levels, which incorporate a considerable principal haircut. However, it carries considerable risks for Argentina. In particular, we see a high risk that debt-markets remain closed for the sovereign as the debt adjustment is not seen as sufficient, as it fails to credibly ensure the long-term sustainability of Argentina’s fiscal stance.

A credible plan would require a deeper fiscal adjustment by Argentina and a fast recovery in economic activity. But, as that seems unlikely, the risk is that such a strategy would just delay a final resolution for Argentina’s fiscal problem, complicating relations with the IMF and reducing prospects for a lasting recovery.

FX outlook depends on post-election policy priorities

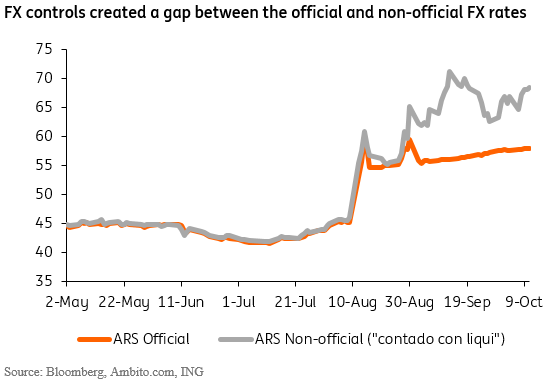

Fast-diminishing reserves suggests that FX controls are likely to get more stringent over time, with tougher rules for USD purchases gradually being implemented for corporates and individuals.

However, the next administration’s FX strategy remains far from clear. Fernandez has stated his preference for a “competitive” FX rate, but his initial strategy may be to keep the ARS relatively strong, allowing for a milder FX depreciation than is current expected by investors.

This could be the case if the key policy priority is to keep debt-sustainability metrics at reasonable levels to facilitate negotiations with bondholders. Around 80% of Argentina’s government debt is FX-denominated, implying a high vulnerability from FX depreciation on the general government debt balance. This would suggest a preference for a relatively strong ARS until the debt renegotiation is complete, and the hope is that this could be accomplished by March 2020.

This would suggest that BCRA would continue to deploy FX reserves to intervene in FX markets and continue to tighten FX controls to limit outflows. Tighter controls for individuals appear especially likely.

In addition, despite Fernandez’s pledge to reduce interest rates, the risk is that, at least initially, local rates remain high, to keep demand for ARS relatively high and prevent a large widening in the premium between the official and non-official FX rates. Credit-boosting initiatives could be implemented via incentive-structures involving banks’ reserve-requirements.

In that case, the USD/ARS could end the year trending below 65, instead of 70 and up.

(Click on image to enlarge)

Overall, however, our level of conviction about what Fernandez would opt to do post-election remains quite low. As a result, assessing the likely trajectory of asset prices remains hard at this stage. This is because much should depend on 1) the policy priorities of new administration, which we don’t know yet, 2) the evolution of investor sentiment after the elections, and 3) the IMF.

The first important statement by the IMF should be released after the election, following an expected meeting between the Fund’s staff and Fernandez's team.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more