Are Markets Done With Inflation Worries?

In case you took a day off yesterday, there’s a new narrative circulating that inflation anxiety is history and worries about slowing economic growth have moved to the fore. Maybe, but there’s no law that says you can’t have both macro risks bubbling, or neither.

Granted, if growth slows fast enough and far enough, it’ll take the wind out of the recent inflationary surge. Meantime, if economic activity stays relatively strong, even if it decelerates, inflation could continue to surprise on the upside. Given the ongoing pandemic shock in the macro numbers, it’s fair to say that getting a handle on the big-picture trend remains an evolving challenge.

What is clear is that inflation risk hasn’t suddenly faded in the last few days, nor have growth worries emerged from nothing over the past week. Both risk factors have been with us for months and will remain so for the near term. Mr. Market, on the other hand, appears to divert his attention from one thing to the next, sometimes with dramatic effect in the short run. Trying to make sense of this over days or weeks is like trying to ride a wild horse overdosing on Ritalin: Even if you hold tight, it’s going to be one hell of a ride.

As an antidote to letting the headlines play havoc with expectations, let’s run a quick reality check on inflation. In upcoming posts we’ll look at US growth prospects, but for now I’ll summarize my economic analysis via the July 18 edition of The US Business Cycle Risk Report:

The US economy continues to reflect strong growth, but the evidence is mounting that peak activity is behind us. But that doesn’t change the fact that recession risk remains virtually nil and for the foreseeable future the probability of economic contraction will remain low (short of an unforeseen exogenous shock)… The main macro focus: How fast will it slow and how far out does the slowdown extend before triggering a significant increase in recession risk?

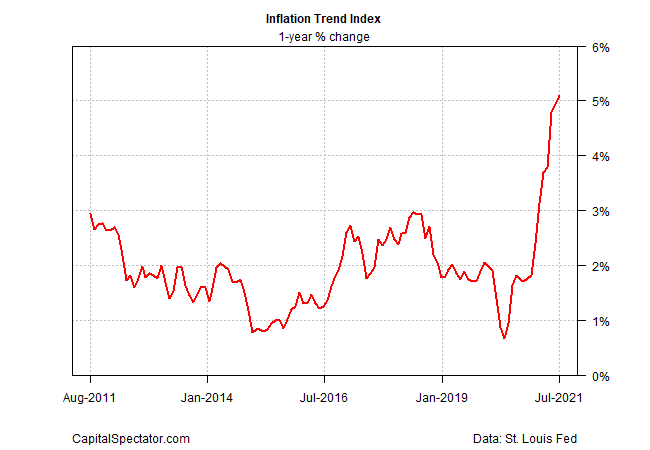

As for inflation risk, let’s revisit a fresh run of the Inflation Trend Index (ITI), a proprietary benchmark that’s designed to provide a degree of forward guidance on the directional bias of pricing activity in real time. ITI is not a proxy for estimating the government’s inflation measures; rather, it’s an eight-factor measure of how inflationary pressures are trending and whether a change in the trend appears likely or not.

In recent updates, ITI hinted at the possibility that the recent surge in inflation was peaking. In mid-June, for example, ITI appeared to be rolling over. More recent data shows that that view was premature. Indeed, today’s update shows ITI still ticking higher in the preliminary estimate for July.

Keep in mind that most of this month’s data sets for ITI have yet to be published and so the current estimate is simply pulling forward the latest data points. Regardless, the best guestimate for inflation’s trend now shows that the recent surge has yet to peak.

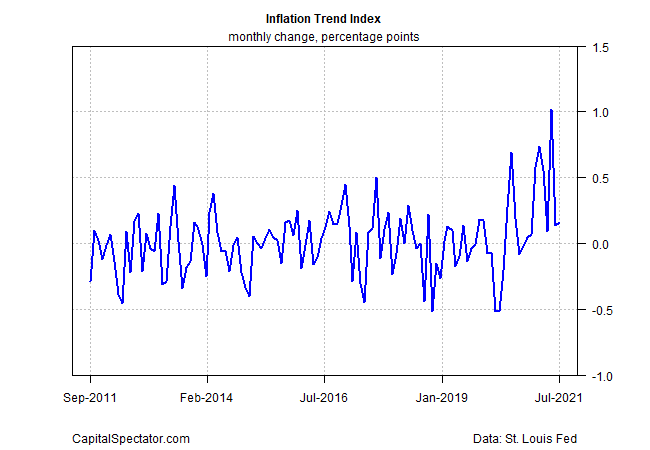

But there are (still) hints that apex for this cycle may be near. For another perspective, consider the monthly changes in ITI through time, as shown in the next chart below. Although the latest numbers remain subject to revision, the current estimate for July reflects a sharp slowdown in the monthly increases vs. earlier in the year.

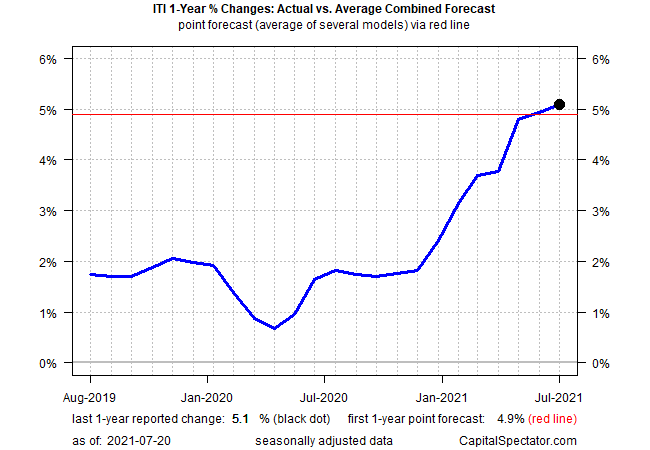

For another perspective, let’s forecast ITI for August using The Capital Spectator’s combination forecasting model, which uses the average of eight models to estimate the future – in this case next month’s ITI data point. On this basis, it appears that ITI will peak in July. The forecast comes with a non-trivial amount of uncertainty, of course – like every forecast. But for the moment, there’s still a case for expecting inflation will become a bit less hot by the end of the summer.

The main caveat, of course, is that there’s still a high level of noise in economic data (and arguably market data, too). The desperate search for signal, in other words, struggles on.

Disclosures: None.