Agriculture Markets Update – Wednesday, Sept. 15

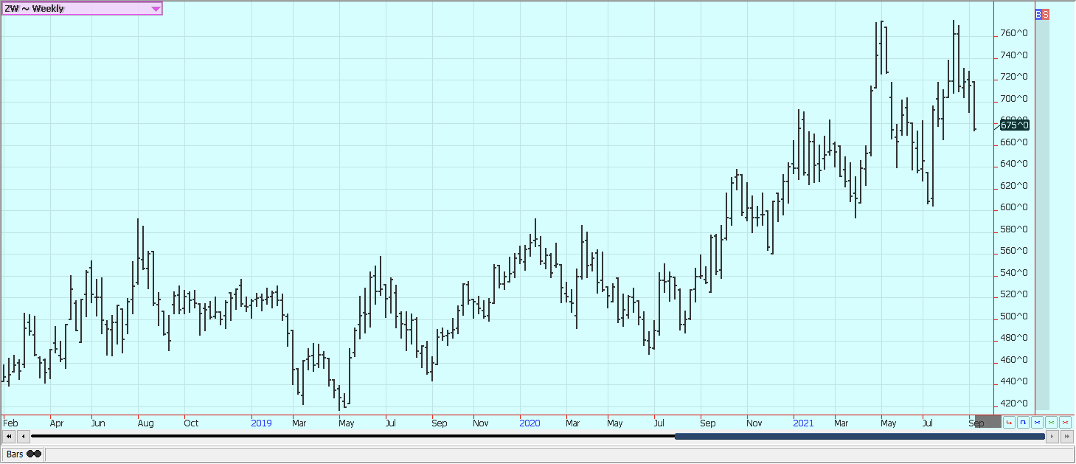

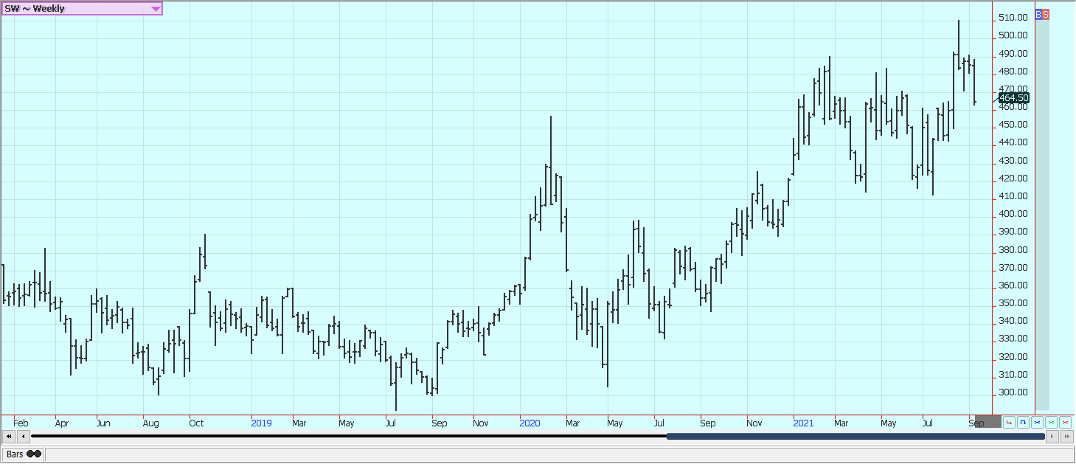

Wheat

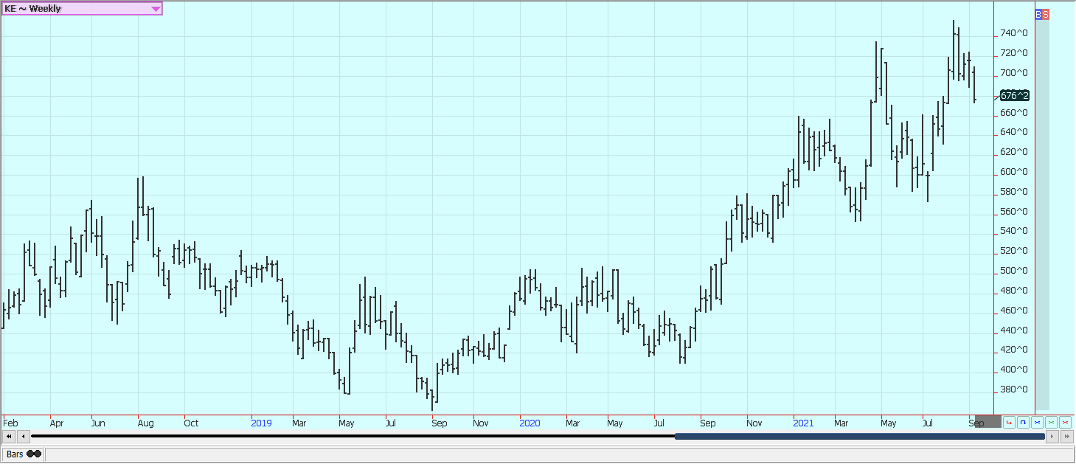

Wheat was mixed, with HRW a little higher and SRW a little lower. Minneapolis was lower but rallied off the lows to close near the bottom of a recent trading range.

Image Source: Unsplash

The weekly export sales was poor once again. The demand has not been seen here, so the Winter Wheat markets have not been able to do more than hold in a range. Hurricane Ida did not reach most Wheat areas but could have brought some big rains to some SRW areas. Wheat loading ports in the US are mostly in Texas or the PNW and were not affected. Dry weather in southern Russia as well as the northern US Great Plains and Canadian Prairies remains a supportive feature in the market although the US and Canada are seeing some showers this week. Crop size estimates in Russia have been reduced and domestic Russian prices are above world prices. The Russian weather has been good for production in northern and western areas but is still trending dry in southern areas and into Kazakhstan. The weather in China and Europe is wet and there is potential for reduced quality in Europe. Europe is expecting top yields in some areas but less yield in others and parts of eastern Europe and northern Russia are expecting strong yields.

Weekly Chicago Soft Red Winter Wheat Futures

(Click on image to enlarge)

Weekly Chicago Hard Red Winter Wheat Futures

(Click on image to enlarge)

Weekly Minneapolis Hard Red Spring Wheat Futures

(Click on image to enlarge)

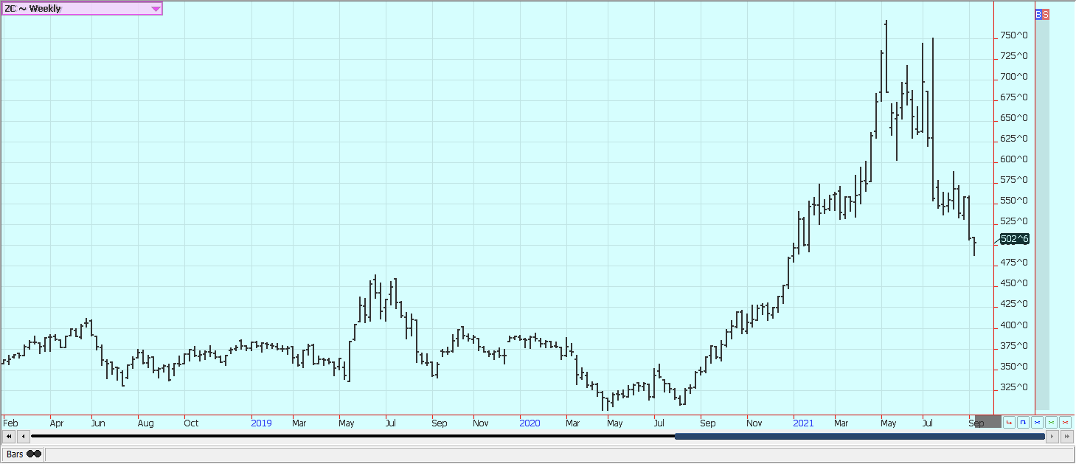

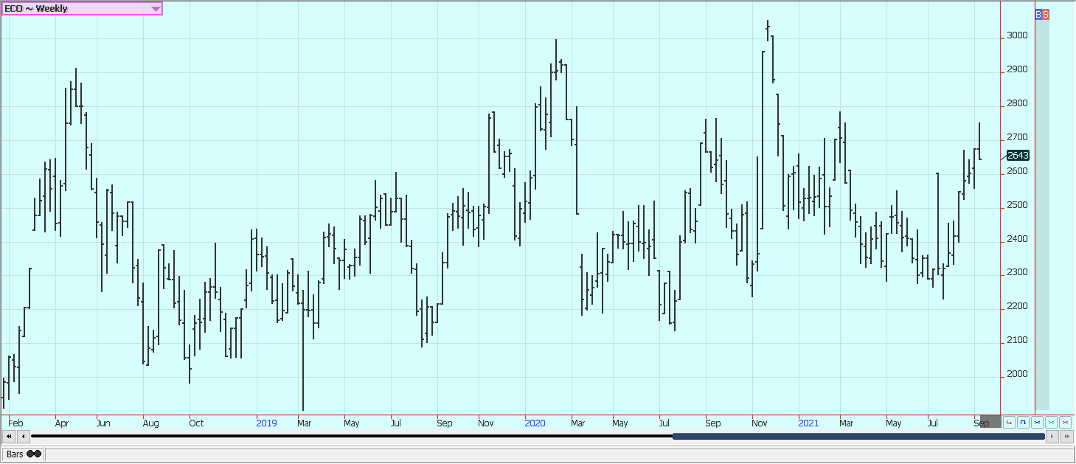

Corn

Corn was higher in sell the rumor and buy the fact trading as USDA estimated yields, production, and ending stocks higher but close to trading expectations. Trends are now mixed on the daily charts but are still down on the weekly charts. Demand was increased to partially offset the increased production and ending stocks were just under 1.5 billion bushels. Most of the elevators along the Mississippi are starting to export again which is good news for nearby demand. The weather remains a feature of the trade but is less important now as the Corn is filling kernels and starting to mature. Ideas are that Brazil's Corn production could be less than 85 million tons so reduced production estimates are expected in coming reports. Oats were lower yesterday on speculative profit-taking before the USDA reports as the weather remains bad for production even with the crop near or in the harvest.

Weekly Corn Futures

(Click on image to enlarge)

Weekly Oats Futures

(Click on image to enlarge)

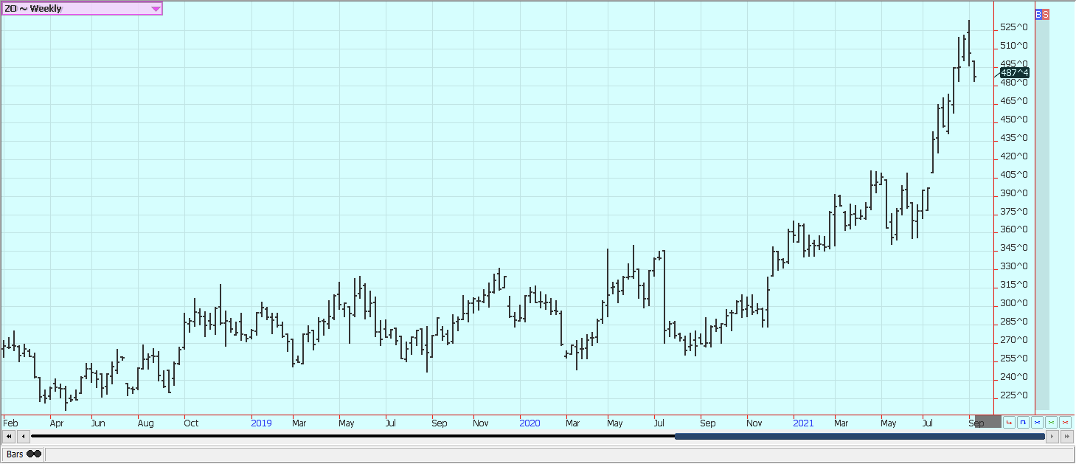

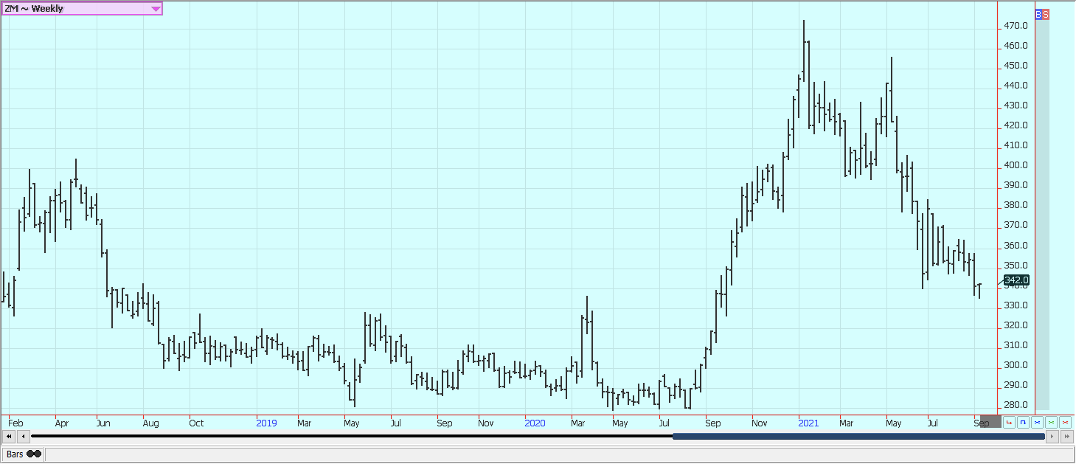

Soybeans and Soybean Meal

Soybeans closed a little lower last week in Soybeans and lower in Soybean Oil but higher in Soybean Meal. The big news came on Friday when USDA released its production and WASDE reports. The reports showed increased production and ending stocks estimates from last month but were broadly in line with trade expectations. Futures traded higher on Friday in a sell the rumor and buy the fact trading situation.FSA released the plantings reports early on Wednesday and the Soybeans planted area was increased. The destruction of Gulf port facilities along the Mississippi River near New Orleans was still a factor in the trade but the elevators are coming on-line and exports have started to resume. The hurricane moved onshore in Louisiana a week ago and did extensive damage to the state, including the grain export elevators. The state also lost electrical posser in all affected areas but the power to the export elevators has started to be restored. Demand has held together despite the export problems but the export inspections report showed that very little is getting shipped right now as the exporters scramble to find other ports to send the grain. The weekly export sales report was also expected to be poor as many US exporters have had to pull offers for now Demand is still weaker than expected overall.

Weekly Chicago Soybeans Futures

(Click on image to enlarge)

Weekly Chicago Soybean Meal Futures

(Click on image to enlarge)

Rice

Rice closed a little lower last week and the price action has been weak as the harvest makes progress in the south. Harvesting continues in Louisiana and Texas. A delayed harvest is expected in Mississippi and Arkansas. Initial yield reports and quality reports have been acceptable to many in Texas and are called good in Louisiana. Smut has been reported in Texas but the smut is coming off the grain in the cleaning process and the problem is considered to be minor. The harvest pace is expected to be slow due to ongoing showers in both regions and farther into the north. Ideas of average yields are also heard in Arkansas and Mississippi. Growing conditions have been mixed at best with many areas getting too much rain.

Weekly Chicago Rice Futures

(Click on image to enlarge)

Palm Oil and Vegetable Oils

Palm Oil closed a little higher last week but well off of the highs of the week on demand concerns. Exports were not strong last month and the trade saw big ending stocks when MPOB released its monthly data last week. Ideas are that Palm Oil got too expensive when compared to the other vegetable oils markets. There are ideas of tight supplies due to labor problems. There are just not enough workers in the fields due to Coronavirus restrictions. Production has also been down to more than offset the export losses so prices have trended higher. Canola closed lower last week as the harvest is getting ready to start. Damaging weather continues in the Canadian Prairies and northern Great Plains and hot and dry are in the forecast for this week. Production ideas are down due to the extreme weather seen in these areas. It remains generally dry and warm in the Prairies. The Prairies crops are in big trouble now due to previous hot and dry weather.StatsCan released its stocks estimates and Canola stocks were above trade expectations.

Weekly Malaysian Palm Oil Futures

(Click on image to enlarge)

Weekly Chicago Soybean Oil Futures

(Click on image to enlarge)

Weekly Canola Futures

(Click on image to enlarge)

Cotton

Futures were a little lower last week as a tropical system formed in the Gulf of Mexico and missed Cotton production in the Southeast and Delta for the most part. The storm brought heavy rains and a lot of damage, but mostly away from Cotton areas. Bolls are opening and fiber could be damaged. Texas growing areas were away from the storm and were not affected. The demand is expected to be strong from Asian countries as world economies recover from Covid lockdowns. Analysts say the demand is still very strong and likely to hold at high levels for the future. However, the expansion of the Delta variant has given pause to the better demand ideas due to fears of economies here and around the world starting to partially lockdown again. Production ideas are being impacted in just about all areas due to the weather extremes. It has been very hot in parts of Texas and the Delta and Southeast have had drenching rains at various times in the last couple of months.

Weekly US Cotton Futures

(Click on image to enlarge)

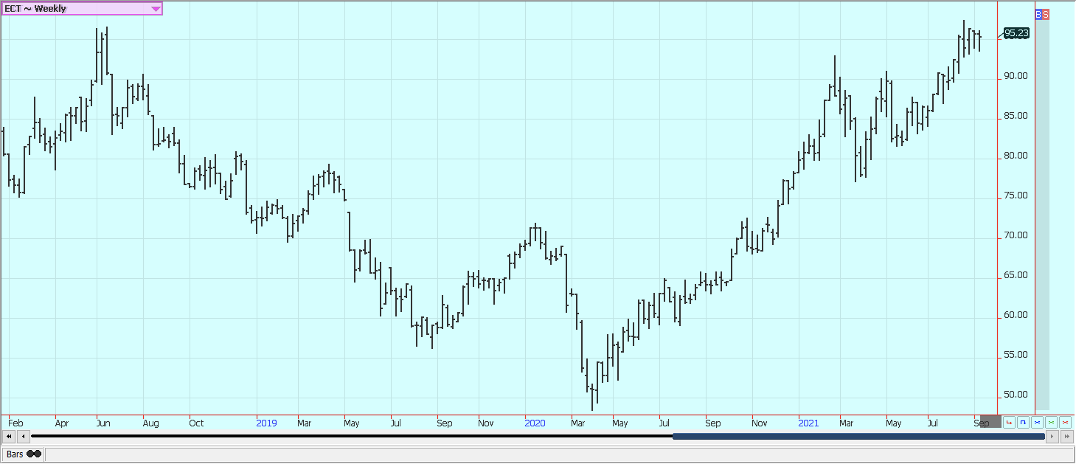

Frozen Concentrated Orange Juice and Citrus

FCOJ closed higher on Friday and higher for the week and chart trends are still mostly upon weather concerns, especially for Brazil but also for Florida and Mexico. A freeze hit Sao Paulo state several weeks ago and reports of significant losses are being heard. Weather conditions in Florida are rated mostly good for the crops with scattered showers and near-normal temperatures. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. Northeastern Mexico areas are too dry, but the rest of northern and western Mexico are rated in good condition.

Weekly FCOJ Futures

(Click on image to enlarge)

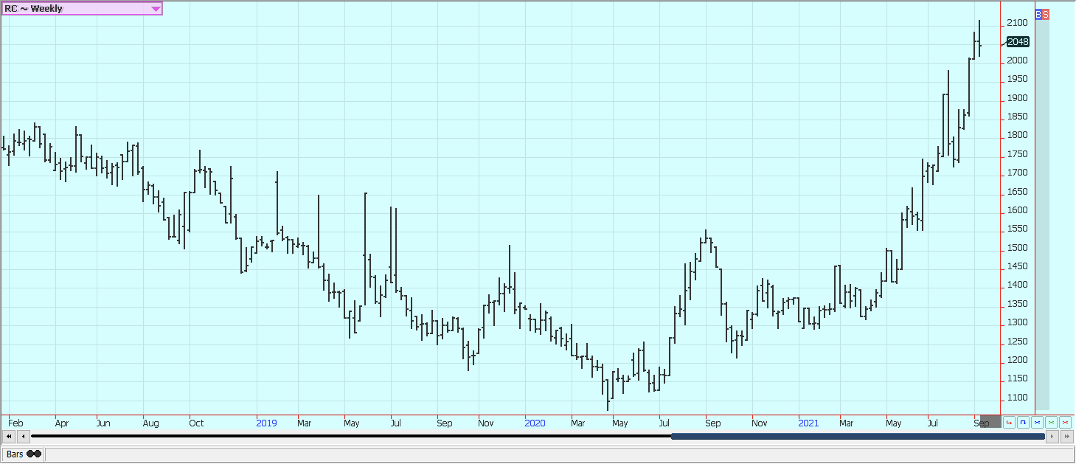

Coffee

New York and London closed lower last week as speculators appeared to liquidate some long positions and as chart trends started to turn down. London is having trouble sourcing Coffee from Vietnam due to a shortage of containers to carry the Coffee out of the country and the expansion of the Delta variant that has caused so many problems around the world and is really affecting the Vietnamese. Prices in New York have been firm as the current Brazil harvest starts to wind down with smaller production. The damage from the Brazil freeze several weeks ago is apparent. Some trees were killed and will have to be replaced. Scattered showers are now in the forecast for Southeast Asia. Good conditions are reported in northern South America and good conditions are reported in Central America. Colombia is having trouble exporting Coffee due to protests inside the country. Conditions are reported to be generally good in parts of Africa, but Ivory Coast and Ghana have been a little dry.

Weekly New York Arabica Coffee Futures

(Click on image to enlarge)

Weekly London Robusta Coffee Futures

(Click on image to enlarge)

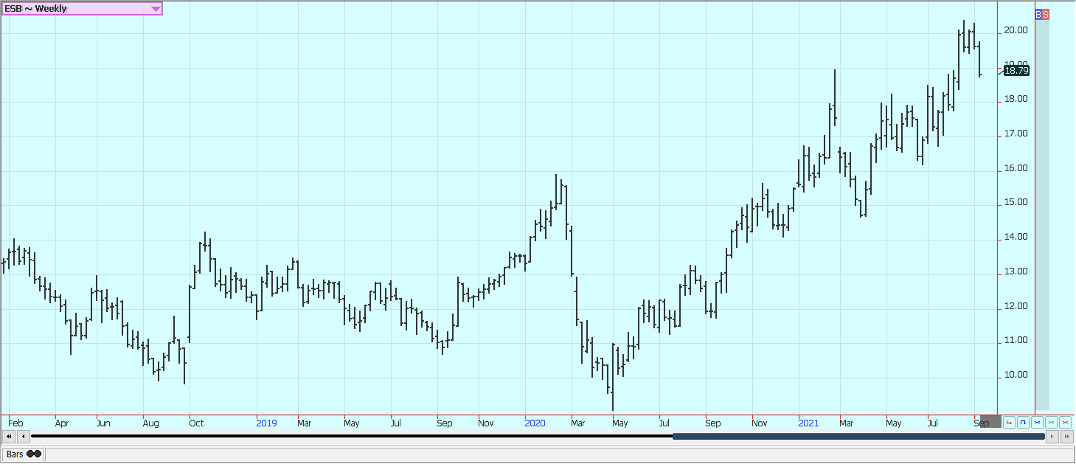

Sugar

New York and London were lower last week and the trends turned mostly down on the daily and weekly charts. The reduced production potential from Brazil is still impacting the market, but the stronger US Dollar makes Sugar more expensive in local currency terms and the recently weaker Crude Oil prices mean that Ethanol prices will probably work lower. Wire reports suggest that Ethanol and Sugar prices are at parity so any lower Crude Oil prices now could mean that Ethanol prices move below those of Sugar. That idea is not seen in the latest UNICA data that showed a slightly greater percentage of Sugarcane processed for Ethanol than Sugar in the latest two-week period. The ISO has noted that this will be the second year of deficit production for the world, in large part because of the Brazil freeze that cut production. Consumption of Sugar remains on the light side. Fears that the Covid is returning and could reduce economic activity and demand are around. The market is still working through a short supply. The freeze and drought damage is there in Brazil as industry sources have said to expect a short season for processing. Thailand is expecting improved production.

Weekly New York World Raw Sugar Futures

(Click on image to enlarge)

Weekly London White Sugar Futures

(Click on image to enlarge)

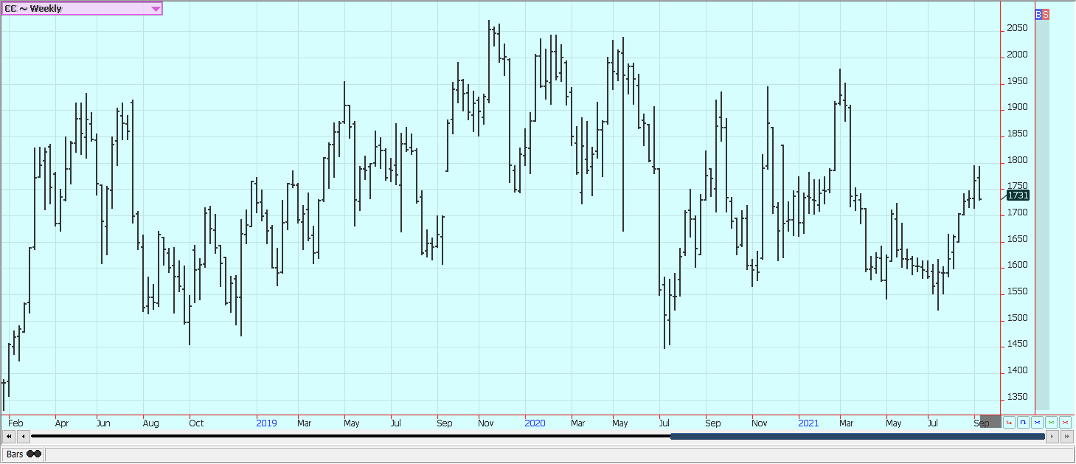

Cocoa

New York and London closed lower last week on what was called speculative long liquidation. Trends are turning sideways to down on the daily charts and are mixed on the weekly charts. Ivory Coast has stopped selling for the next crop on fears of fewer supplies. World economies are starting to reopen after Covid and the open economies are giving demand the boost. The weather has had below-normal rains in West Africa and crop conditions are rated good for now but there is concern about the lack of rain. Some are forecasting less production in the coming year but the ICCO said that it expects a production surplus of 230,000 tons this year, from its previous estimate of 165,000 tons. Ivory Coast sources told wire services that the country has sold between 1.64 million and 1.66 million tons of Cocoa so far this season. This is considered a very big amount and there are concerns about Cocoa availability at origin moving forward.

Weekly New York Cocoa Futures

(Click on image to enlarge)

Weekly London Cocoa Futures

(Click on image to enlarge)

Disclaimer: A Subsidiary of Price Holdings, Inc. – a Diversified Financial Services Firm. Member NIBA, NFA Past results are not necessarily indicative of future results. Investing in ...

more