Agriculture Data Lagging Stocks

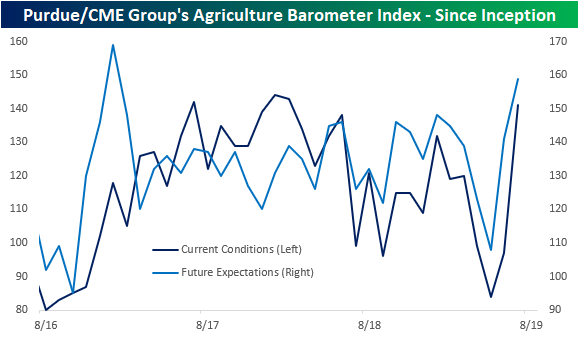

The Purdue University/CME Group’s Agriculture Barometer Index released today at its joint highest level since January 2017. The index—which surveys 400 agriculture producers on economic/industry sentiment— saw solid gains in both current and future expectations. In fact, the index for current conditions jumped 44 points to 141; the largest increase since the barometer’s inception. As with the headline reading, expectations rose to 159 which is the highest level since January 2017.

The major caveat to these numbers is the timing of the survey. The survey was conducted from July 15th to the 19th which would not pick up effects from recent trade developments. Throughout the ongoing trade war, US agriculture has been a major bargaining chip for China. The most recent spat has resulted in China officially ceasing the purchase of US agricultural products. Additionally, the effects of the USDA’s Market Facilitation Program which is essentially relief to farmers affected by tariffs is also likely to not be factored into this data. In other words, it is hard to put much weight on these numbers given all that has occurred since the data collection period.

(Click on image to enlarge)

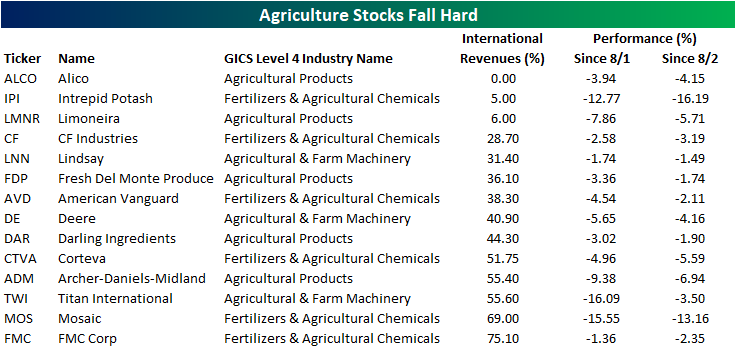

Although it is too early to show up in some economic data points, stock prices of agriculture-related business have underperformed since trade tensions ramped up last week. In the table below, we show the stocks in the S&P 500 and Russell 2000 with an agricultural focus. As shown, not a single one has risen since last Thursday when the President initially announced more tariffs, and each one has also fallen since Friday’s close (last price before China’s retaliation). While the broader market has also declined in this time, these agriculture stocks have more dramatically underperformed falling 6.4% on average since August 1st versus a 2.6% decline in the S&P 500 and 3.45% decline in the Russell.Some of these stocks that have seen the worst declines also boast the highest degree of international exposure. The three worst performers are Intrepid Potash (IPI), Titan International (TWI), and Mosiac (MOS) which have all fallen double-digits in just the span of a few days. They also have the added catalysts of weak earnings on top of headline news. TWI reported Thursday morning and MOS and IPI reported this morning.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Premium to access Bespoke’s most actionable research ...

more