After Just Two Months Of Futures Contracts, It Appears Wall Street Does Have Some Control Over The Bitcoin Price

In this era of controlled markets, very little should be considered a surprise or coincidence anymore. And judging by the results of the CME's first two Bitcoin futures contracts, those who continue to believe that the cryptocurrency is free from manipulation are highly mistaken.

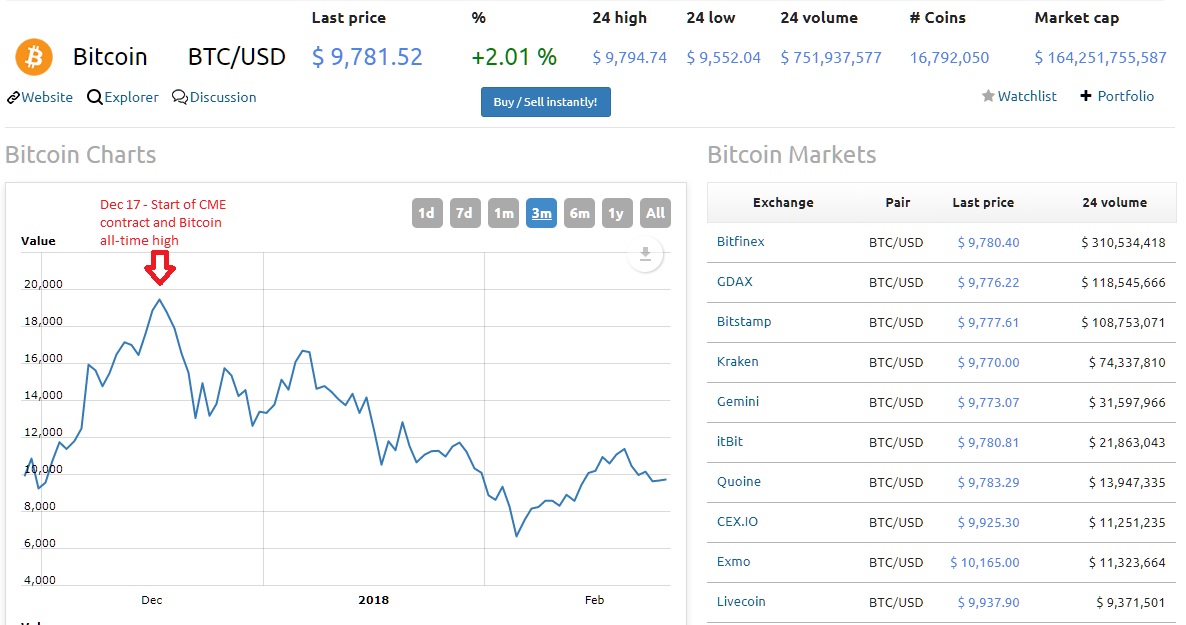

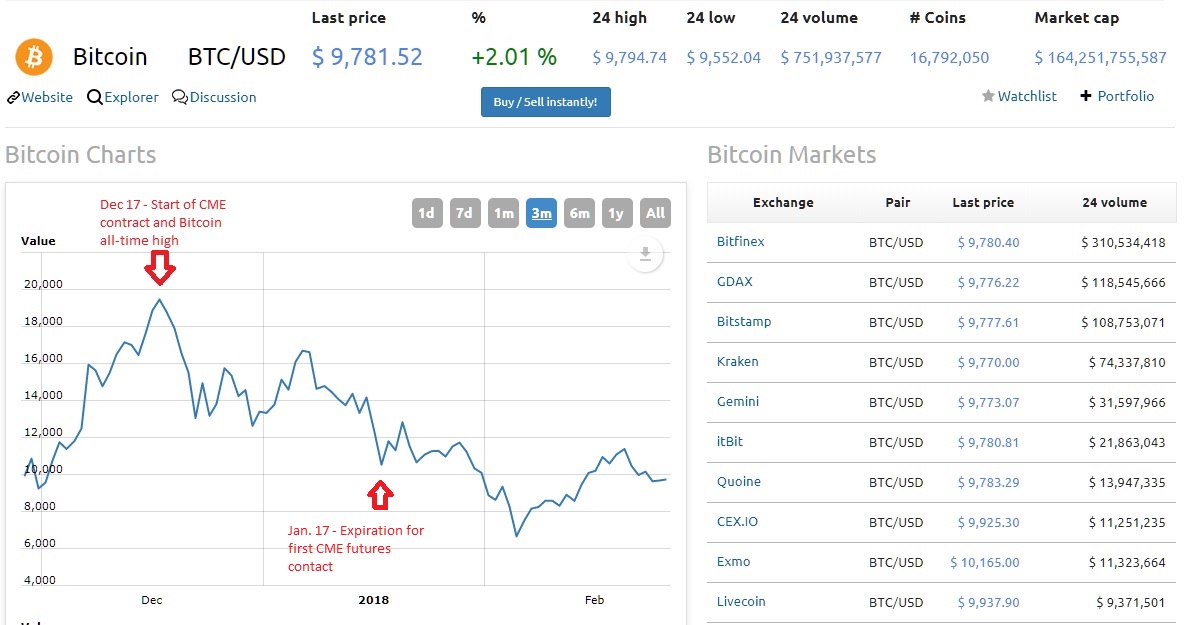

Case in point. The first Bitcoin futures contract was initiated back on Dec. 17 of last year... the very day Bitcoin achieved its all-time high of over $20,000 per coin on a few exchanges. And since that time the price has fallen as much as 70% from that high, begging the questions of who, how, and why this has occurred.

Now taking a look at Bitcoin's price movement during the final week of January's expiration, we can see that the price was moved sharply down, and in accordance with the fact that the majority of contacts in play were on the short side.

As you can see during that week, the price was pushed down quite a bit to close out at around $10,500.

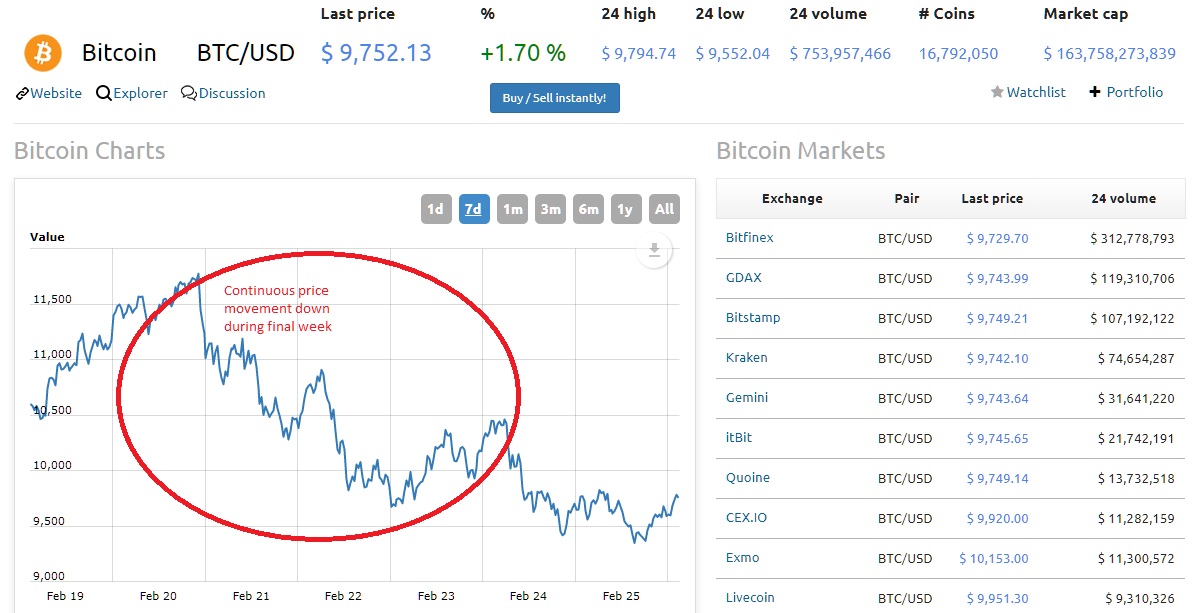

But one month does not a trend make, so let's see the price action last week as the February Bitcoin futures contract closed out on the 23rd.

Two months in a row, the price of Bitcoin was pushed down during the week of its futures contract expiration.

Now we can try to address the reasoning behind how this price could be manipulated, however, the answer most likely is due to the axiom known as Occam's Razor.

ie... Wall Street investment houses own a large stock of the cryptocurrency.

Because of its volatility and high price, you don't need to dump a lot of Bitcoins to make the price go down quickly. In fact, according to Blockchain analysis, 1% of all Bitcoin wallets own 99% of all mined Bitcoins, and we know from several reports that JP Morgan alone was buying the cryptocurrency in their European desks at the same time CEO Jamie Dimon was vilifying it as an asset.

The scenario for Wall Street actually works well to profit from this setup. First, you either short or go long a number of contracts, then when it gets close to expiration time you either buy or sell Bitcoin at an exchange which will drive up or down the price. And in the case of dumping Bitcoins when you have a short contract, you can then always pick more up at the dip after you have cashed in your profits from the contract.

No muss, no fuss, and this is simply using a free market mechanism to manipulate the price of even a de-centralized asset to come out in your favor. Because whether it is a freely traded asset, or one regulated to allow for a monopoly, if you own a large portion of that asset, you also inevitably control its price and direction.

What an interesting idea. Surprised it's legal.