After Declining For 7 Years, US Fall Seedings Are Expected To Rise

Market Analysis

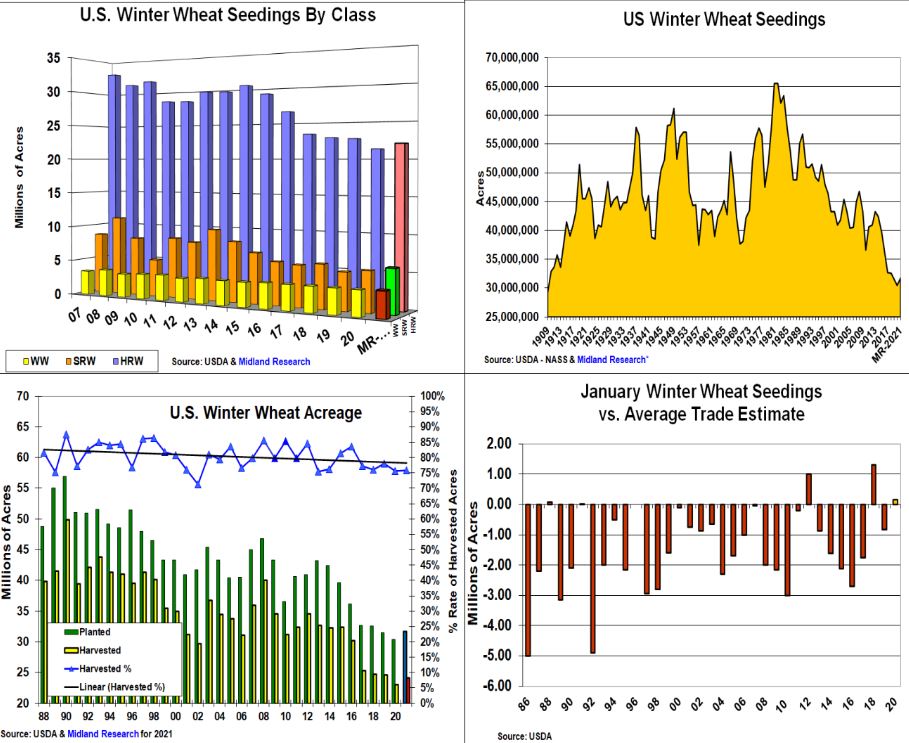

The combination of smaller wheat output in Ukraine, W. Europe & the U.S. along with the world-wide stay-at-home orders from the coronavirus pandemic has helped advance wheat to their highest prices in 5 years. Fall dryness in the Black Sea & US Plains along with many importing nations wanting to get their needs closer to home have also helped boost world prices in the past 6 months. Last year’s plant-ings of 30.415 million acres of W. wheat were the lowest US seedings since 1909. Poor 2019 fall weather delaying the feed grain harvest across the Plains and low prices prompted the 7th year of lower US winter wheat seedings.

This trend has changed. A timely fall harvest in the East-ern Midwest & Mid-South along with abundant moisture in the SE US from this year’s numerous hurricanes have boosted seedings of Soft Red wheat. With soybean prices on the rise, the potential to double-crop this oilseed behind their food grain also helped advance this variety’s planting by 9% to 6.07 million acres. (a 510,000 acre increase). The US Plains’ fall conditions were mixed. Parts of the Central Western areas experienced dryness that curtails their late seeding while the Northern & Southern regions had favorable conditions. Overall, 2021’s Hard Red plantings are expected to rise 715,000 acres to 22.075 million, the 1st jump in 6 years. 2021’s PNW winter white plantings also are likely to be up. Higher prices and China’s purchases of their variety could advance these seedings by 90,000 to 3.585 million acres. The highest level in 10 years.

Overall, last fall’s US winter wheat seedings are expected to increase by 1.315 million to 31.73 million acres (a 4.3% rise from 2020). This fall’s US WW crop ratings were historically low, but next spring’s rainfall will be the ultimate determiner of the US wheat size. The other amazing statistic has been the trade’s tendency to over-estimate the US January WW seedings. Only three times (2012, 2018, and 2020 crops) since 1984 has the USDA’s initial report been significantly above the trade’s estimate. The trade’s aver-age for 2021 US WW seedings is 31.528 million acres.

(Click on image to enlarge)

What’s Ahead

With the market’s focus on the upcoming US/World soybean & corn crop data & balance sheets, the US 2021/22 winter wheat seedings & wheat data probably will not garner much attention, without a big surprise. With the world’s wheat either harvested or dormant, no supply scares are likely. Use current strong prices to have 80% of your old crop marketed & 30% of your 21/22 wheat priced at this time.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more