A "Summer Chill" Looms For Consumers As Child Tax Credits Fail To Boost Spending

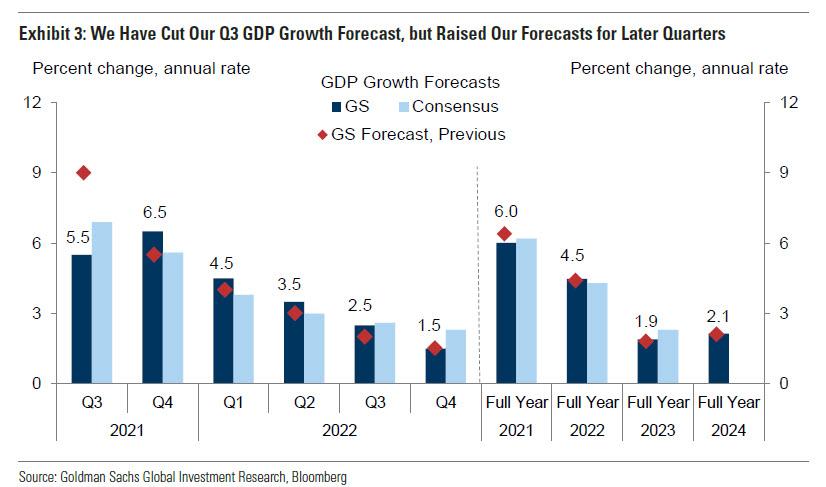

Last week we warned that the US economy was facing a "sudden negative change" as consumer spending was set to collapse, and we even warned that the retail sales data this week would be atrocious. Well, it was, and whether due to the end of stimmy checks, the evaporation of savings, or a fresh round of Delta covid restrictions, suddenly the worst kept secret - that the US consumer is once again on the verge of tapping out - is fully in the public, leading to many prominent banks slashing their GDP forecasts for the current and future quarters, most notably Goldman which took a machete to its 8.5% Q3 GDP forecast and now sees just 5.5% even as it warns of a stagflationary burst of even higher inflation.

And with Goldman also pointing out - well after the fact, and well after its chief equity strategist hiked his S&P price target to 4,700 from 4,300 as if the two are now completely unlinked (spoiler alert: in today's centrally planned markets they are) - that consumer spending declined 3% in just the past few weeks...

(Click on image to enlarge)

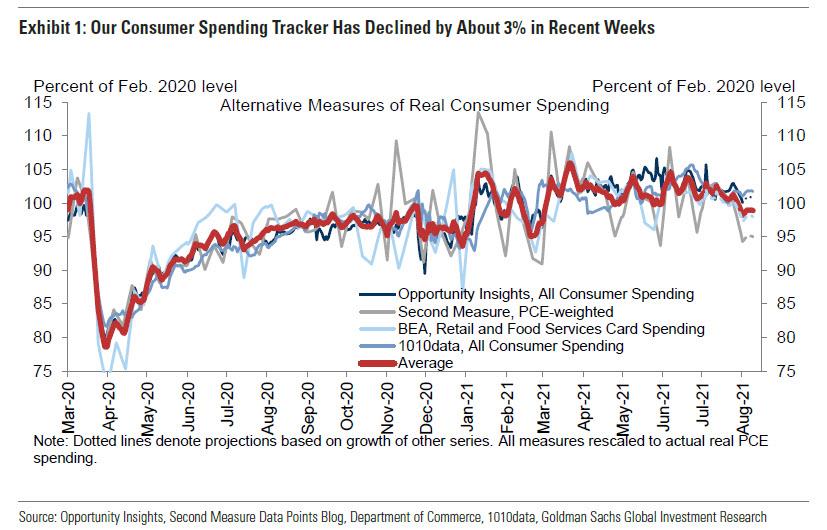

... other banks are joining in the fray, with Bank of America's Michelle Meyer pointing out on Thursday that total card spending, based on BAC aggregated credit and debit cards, has hit a "summer chill" slowing to just 11% 2-year growth rate for the 7-days ending August 14th, while the 1-year growth rate is similarly at 11% as the 1 and 2-year rates have now converged for total spending although remain wide apart for a number of categories.

The charts below shows just how sharp the slowdown and normalization in spending has been in recent weeks as US consumers are reverting to their pre-covid spending patterns, albeit in a time when prices are exploding, and it is only a matter of time before we enter the "trapdoor" plunge phase once all accumulated purchasing power disappears.

(Click on image to enlarge)

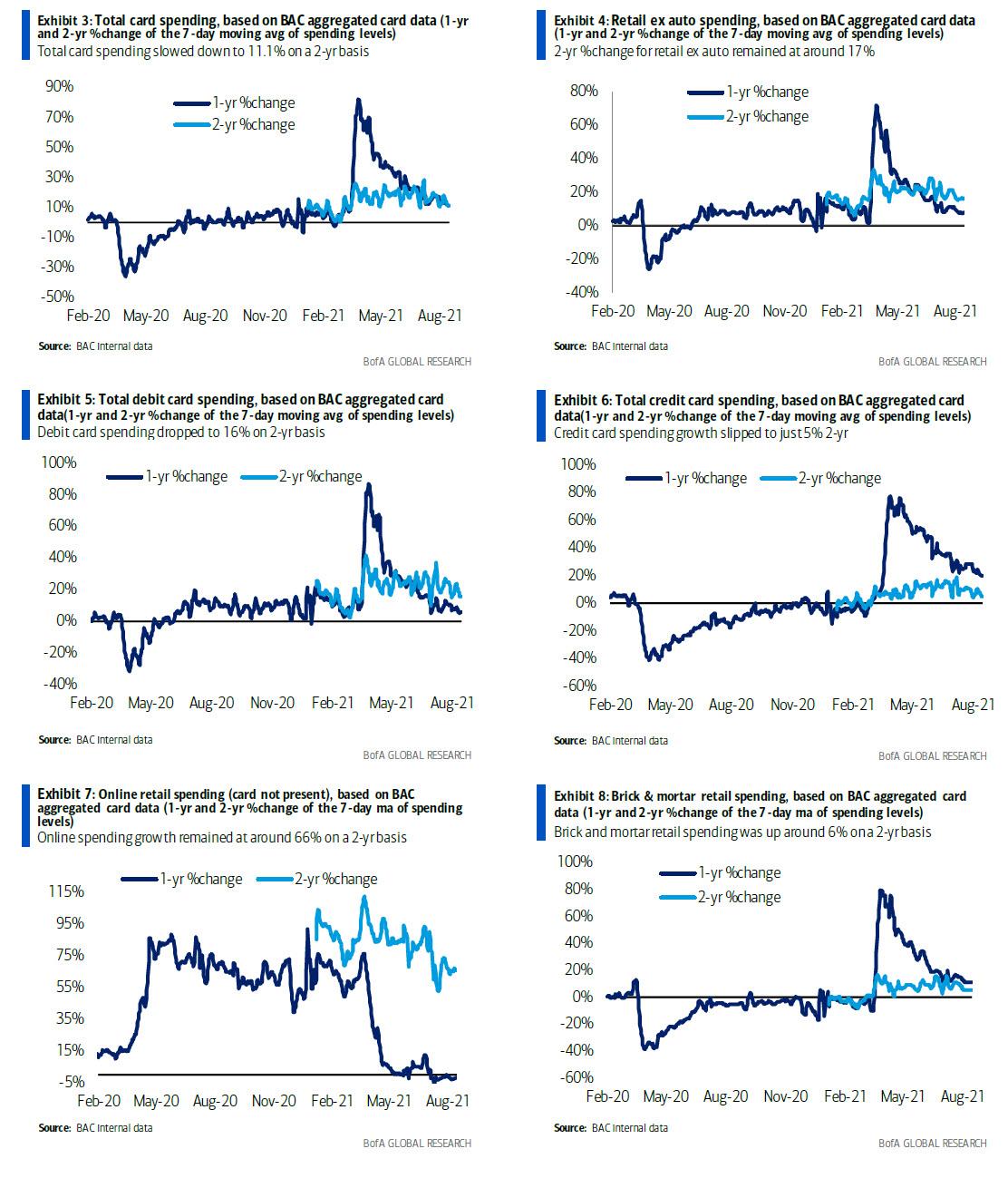

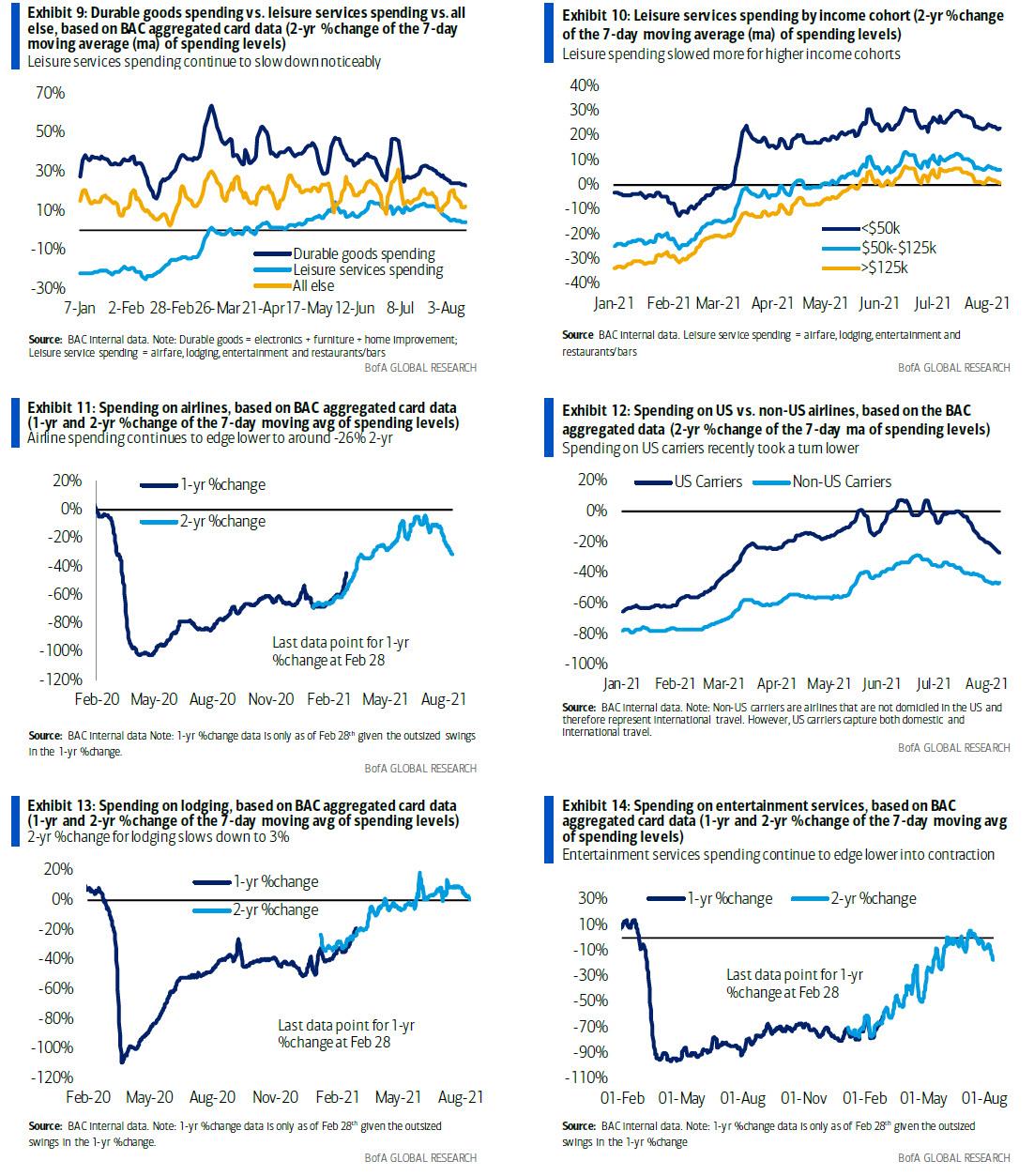

According to Meyer, the main reason behind the moderation over the last several weeks has been due to a pullback in spending on leisure services, which are defined as travel (airlines + lodging), entertainment and restaurants/bars. The 2-year growth rate of this composite is running at 0.6% for the latest week, down from the recent high of 2.5% in late June.

A more detailed look shows a slowdown across virtually all leisure sectors, from airlines to lodging and entertainment, although one can see that spending on durable goods is also starting to take on water.

(Click on image to enlarge)

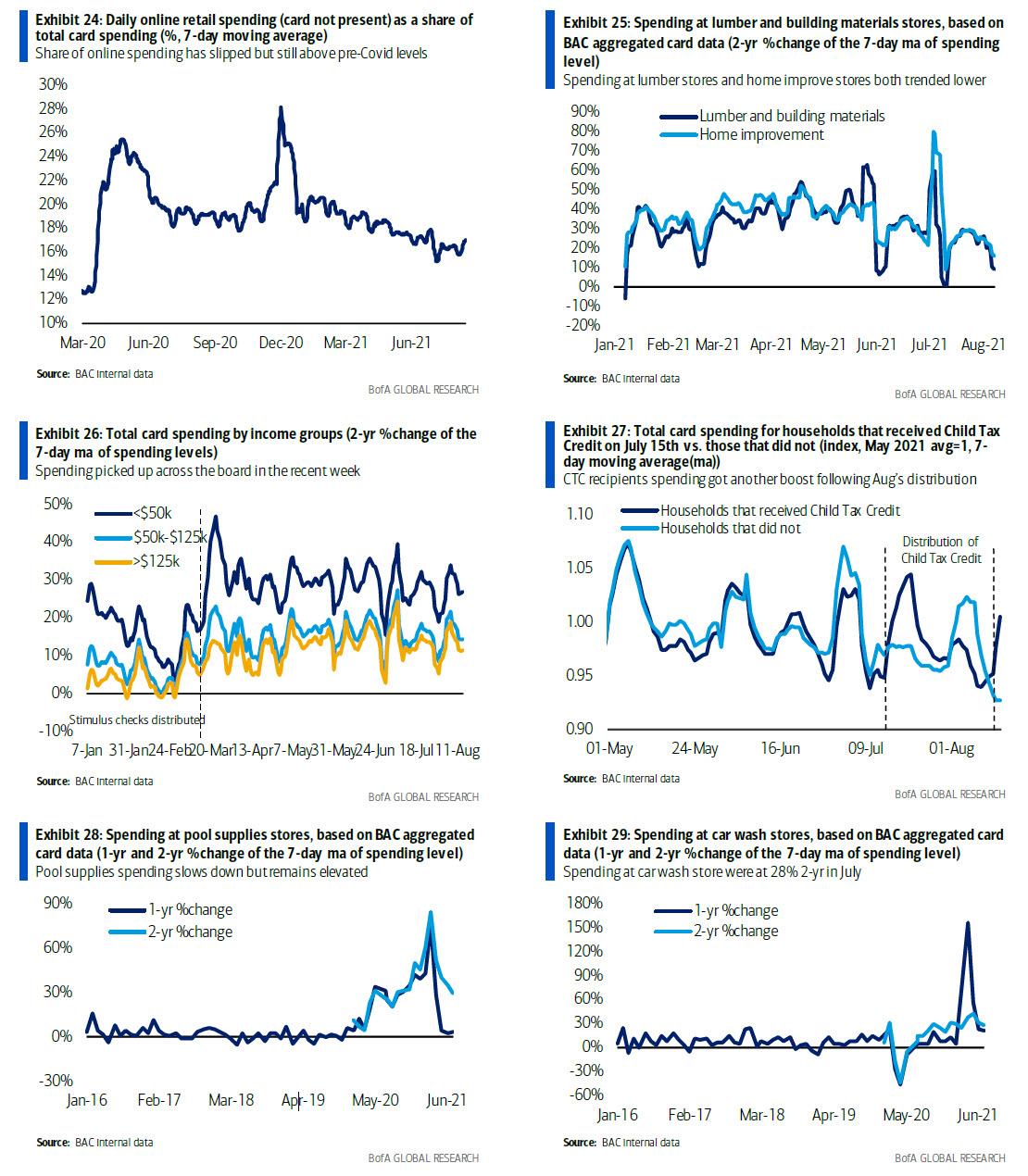

When netting out leisure service spending, BofA still sees a drop in the growth rate of spending from early July but some stability over the last few weeks. According to Meyer, the weakening in leisure services spending is responsible for just more than a quarter of the slowdown in total card spending over the last four weeks. Which also means that non-leisure spending is taking a big hit too as the next series of charts shows. Tangentially, as exhibit 28 shows, the pool bubble has also burst.

(Click on image to enlarge)

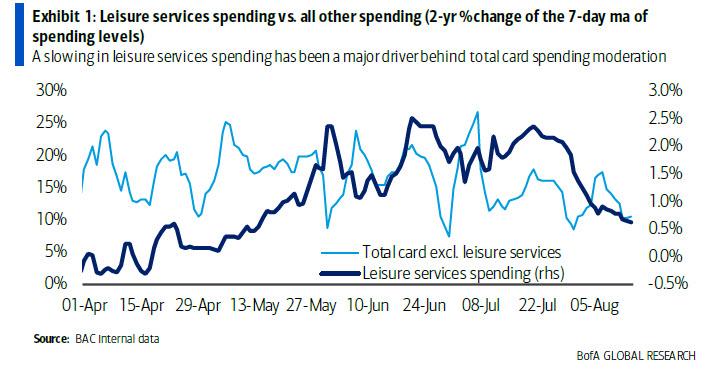

Finally, what about the stimmies? Well, with the bulk of Biden's trillions now spent, there was a modest bounce in household spending when the welfare president started sending out child tax credit. However, while CTC recipients did spend in excess of others for 2 weeks after they got the check, they then fell below for the following two weeks as they spent the entire stimulus and then hunkered down more than non-recipient households until the next child tax credit.

One can't help but dread what happens to the US economy - and society - when one day the stimmies, the universal basic income, the emergency benefits and so on, finally come to an end.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more