A Security Selection Method That (Still) Beats The Market

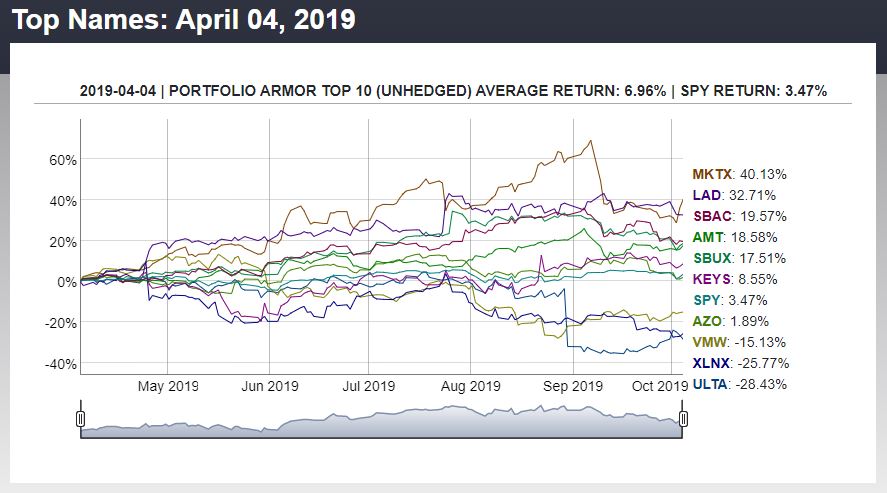

Performance of the most recent top names cohort for which we have 6-months' data.

Revisiting A Successful Security Selection Method

In a post here in February of 2018 ("A Stock Picking Method That Beats The Market") I wrote,

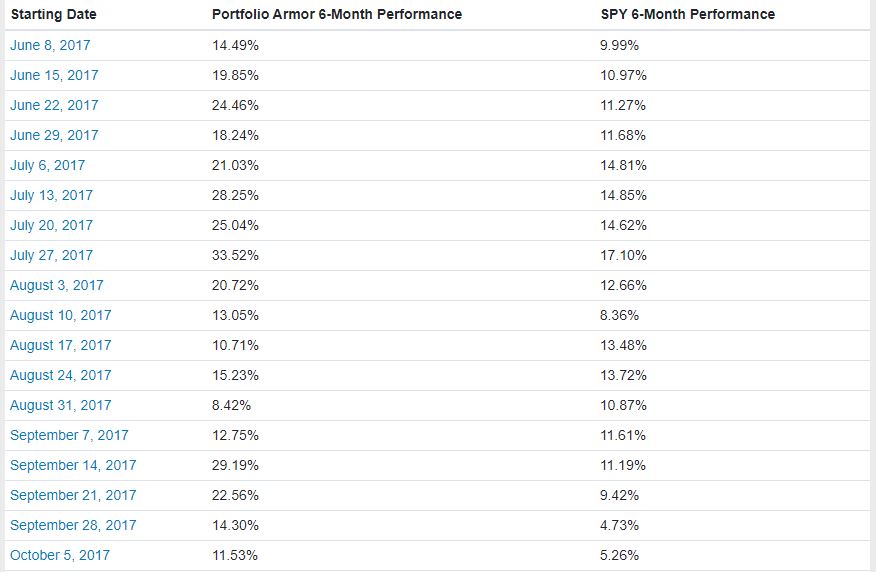

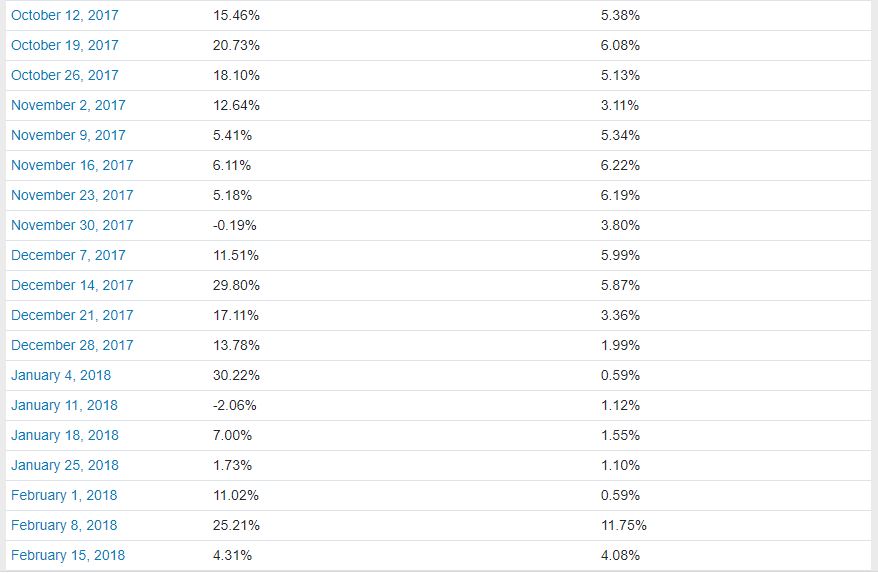

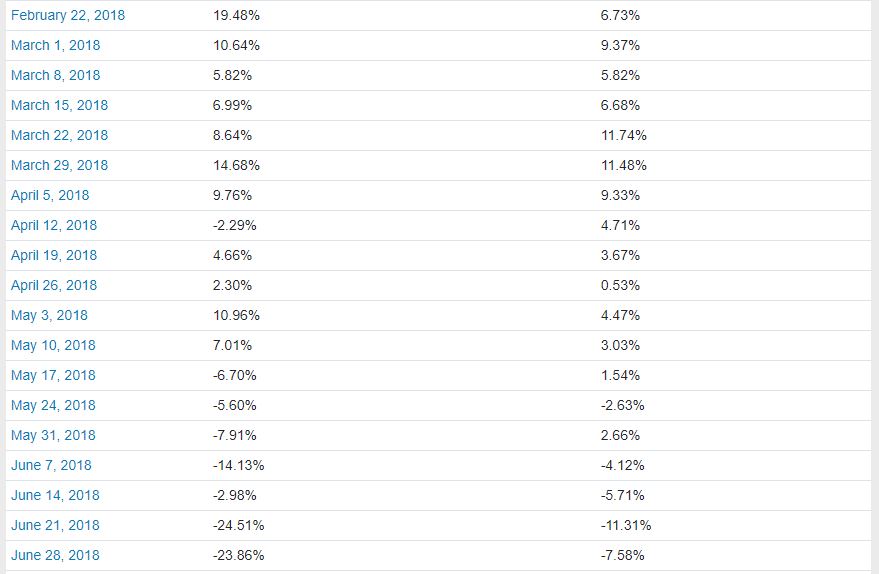

Since June 8th, I've been posting Portfolio Armor's top ten names each week. These names are ranked based on my site's estimate of their potential returns over the next 6 months, net of hedging costs. As of Friday, we have actual 6-month returns for the first 9 weekly cohorts. 8 out of 9 of them beat the SPDR S&P 500 ETF (SPY), and the average 6-month performance of each weekly cohort was 22.18% versus 13.07% for SPY. This is further evidence that Portfolio Armor's security selection method, which uses price history as well as option market sentiment, delivers alpha, as I elaborate below.

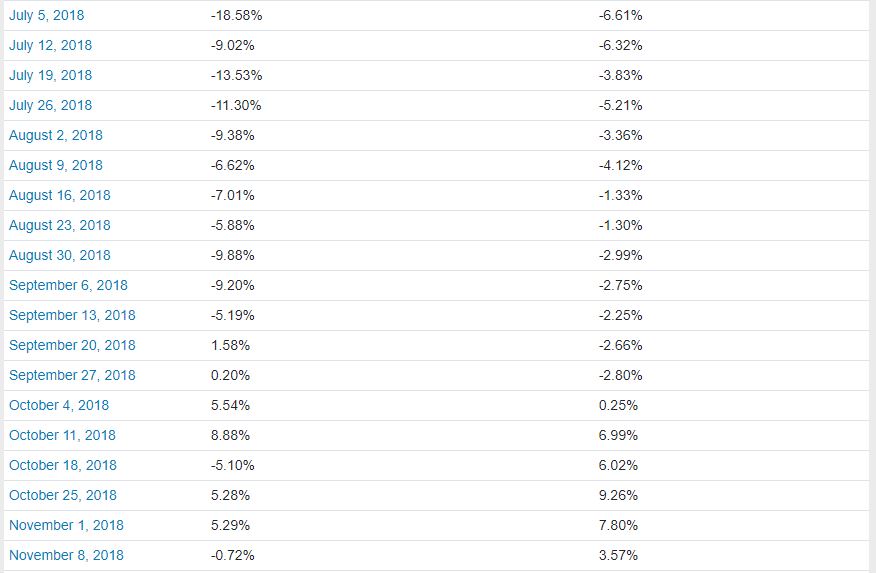

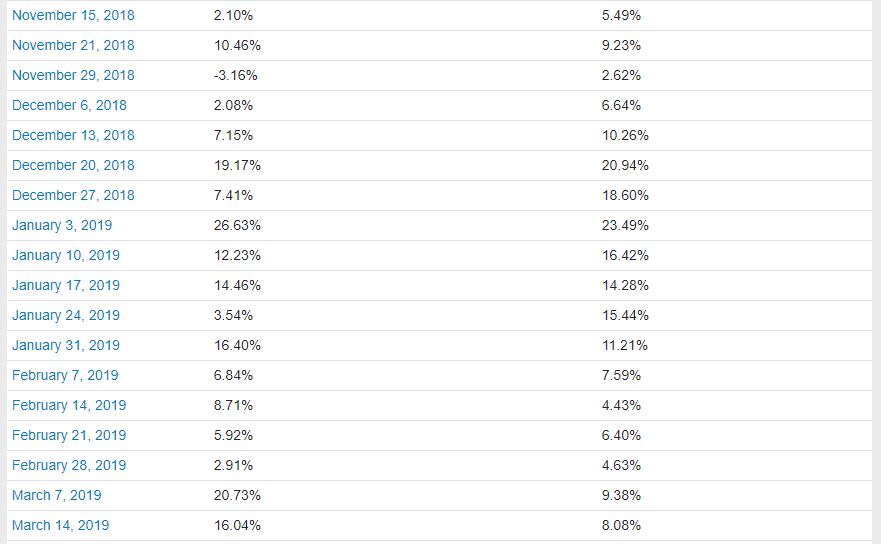

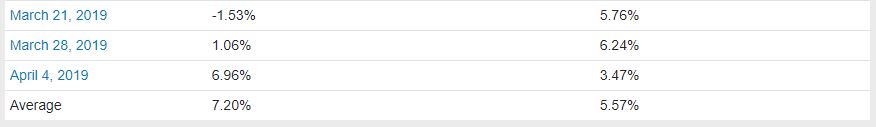

We now have full 6-month performance data for 96 weekly cohorts. Here's how they all have done:

So our top ten names averaged 7.20% over the average of these 96 6-month periods, versus SPY's average of 5.57%, an average outperformance of 1.63% over 6 months, or 3.26% annualized.

Wrapping Up

The most recent cohort to complete six months (pictured at the top of this article) included MKTX, LAD, SBAC. AMT, SBUX, KEYS, AZO, VMW, XLNX, and ULTA. To see what holdings were in the other cohorts, you can go to this page where there's an interactive version of the table above. If you click on a date there, it will show you a chart and holdings from that cohort. If you're wondering whether this outperformance is due to high beta, it's not. The average 24 month beta of the March 4th cohort was 0.76 at the time.