"A Market Of Just 5 Stocks": Earnings Season Confirmed "Winner-Take-All" Phenomenon Is Accelerating

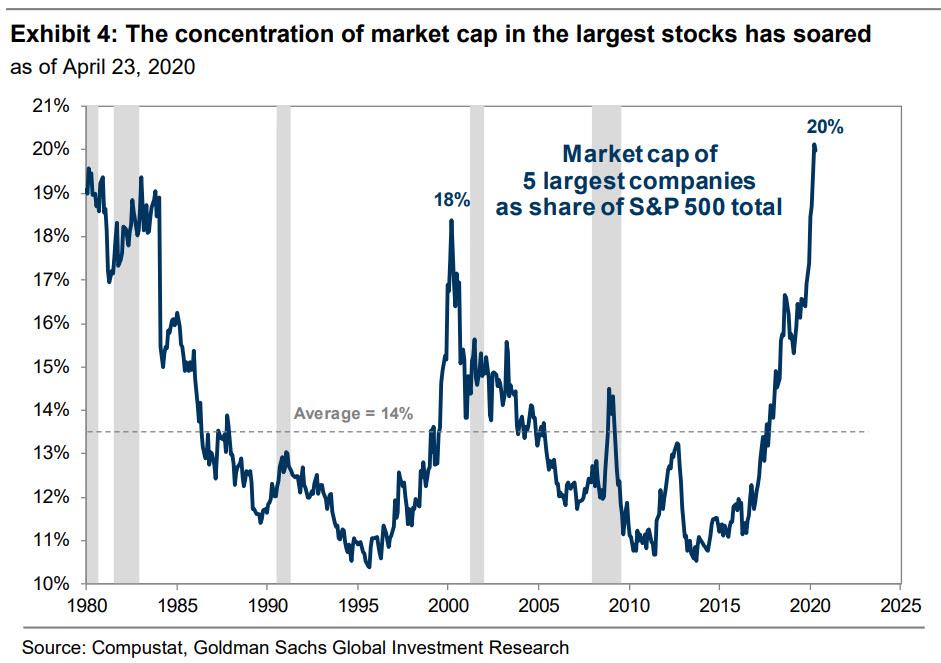

One month ago, Goldman triggered a modest selloff in growth and momentum stocks, when it pointed out that the five largest S&P 500 stocks, the FAAMGS (or MSFT, AAPL, AMZN, GOOGL, FB) have risen to account for over 20% of index market cap, representing the highest concentration on record.

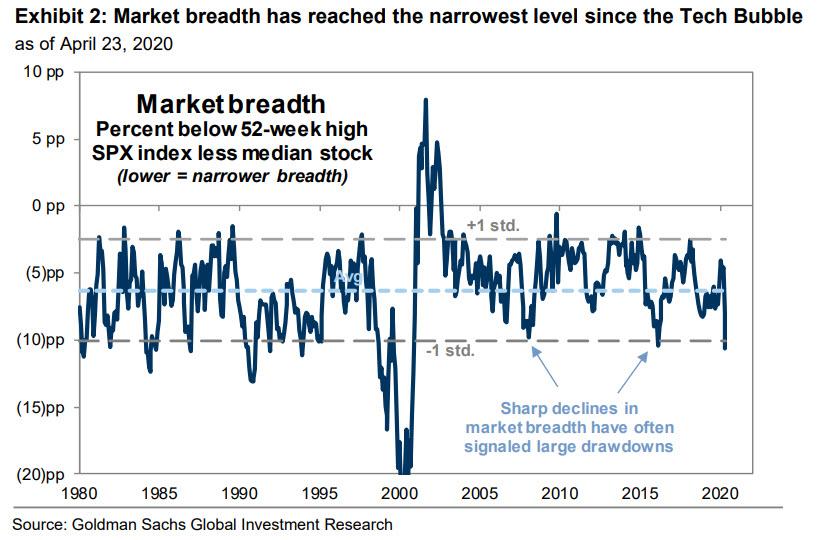

This is resulting in the lowest market breadth since the tech bubble.

And warning that "narrow market breadth is always resolved the same way [as] narrow rallies lead to large drawdowns as the handful of market leaders ultimately fail to generate enough fundamental earnings strength to justify elevated valuations and investor crowding. In these cases, the market leaders 'catch down' to weaker peers."

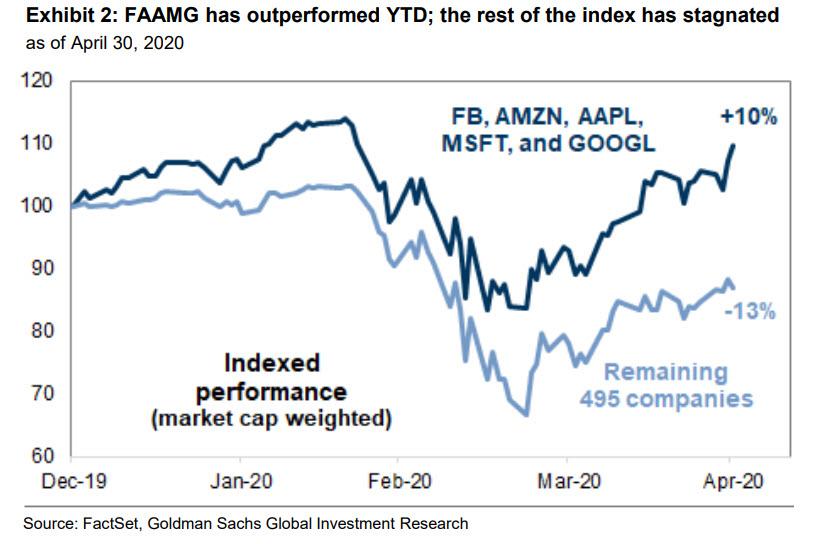

In short, as we wrote - jokingly - on April 17 that "The Market Is Now Just 5 Stocks", that's precisely what has happened, with investors dumping everything but the top 5 names, and creating the biggest "hedge fund/mutual fund/retail/momentum hotel" ever assembled in the FAAMGs, with Goldman revealing another stunning statistic: as of April 30, the 5 biggest stocks are up 10% while the remaining 495 S&P 500 companies are lower by a collective 13%.

A few days ago, JPMorgan's Marko Kolanovic made another important observation when he pointed out that the coronavirus lockdowns were accelerating this split in the market between the tech megacaps and everyone else:

Clearly there are economic winners and losers of prolonged shutdowns and social distancing. Working remotely, software/cloud, online shopping and socializing, etc. all benefit large technology firms. It should not come as a surprise that large tech stocks are near all-time highs. This could create (perhaps wrong) perceptions of conflicts of interest when the leading technology firms are influencing policies related to reopening (such as reimagining education, health care, vaccines, contact tracking and tracing etc.).

None other than Trump's former chief economic advisor and Goldman COO, Gary Cohn, confirmed all of this:

We let big box retailers stay open because they sell essential goods, but they also sell the same nonessential goods that small stores - who were forced to close - normally do. We can't let this run small stores out of business and need to make sure we level the playing field.

— Gary Cohn (@Gary_D_Cohn) May 20, 2020

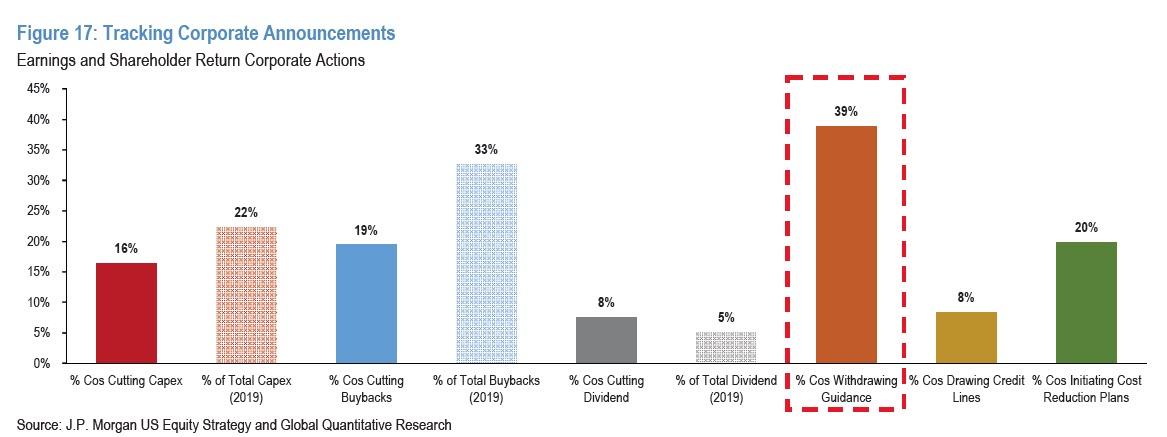

And now, the latest confirmation that the coronavirus is just what the megacaps (and their billionaire owners) would have ordered, comes from the concluding Q1 earnings season as JPMorgan points out that 40% of S&P 500 companies have withdrawn 2020 guidance, which may not seem like too many but consider that only 310 companies discussed full-year guidance, which means that two-thirds of companies that normally discuss the future no longer have any visibility.

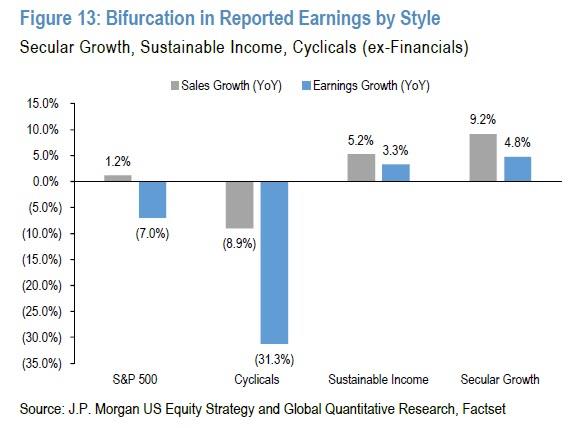

Cyclically-sensitive companies continue to bear an outsized weight of this recession.

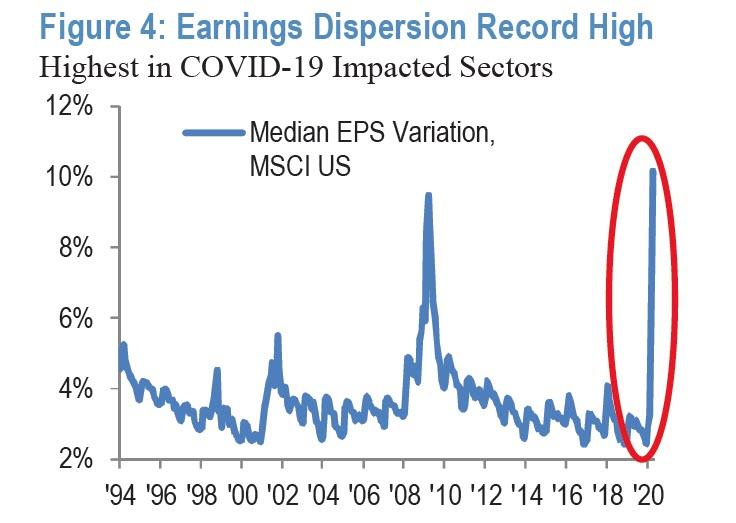

Earnings estimate dispersion is at a record high (100th %tile) with the highest uncertainty seen in sectors most directly impacted by COVID-19.

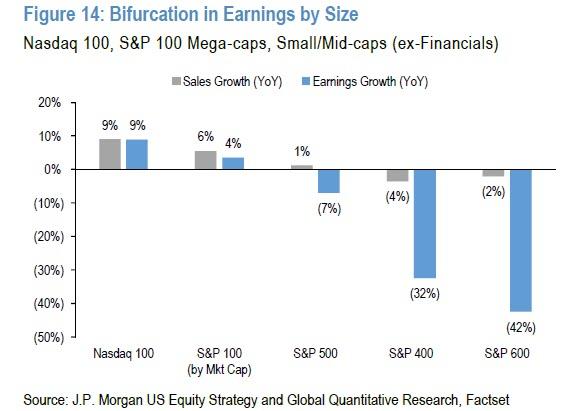

But one thing is more certain: confirming everything said above, JPMorgan finds that the coronavirus "shock" is accelerating the "winner-take-all" phenomenon (winners being US mega-caps, secular growth, high profit margin, i.e., FAAMGs) while economically-sensitive companies are forced to play defense (cyclicals, small-caps).

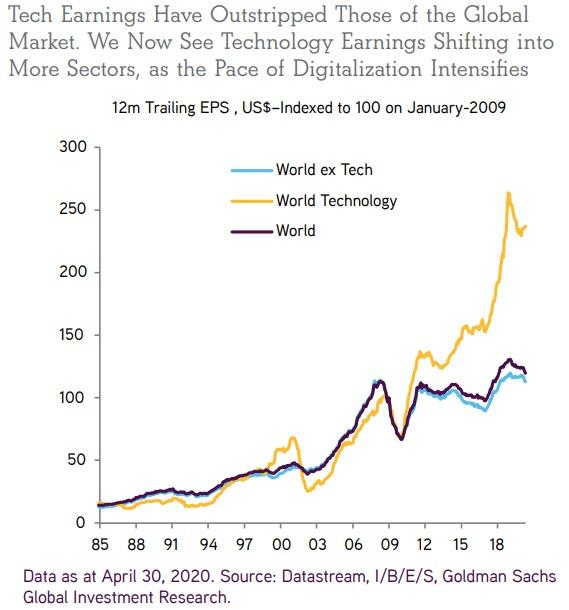

While this probably should not come as a surprise to those who read our article two years ago showing that technology-related company earnings have essentially represented 100% of profits for the last decade, many are still shocked to find that only tech companies are generating profits now.

Alas, what we now know for certain is that the coronavirus shutdowns only accelerated this theme of making the uberbig even bigger, while crippling the rest of the US corporations, not to mention decimating the small and medium business sector which does not have access to capital markets yet employs over 60 million people. Indeed, as JPM points out, there was significant bifurcation in reported results between winner-take-all Nasdaq 100 (earnings surprise 2% and growth of 9%) and cyclically-sensitive Small-caps (earnings surprise -29% and growth of -42%).

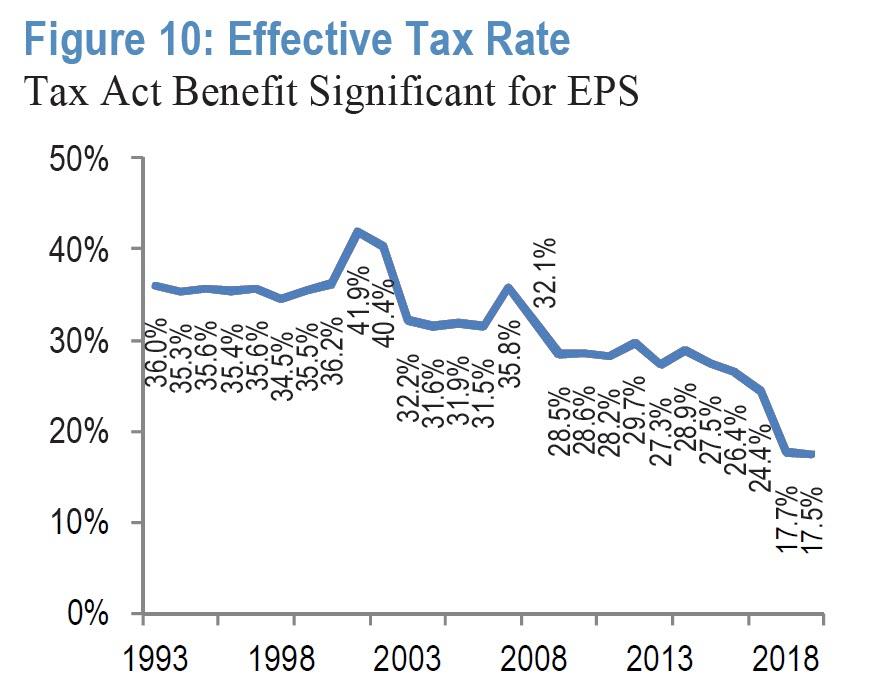

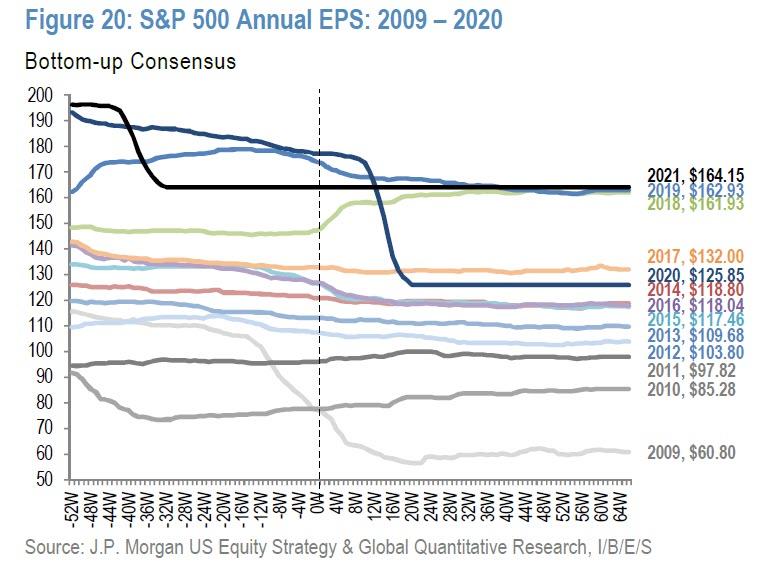

Looking ahead, JPM's 2020 EPS estimate is $120 (vs. consensus $126) and preliminary 2021 EPS range is $150-160 (vs consensus $164); that means that the S&P is now trading at 20x JPM 2021 (not 2020) earnings estimate, the highest on record, and that's with record low taxes. Should Biden defeat Trump and corporate tax cuts are repealed, do we hear a 30x P/E?

Meanwhile, the Street continues to revise down 2020 estimates by 28% since Feb to $126, below where earnings were in 2017 (and this is all adjusted earnings, not GAAP).

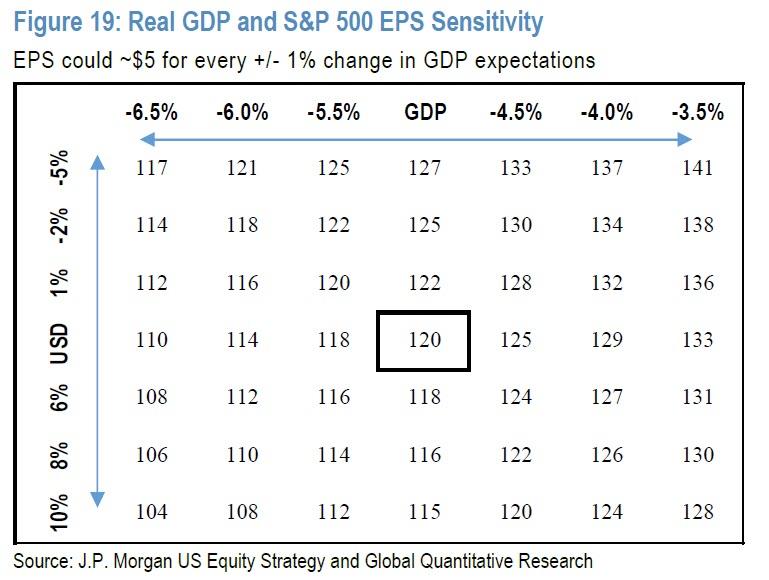

This EPS estimate implies a real GDP growth rate of -5% and revenue decline of 5-6%, margin compression of ~250bp, and flat contribution from net buybacks. Depending on the re-opening and speed of actual economic recovery, with JPM forecasting that 2020 EPS could swing ~$5 for every +/- 1% change in GDP.

By which, what JPM means is that heads the megatechs win, tails everyone else loses.

One final point: not even during the Gilded Age did a handful of companies/oligarchs command more net worth, political clout and market impact than the five tech giants do now. Back then, the government eventually realized that to avoid a social uprising and second French revolution it had to break up the monopolies. Will it do the same now before it is too late?

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more