5 Deep Value Dividend Stocks For Annual Portfolio Rebalancing

It is no secret that we are huge proponents of dividend investing. At Sure Dividend, we recommend investors buy and hold quality dividend growth stocks, such as the Dividend Aristocrats, to generate superior long-term returns.

But we also recommend investors focus on stocks that offer the highest total returns. In addition to dividend yield, we favor quality stocks that have future earnings growth potential, and also low valuation multiples as measured by the price-to-earnings ratio.

Buying stocks with high dividend yields is good–buying undervalued dividend stocks with growth potential is even better. With that in mind, it could be said that value investing and dividend investing go hand-in-hand. After all, as a stock price declines, its valuation multiple declines and its dividend yield rises, thus making shares more attractive on a total return basis.

With 2020 in the books, investors are looking ahead to what 2021 may bring. Stock prices remain near record highs right now, which makes value and dividend investing even more difficult. Valuation multiples appear stretched, while dividend yields have fallen–the average dividend yield of the S&P 500 Index is just 1.5% today.

Therefore, investors that are rebalancing their portfolios have fewer attractive stocks to choose from, due to broadly elevated valuations and reduced dividend yields. But the following 5 stocks offer deeply-discounted valuations, along with attractive dividend yields, that make them attractive for investors interested in high total return potential.

A number of criteria were applied in order to come up with the top 5 stocks. First, only large-cap stocks with market capitalizations above $2 billion were chosen. Next, only stocks in the 90th+ percentile for both valuation and total returns were allowed. In other words, these 5 stocks are among the 10% most undervalued, and also in the top 10% for total expected returns, in the Sure Analysis Research Database.

Lastly, to screen for attractive dividend payers with solid yields and safe payouts, only stocks with 3%+ dividend yields and Dividend Risk Scores of C or better were allowed.

Deep Value Stock #5: Lazard Ltd. (LAZ)

- 5-year total expected returns: 12.9%

Lazard Ltd. is an international investment advisory company that traces its history to 1848. The company has two business segments: Financial Advisory and Asset Management. The Financial Advisory business includes mergers and acquisitions, debt restructuring, capital raising, and other advisory business. The Asset Management business is about 80% equities and focuses primarily on institutional clients.

By geography, Lazard’s revenue is about 60% Americas, 30% Europe and Middle East, and 10% Asia Pacific. At the end of 2020, Lazard had roughly $259 billion in assets under management (AUM). Lazard has an impressive track record of revenue growth over the past 15 years.

Source: Investor Presentation

Lazard reported a record fourth-quarter and full-year results on February 5th, 2021. For the quarter, company-wide operating revenue increased 20% to $849 million, while diluted adjusted earnings per share increased 82% due to rising assets under management (AUM), M&A deals, and debt restructuring.

For the year, company-wide operating revenue fell -1% to $2.52 billion, but diluted adjusted earnings per share grew 10% to $3.60 for 2020. Financial Advisory operating revenue rose 29% in 2020, while Lazard’s Asset Management operating revenue increased 12% for the year. Assets under management grew 4% to $259 billion for 2020.

Lazard’s competitive advantage is derived from its reputation, worldwide reach, long-term relationships, and ability to advise on complex transactions. The company is often the go-to firm for complex global M&A transactions and restructuring. Its reputation also allows it to attract top talent, which is important in the advisory business.

Based on expected EPS of $3.78 for 2021, Lazard stock trades for a price-to-earnings ratio of 10.3. Our fair value estimate is a P/E ratio of 13, meaning Lazard is undervalued. The stock also has a high dividend yield of 4.8%, while we expect 5% annual earnings-per-share growth over the next five years. In total, we expect total returns of 12.9% per year over the next five years for Lazard stock.

Deep Value Stock #4: Merck & Company (MRK)

- 5-year total expected returns: 13.6%

Merck & Company is one of the largest healthcare companies in the world. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal health products. On 2/5/2020, Merck announced that it was spinning off its women’s health, legacy brands, and biosimilar products into a separate company. These businesses represent ~$6.5 billion of revenues. The transaction should be completed in the first half of 2021.

Merck released fourth-quarter and full-year results on 2/4/2021. Quarterly revenue increased 5.4% to $12.5 billion but was $140 million lower than expected. Reported net income was a loss of $2.094 billion, or -$0.83 per share, compared to net income of $2.357 billion, or $0.92 per share, in the previous year. Net income and earnings-per-share included significant charges related to acquisitions and intangible asset impairments.

For the year, revenue grew 2% to $48 billion. Reported net income of $2.78 per share, compared unfavorably to $3.81 per share, in the prior year. Again, reported net income and earnings-per-share included significant charges related to acquisitions and intangible asset impairments. Adjusted EPS of $5.94 per share for 2020 was up 14.5% from $5.19 per share in 2019.

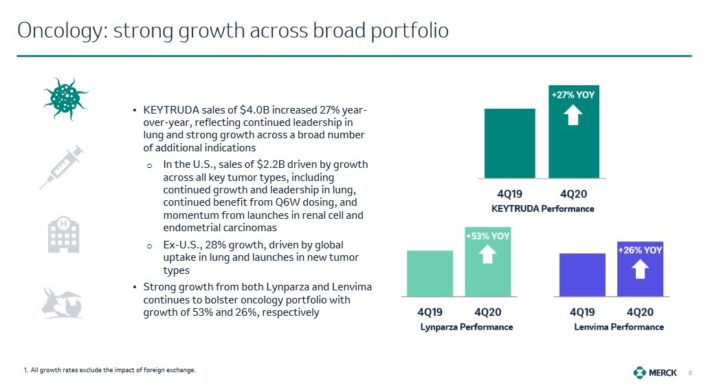

Oncology continues to be a growth driver for Merck.

Source: Investor Presentation

Keytruda, which treats cancers such as melanoma that cannot be removed by surgery, and non-small cell lung cancer, remains an excellent source of growth as revenues were higher by 28% for the quarter and 30% for the year. The product eclipsed the $14 billion mark for revenue in 2020. Merck’s HPV vaccine Gardasil returned to growth in the fourth quarter, as sales improved 44% due to replenishment of doses that were borrowed in the fourth quarter of 2019 from the CDC Pediatric Vaccine Stockpile.

Merck expects adjusted EPS of in a range of $6.48 to $6.68 and revenue of $51.8 billion to $53.8 billion for 2021. We expect 5% annual EPS growth over the next five years. In addition to valuation changes and the 3.5% dividend yield, we expect total returns of 13.6% per year for Merck stock.

Deep Value Stock #3: Telephone & Data Systems (TDS)

- 5-year total expected returns: 14.8%

Telephone & Data Systems is a telecommunications company that provides customers with cellular and landline services, wireless products, cable, broadband, and voice services across 24 U.S. states. The company’s Cellular Division accounts for more than 75% of total operating revenue. TDS started in 1969 as a collection of 10 rural telephone companies.

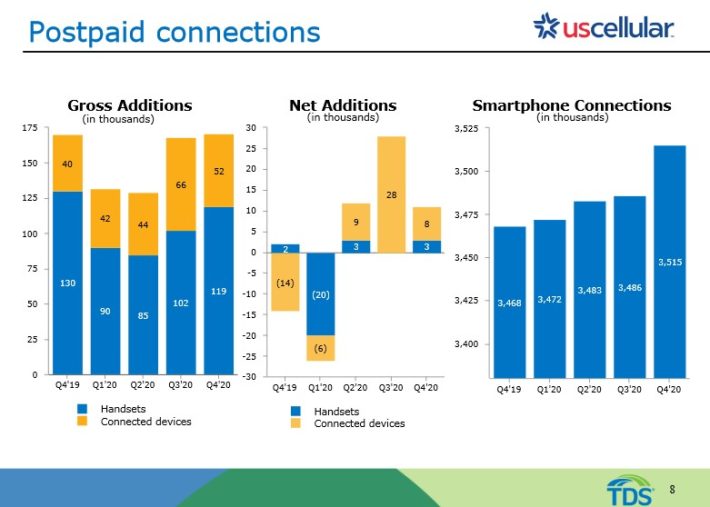

On February 18th, TDS reported financial results for the fourth quarter and full year. The company grew its total operating revenues by 3%to $1.38 billion in the fourth quarter. Diluted earnings per share grew 20% in the fourth quarter, from the same quarter the previous year. Strong postpaid performance at U.S. Cellular fueled the company’s fourth-quarter results.

Source: Investor Presentation

For the full year, total operating revenues grew 1% to $5.23 billion compared to $5.18 billion in 2019. Diluted earnings per share significantly grew year-over-year, from $1.03 in 2019 to $1.93 in 2020, for an 87% increase. Postpaid churn rate was identical YoY at 1.21%. Average revenue per user for postpaid connections grew from $47.23 to $47.51, a 0.6% increase. Total residential revenue per wireline connection grew from $50.12 to $51.33 YoY.

Management provided 2021 guidance and expects service revenues at U.S. Cellular of around $3.1 billion, in-line with 2020 results. Total expected operating revenues for TDS Telecom is around $1 billion, also in-line with actual 2020 results.

Telephone & Data Systems operates in the competitive telecommunications industry. Price wars are common among telecoms in the constant battle for subscribers. That said, the entire industry benefits from a high level of concentration. There are only a few major telecoms (AT&T, Verizon, and T-Mobile) that dominate the U.S. market. Building a new network large enough to compete with the established giants, TDS included, would be extremely prohibitive.

TDS has historically held up extremely well during recessions; consumers are very reluctant to cut their telecommunications services like wireless, broadband, and cable, even during an economic downturn. For example, during the Great Recession, TDS’ earnings-per-share actually increased 69% from 2008-2010. The company has remained profitable during the current period of economic weakness caused by the coronavirus pandemic.

Much of TDS’ future growth potential depends on U.S. Cellular, as TDS has an 82% stake in U.S. Cellular. The company has a mixed track record when it comes to growth. During the last decade, its earnings-per-share have declined approximately 2.6% compounded-per-year on average. While the earnings trend has been volatile, book value per share has grown by 2.0% per year over the last decade. We expect 1.5% annual earnings-per-share growth over the next five years. Earnings growth will be achieved through a mix of revenue growth and margin improvements.

Shareholder returns will be boosted by a rising valuation multiple, expected EPS growth of 1.5%, and the current dividend yield of 3.9%. Overall, total returns are expected to reach 14.8% per year over the next five years.

Deep Value Stock #2: Lockheed Martin (LMT)

- 5-year total expected returns: 14.8%

Lockheed Martin is the world’s largest defense company. About 60% of the company’s revenue comes from the U.S. Department of Defense, with other U.S. government agencies (10%) and international clients (30%) making up the remainder.

The company consists of four business segments: Aeronautics (~40% of sales) which produces military aircraft like the F-35, F-22, F-16and C-130; Rotary and Mission Systems (~26% sales) which houses combat ships, naval electronics, and helicopters; Missiles and Fire Control (~16% sales) which creates missile defense systems; and Space Systems (~17% sales) which produces satellites.

Lockheed Martin reported another year of growth in 2020. For the fourth quarter, company-wide net sales increased 7% to $17 billion, while earnings-per-share increased 21%. All four business segments again increased net sales. For the year, company-wide net sales increased 9% to a record $65.4 billion while diluted GAAP earnings per share increased 12% to a record $24.50 per share.

Source: Investor Presentation

Lockheed Martin’s backlog is approximately $147.13 billion, driven by increases in Aeronautics, Missiles and Fire Control, and Rotary and Mission Systems, offset by a decline in Space. The company’s outlook for 2021 provides from revenue of at least $67.1 billion and diluted earnings per share of at least $26.00 per share.

Lockheed Martin is an entrenched military prime contractor. It produces aircraft and other platforms that serve as the backbone for the U.S. military and other militaries around the world. This leads to a competitive advantage as any new technologies would have to significantly outperform extant platforms. These platforms have decades-long life cycles and Lockheed Martin has expertise and experience to perform sustainment and modernization.

The combination of P/E expansion, 8% expected EPS growth, and the 3.1% dividend yield to generate 14.8% annualized total returns over the next five years.

Deep Value Stock #1: Bristol-Myers Squibb (BMY)

- 5-year total expected returns: 15.6%

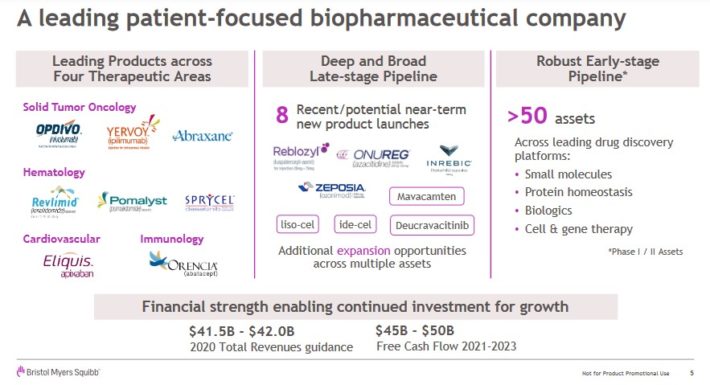

Bristol-Myers Squibb was created when Bristol-Myers and Squibb merged in 1989, but Bristol-Myers can trace its corporate beginnings back to 1887. Today this leading drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $42 billion.

The past year has seen the company transform itself, due to the $74 billion acquisition of Celgene, a peer pharmaceutical giant which derived almost two-thirds of its revenue from Revlimid, which treats multiple myeloma and other cancers.

The end result is that Bristol-Myers Squibb is now an industry goliath, which continues to generate strong results even during the coronavirus pandemic.

Source: Investor Presentation

The past year has seen the company transform itself, due to the $74 billion acquisition of Celgene, a peer pharmaceutical giant which derived almost two-thirds of its revenue from Revlimid, which treats multiple myeloma and other cancers.

Bristol-Myers announced fourth-quarter and full-year results on 2/4/2021. For the quarter, revenue grew 39% to $11.1 billion, topping estimates by $329 million. The company reported a net earnings loss of $10 billion, or $4.45 per share, compared to a net loss of $1.1 billion, or $0.55 per share, in the prior year. Reported net earnings included significant charges related to recent acquisitions.

Meanwhile, adjusted earnings-per-share of $1.46 per share for the fourth quarter, grew 20% year-over-year. For the year, revenues grew 63% to $42.5 billion while adjusted EPS improved 37% to $6.44.

BMY has positive growth potential moving forward. Not only is the Celgene acquisition an immediate catalyst, the company’s strong pharmaceutical pipeline will fuel its future growth. For example, Revlimid sales increased 18% for the fourth quarter, while Eliquis, which prevents blood clots, reported sales growth of 12% due to high demand in the U.S. and internationally, offset by lower prices. Another growth product is Orencia, which treats rheumatoid arthritis, which grew revenue by 9%. We expect 3% annual earnings growth over the next five years for BMY.

Bristol-Myers raised its guidance for adjusted EPS to a range of $7.35 to $7.55 from $7.15 to $7.45 previously. The company’s recently announced $2 billion addition to its share repurchase is a positive catalyst for earnings-per-share growth.

Based on expected EPS of $7.45, shares of BMY trade for a forward P/E ratio of 8.3. Our fair value P/E estimate is a P/E of 13-14, which is more in-line with the pharmaceutical peer group. Lastly, BMY has a 3.2% dividend yield, leading to total expected returns of 15.6% per year over the next five years.

Final Thoughts

Much of our research focuses on dividend stocks, and for good reason. The best dividend growth stocks, such as the Dividend Aristocrats, have generated excellent returns for shareholders over the past several decades. But investors should not forget about valuation. With stock prices near record levels, valuations appear elevated across multiple market sectors.

The 5 dividend stocks on this list still have reasonable valuation multiples. An expanding P/E ratio could boost their future shareholder returns, in addition to their high dividend yields, making them potentially worthwhile investments in 2021 and beyond.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more