4 Reasons Enterprise Products Partners Is A Strong Super SWAN Buy

Summary

- Recognizing that dividend investors are hungry for yield, we have extended our coverage universe to include Master Limited Partnerships.

- I want to highlight why Enterprise Product Partners, the highest quality MLP, is currently a strong buy.

- Super SWANs can fall (though usually less) with the broader market, and “sleep well at night” only pertains to the quality of the company/MLP and the safety of the payout.

- This idea was discussed in more depth with members of my private investing community, iREIT on Alpha.

This article was co-produced with Dividend Sensei.

I recently introduced a list of 28 REIT SWANs, and as I explained "there are only nine SWANs on this list (of dividend growers) that have increased their dividend by an average of 5% per year." And within that short list (of nine SWANs) there are just a smaller sample of REITs that are trading at an attractive margin of safety.

Recognizing that dividend investors are hungry for yield, we have extended our coverage universe to include Master Limited Partnerships (or MLPs).

4 Reasons Enterprise Products Partners Is A Strong Super SWAN Buy

Super SWANs are as close to perfect dividend stocks as you can find on Wall Street. Dividend Kings tracks 40 of these legendary income payers, and unfortunately, most are highly overvalued right now.

However, no matter how overheated the market gets, something good always is on sale. Which is why I want to highlight why Enterprise Product Partners (EPD), the highest-quality MLP, is currently a strong buy.

There are four reasons why this 6% yielding pipeline giant will not just deliver clockwork-like safe and growing income over time, but at its current 10% discount to fair value, has the potential to also beat the market with 11% to 13% CAGR total returns over the next five years.

Reason 1: Excellent Payout Safety

To be a Super SWAN it takes a perfect quality score based on three metrics

-

5/5 dividend safety (excellent), based on payout ratio, balance sheet, and cash flow stability over time

-

3/3 business model (wide moat, consistent above industry average profitability, long growth runway)

-

3/3 management quality (superb capital allocation, a proven track record of smart growth strategies and dividend friendly corporate culture)

Enterprise’s distribution safety is basically bulletproof courtesy of

-

62% analyst forecast 2019 payout ratio (1.61 coverage ratio) - 1.7 in Q1

-

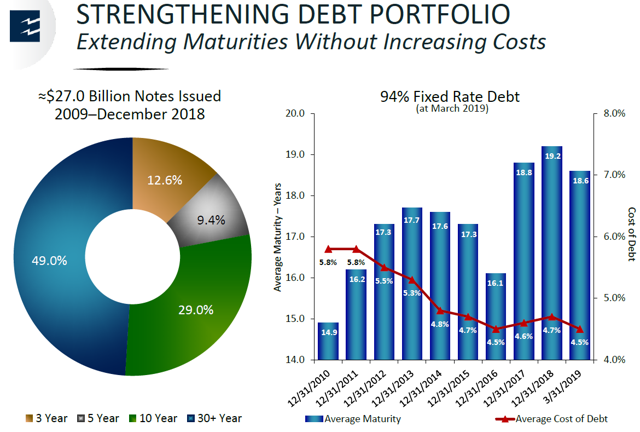

BBB+ stable credit rating (tied for the highest in the industry)

-

3.4 net debt/EBITDA (vs 4.3 industry average)

-

Interest coverage ratio 4.8 (vs 4.5 industry average)

(Source: investor presentation)

Continue reading on Seeking Alpha.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

Disclaimer: This article is intended to provide information to interested parties. As ...

more