4 Investment Analysts And Managers To Watch

“It is impossible to produce superior performance unless you do something different from the majority.” – John Templeton

- Best investment analysts who think outside the box.

- Indexing is popular, but not the only path to wealth.

- Active investing approaches may pay off at this stage in the bull market.

- Whether an active investor is lucky or skillful is only determined after decades of hindsite.

Finding a smart investment analyst or financial manager to follow, with reasonable fees and a sound record is no easy feat. There are a multitude of investment strategies all attempting to either beat the market, or match the market, but with less volatility. In my work as a regular commentator on the Money Tree Investing Podcast with Kirk Chisolm, columnist for US News and World Report’s investing vertical, and InvestorPlace, along with my role running Robo-Advisor Pros, I encounter a lot of investing strategies and managers.

In fact, nearly every week I’m tempted to invest in a real estate crowdfunding offer, a fund managers smart ETF, an investment advisor’s strategy portfolio or a specific robo-advisor (or two or three). There are a lot of great investing opportunities today representing a variety of investment styles.

Despite learning in my MBA program and reaffirmed in countless scholarly articles that attempting to beat the market is a loser’s game, market-based passive investing isn’t fool proof. If it were, there wouldn’t be so many alternatives.

Why Not Invest in an S&P 500 Index Fund Like Buffett Advised His Estate Executor?

Warren Buffett’s advice to his heirs might not be correct. One of the best investors of this generation, Buffett instructed the executor of his estate, to invest 90% of his assets in a Vanguard S&P 500 index fund and !0% in short-term government bonds.

If passive index fund investing is good enough for Buffett’s heirs, shouldn’t it be appropriate for the rest of us?

Yet, passive index fund investing is not as easy as it seems. There are many ways to invest in index funds. Deciding how to set up a passive index fund portfolio can be a challenge with the ample varieties of index funds, weighted distinctly, and covering broad swaths of the investment markets.

The varieties of index funds are vast, from the market weight S&P 500 to the equal weight S&P 500 fund to strategy and sector funds of all shapes and sizes. For example, there are smart beta funds galore designed to capitalize on factors shown to outperform such as dividends, small cap, equal sector weight, and value-based.

The index fund aficionado can choose a few low fee funds, in line with one’s risk tolerance, and go on about life.

Or, you can practice a more tactical asset allocation, favoring factors which have outperformed the market during the long term. You might create an algorithm or follow an advisor who’s done the legwork and attempt to invest according to market conditions and beat the markets.

And that’s why I’m calling attention to a few smart financial managers and analysts who seem to have an investment approach that makes sense and might offer a chance to improve on a simple, market cap weighted index fund portfolio.

Before you read on, I need to confess my bias.

I’m a value investor at heart. So, my investment management picks all have a value investing bent.

1. Lyn Alden Schwartzer at Lyn Alden Investment Strategy

In my writing, I’ve come across Lyn many times. She’s an engineer by trade, as many smart investment analysts are, and she leans toward value investing. Founder of Lyn Alden Investment Strategy, she provides market research and investment information to amateurs and professional investor alike.

Lyn writes about investing in a deep and comprehensive fashion. She covers topics such as currency, options, discounted cash flow analysis, and the impact of global trade on investors, as well as investing basics. Alden recently launched a premium stock research service, likely due to the interest in her investment coverage and recommendations,

I’ve read a lot of investment research, but Alden’s comprehensive views on financial markets make her an investment analyst to watch.

2. Victor Hagani and James White at Elm Partner

I met Haganyi and White through my work as publisher of Robo-Advisor Pros where we drill into the deepest recesses of the burgeoning robo-advisory investment management world. The Elm Partners robo-advisor is unlike most of the others that we cover.

Haganyi is a former hedge fund manager and White is a mathematician and former investment company partner. Their proprietary automated investment advisor combines value and momentum investing strategies in an attempt to match or exceed market returns with lower volatility. In addition to investment management, the investment managers offer well-researched sophisticated articles on investing topics. Some of their recent articles discuss negative interest rates, home-biased investing, and what gamblers can teach buy and hold investors.

During a recent visit to Philadelphia I chatted with White. He went through the research behind Elm’s investment algorithm and showed me the recent portfolio returns vs. their market benchmarks. Despite improved returns versus the benchmark, White was quick to explain that Elm’s goal is not extraordinary returns, but to approximate global investment stock and bond market returns with lower volatility.

Elm Partner’s .12% management fee is economical, even within the robo-advisor community. It’s rare to find a tactical investment approach with a reasonable fund management fee. Their current Assets Under Management surpass $850 million. The investment minimum is $300,000, and many of firm’s the clients are former and current investment professional and families with exceptional wealth.

Elm offers two portfolios, both with the same value and momentun-based approach. One portfolio approximates a 75% stock and 25% fixed allocation while the other is a 100% equity portfolio.

Photo by William Iven on Unsplash

2. Steven Jon Kaplan at True Contrarian Investments

Kaplan is a New York-based investment consultant with a value bent. With a background as an Options Pricing Specialist at Thomson Reuters, and an engineering and Computer Science degree, Kaplan has the technical chops to tackle algorithmic-based investing. I encountered Kaplan in my role as a writer for US News and World report, as he frequently contributes his value-based investment recommendations to my articles.

Kaplan examines theglobal financial markets to identify assets that are greatly undervalued. He identifies signals that capture insider buying, investor capital inflows vs. outflows, media and advisor sentiment along with other factors. Kaplan adds in historical interrelationships to the algorithm to pinpoint trend changes.

Kaplan, along with our next investment manager, Meb Faber, currently likes emerging market stocks. In this frothy investing environment, where the CAPE P/E ratio is 30, nearly double the average of 15, it’s tough to get enthusiastic about most US stocks.

Current Yardeni research places the emerging markets forward PE ratio at 12.3, squarely in value territory.

He offers a newsletter and is a frequent source for my US News articles.

3. Meb Faber at Cambria Investment Management

Meb Faber’s bio spans The Meb Faber Show podcast, books and whitepapers, and his role as co-founder and chief Investment officer at Cambria Investment Manager.

During Faber’s recent appearance on Money Tree Investing Podcast, he covered his tactical asset allocation strategies. He’s offering his best investing approaches through the firm’s 12 targeted ETFs. The Cambria ETFs allow investors to capture domestic and foreign shareholder yield, value and momentum strategies and the new cannabis sector.

Cambria’s three shareholder yield funds apply this factor-based investment screen across US and international markets. These rules-based ETFs screen stocks based upon high shareholder value. This metric is a supercharged version of the dividend yield ratio.

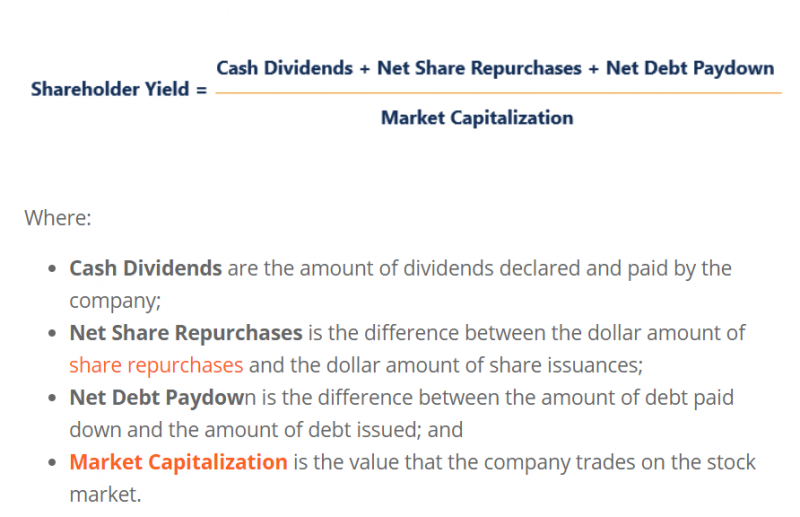

Shareholder yield was popularized in 2005 by William Priest, at Epoch Investment Partners. Shareholder yield refers to the amount of money shareholders receive from a company that is in the form of cash dividends, net stock repurchases, and debt paydown.

What is Shareholder Yield?

4. Personal Capital

Founded by Bill Harris in 2009, Personal Capital is another automated investment manager with a sector weight investment approach, versus the typical market capitalization weighted passive portfolio.

Personal Capital eschews the traditional market-cap-weighted index like the S&P 500 with a proprietary “smart weighting” investing approach. You can read all about the investment methodology in this white paper. This investment strategy takes a sample of US stocks and constructs an index that more equally weights economic sector, style, and size. The Personal Capital smart weighting investing goal is to maximize risk-adjusted return and capitalize on value-adding opportunities.

The Benefits of Smart Weighting are:

- Better factor diversification

- Increased return potential

- Increased tax management opportunities

- Avoidance of sector bubbles

- Elimination of fund costs – by investing in individual stocks in lieu of ETFs

Personal Capital validates this investment approach with a “Russell Investments Study on Equal Weighting,” that handily shows outperformance of a Russell 1000 equal weight index against a Russell 1000 market cap weight index using performance information since 1990.

Personal Capital also finds their back-tested smart weighting approach since 1990 yields an 11% annualized return and 16.8% standard deviation versus a 10.2% return and 17.5% for the S&P 500.

Whether you invest with Personal Capital or not, the firm offers among the best investment analysis tools for free on their website. Sign up and account synch is free and seamless.

The Returns of the Best Investment Managers

The best investment managers returns can only be trusted after decades. Recent investment returns aren’t the best way to pick and investment analyst to follow. One strategy might outperform for one decade while another during another time.

Picking an investment manager based upon past returns is risky business. There’s abundant evidence of falling stars such as Bill Gross, bond king at Pimco, who moved to Janus only to suffer disappointing results in subsequent years.

The best way to choose an investment manager or strategy is to study the research of what has generally been successful on Wall Street. Choose a manager or a strategy that makes sense to you and apply patience. One thing is certain, jumping in and out of the markets is not a winning investment approach.

Disclosure: I have no money invested with any of these investment analysts. I previously consulted for Elm Partners but have no current fiduciary relationship with the firm. I use the free Personal ...

more