3 Tech Giants That Could Benefit From The 5G Revolution In 2020

Hyper-fast internet downloads. Household appliances that “talk” to the internet. Cars that talk to… each other. The 5G internet revolution is coming to America, and 2020 will probably be the first year that 5G becomes widely available to consumers.

Recognizing this, Apple made the strategic decision to keep 5G capability out of its latest iPhone model, the iPhone 11, released in September 2019. The company’s next iPhone iteration, however, which will be 5G-capable, is due to arrive in late 2020.

Perhaps not coincidentally then, Wall Street analysts by and large are optimistic about Apple stock in 2020. According to TipRanks, a company that tracks and measures the performance of analysts, more than half the Wall Street bankers who have issued ratings on Apple stock over the past month rate the stock a “buy.”

And Apple isn’t the only stock they like. Here’s what analysts have to say about it… and two other 5G-related stocks they like.

Apple Inc. (AAPL)

But let’s consider Apple first. With $260 billion in annual sales and a $1.3 trillion market capitalization, Apple needs no introduction — this hi-tech juggernaut is literally America’s most valuable tech company today, and likely to be a leading force in the 5G revolution.

Last week, Wedbush analyst Daniel Ives predicted that 2020 will be “the year of the 5G supercycle for Apple.” Apple is preparing “a slate of 5G smartphones set to be unveiled in September that will open up the floodgates on iPhone upgrades across the board that the Street continues to underestimate.” Indeed, Ives believes ” underlying iPhone demand remains comfortably ahead of Street/original expectations for FY20 with 185 million/190 million units” in 2020, and the company is set to release “at least 5 iPhone versions to capitalize on this demand.

Based on its supply chain checks, Ives predicts that “200 million units could be the starting point for 5G Apple smartphone demand [in 2020] as roughly 350 million iPhones [out of900 million iPhones currently in use] are currently in the window of an upgrade opportunity.

Ives’ estimate, by the way, is in line with a similar analysis just out of PiperJaffray, where analyst Michael Olson says “23% [of current iPhone owners] are interested in purchasing a relatively higher ASP ($1,200) 5G iPhone.” Working off of Wedbush’s 900 million unit estimate for the installed base, this would suggest 207 million 5G-capable iPhones could be sold in 2020 — well ahead of consensus estimates. Furthermore, Olson believes that 2021 could be even bigger for Apple, as that will be the year “most positively impacted by 5G iPhone upgrades.”

Both analysts are positive on Apple stock, with Olson assigning an “overweight” rating with a $305 price target, and Ives an “outperform” rating and a $350 price target. If they’re right, investors could be in for a very pleasant surprise … because right now, the consensus on Wall Street is that Apple stock will end 2020 around only $268 a share — below where it trades today. (See Apple price targets and analyst ratings on TipRanks)

(Click on image to enlarge)

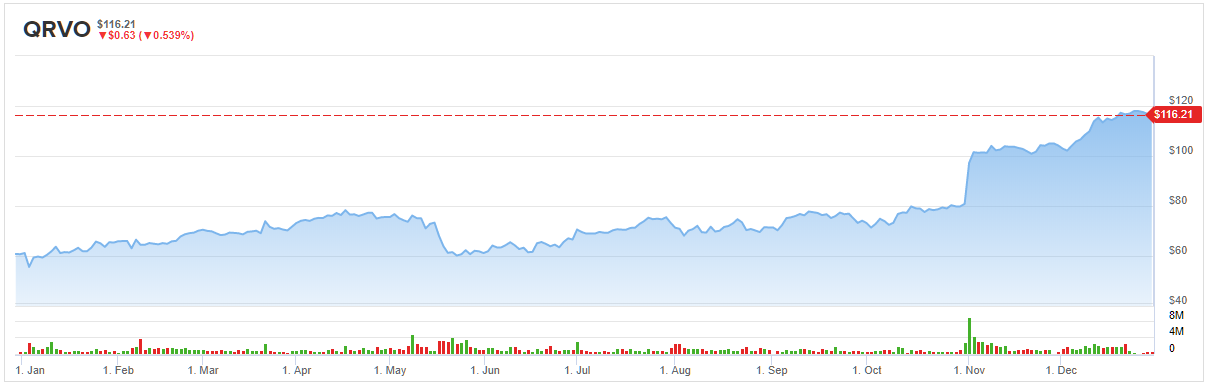

Qorvo, Inc. (QRVO)

And what’s good news for Apple investors could be good news for Quorvo as well. One of Apple’s key suppliers of radio frequency chips to make the iPhone work, sales to Apple account for about 30% of Qorvo’s revenue stream.

In a recent note, Benchmark analyst Ruben Roy said Qorvo stock is “well-positioned ahead of [the] 5G cycle,” with both cash flow and profit margins set to “improve over the next few years.” Echoing the sentiments already expressed regarding Apple above, Roy sees “~200 million 5G smartphone shipments in 2020,” a number up sharply from predictions for just 120 million unit sales earlier this year.

“As the 5G markets expand,” says Roy, “we expect the Company to deliver on its longer-term margin targets” for 50% gross margins and 30-35% operating profit margins. To put that in perspective, last year Qorvo’s gross profit margin was less than 40%, and its operating margin just 9%. Even those margins were good enough to keep Qorvo profitable — but with much better profit margins will come much greater profits, period.

Thus, despite many analysts on Wall Street being skeptical of Qorvo (consensus expectations are for the stock to end 2020 around $100 a share, below where it trades today), Roy bucks the trend and predicts that Qorvo stock will hit $127 before a year is out.

Cowen analyst Karl Ackerman is even more optimistic, reiterating his “outperform” call on Qorvo, while predicting the shares could hit $120, or even $140 within the next 12 to 18 months — as much as a 20% gain from today’s prices.

“This stock has had an astonishing run since June, up 80%, but we see a path toward $140 over the next 12-18 months as QRVO remains extremely well aligned to 5G infrastructure spending, 5G cellular applications and smart home WiFi that are now just hitting the P&L,” Ackerman wrote. (See Qorvo stock analysis on TipRanks)

(Click on image to enlarge)

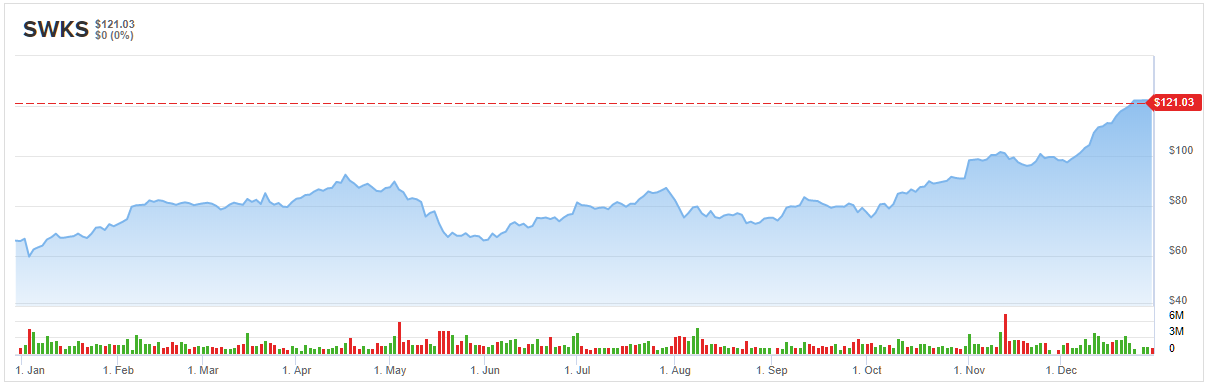

Skyworks Solutions (SWKS)

Another wireless chipmaker and Apple supplier, gearing up to profit from the 5G revolution, is Skyworks Solution. With 47% of its sales going to Apple, a successful 5G foray for the iPhone maker should translate into immediate benefits for Skyworks.

PiperJaffray analyst Harsh Kumar says “Handset unit volumes benefiting from 5G remains a vibrant possibility In our view, any uptick in units can be upside to estimates.” The analyst continued, “We believe the current market estimate of 200 million 5G phones in 2020 (presented at a competitor analyst day) seems largely accurate. We believe the largest manufacturer of high-end phones in the United States will likely drive about 40% of those shipments, with mid-to-upper end Android models and China 5G handset makers driving the remaining 60% of the units.”

Meanwhile, over at Summit Insights Group, analyst Kinngai Chan, predicts that “5G content growth and a strong position at AAPL should position SWKS to outperform its peer group.” While “5G content growth will benefit RF companies overall,” Chan is particularly keen on Skyworks stock because “Huawei will lose market share to AAPL and other smartphone OEMs in 2020,” and therefore, suppliers “that have high(er) exposure to Apple” are likely to better than those that do not. In this regard, Chan argues, “we believe SWKS is the best RF name positioned to outperform its peer group in 2020,” which is why he considers the stock one of the “2020 best ideas in semiconductors.”

Elsewhere on Wall Street, this idea is catching on. Although the “consensus” price target on the stock is still only $109 per share, analysts who have published ratings on Skyworks in the past month are voting 2-to-1 in favor of Skyworks, and assigning price targets as high as $122 a share. This suggests that while price targets may look unimpressive today, they’re moving in the right direction to reward investors tomorrow. (See Skyworks stock analysis on TipRanks)

(Click on image to enlarge)

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more