3 Dividend Stocks Retirees Must Have In Their Portfolio

Guest contribution by Mike Heroux from The Dividend Guy Blog.

Before I became an entrepreneur, I used to be a private banker. I was in charge of covering all financial planning aspects for wealthy clients. Most of them were business owners with a large amount to invest. Interesting enough, my client’s most common concern was to survive their portfolio once they sold their business. They feared the market would take away their hard-earned money. A classic question used to come inevitably:

Past returns look great and all that, but now, is it the right time to invest?

For each year, you could come out with a very good reason not to invest in the market:

- 2014: Don’t invest, we are the peak after 5 yrs.

- 2015: Don’t invest, oil is collapsing.

- 2016: Don’t invest, Brexit is coming.

- 2017: Don’t invest, NAFTA future is unsure.

- 2018: Don’t invest, the market is crashing.

- 2019: Don’t invest, we are at a peak after 10yrs.

But it’s really the time to invest, here’s why.

This is how many retirees prefer to avoid getting worried and leave money aside and wait. They wait until there is a market bottom. Unfortunately, many missed the latest market opportunity as they were busy cooking on Christmas Eve.

Once you reach retirement, leaving your money in a money market fund could increase your chances of surviving your portfolio and not having enough money to support your lifestyle at retirement and take care of the ones you love.

Similar to Sure Dividend, I believe in dividend growth investing and consider holding strong companies will help me going through any stock market storm. I believe dividend growth investing is the perfect strategy to achieve my retirement goal and make sure my family doesn’t lack money.

This is why investing today in strong dividend growers will help you live a stress-free retirement and generate enough income so you can continue to enjoy your favorite activities. Even if we are currently trading at an all-time high, Mr. Market offers us a few great opportunities. Here are my favorites right now.

AbbVie: A Great Combination Of Growth And High Income

You are probably aware of the substantial sum AbbVie (ABBV) is about to disburse to acquire Allergan (AGN). On the day of the announcement, ABBV went all the way down to ~$65. But this is just another hit on a stock that isn’t doing well for the past 18 months:

Source: Ycharts

The problem with AbbVie, as well as many pharma stocks, is the continuous concern around drug patents expiring. The company sells the most profitable drug in the world, Humira with yearly sales of ~$20B in 2018. Unfortunately, Humira’s patent expired in Europe and its exclusivity days are numbered in the U.S. ABBV’s lawyers were able to extend the patent up to 2023 where biosimilars will enter the market in exchange of companies paying AbbVie a royalty. Not a bad deal.

ABBV’s legal department is known to be quite creative to find new ways to extend patent and it seems it will be a perfect match to add Allergan’s products to their business. After all, AGN’s legal department even found a way to trademark Botox to avoid patent expiry.

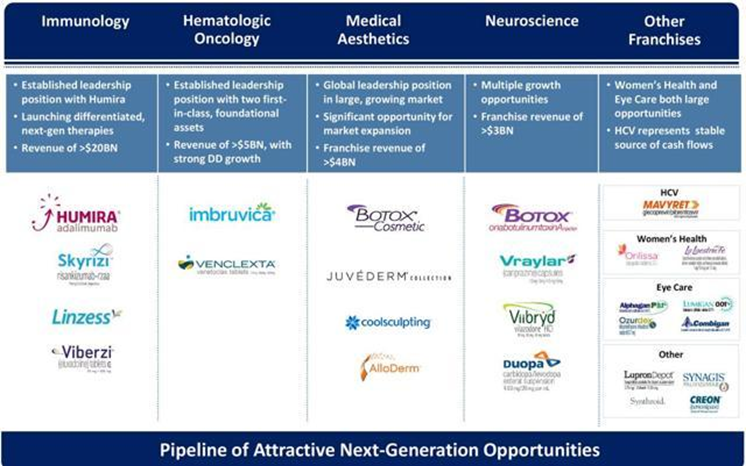

Before the transaction, ABBV had a great drug pipeline, especially toward new cancer drugs. With this new acquisition, the new AbbVie presents a well-diversified portfolio of products with even more new drugs coming out:

Source: ABBV presentation page 7

Such a combination will grant the company with several growth vectors. You can expect ABBV shares to come back strong once the dust is settled. In the meantime, you will benefit from a juicy dividend…

AbbVie As A Source Of Income

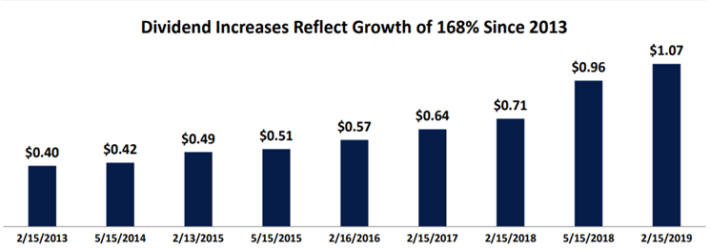

If you remember, AbbVie was spun-off Abbott Labs (ABT) in 2013. While ABT continues its way to become a Dividend King (currently showing 46 consecutive dividend increases), ABBV kept its old management good habit and now show 8 years with a consecutive increase:

Source: ABBV investors presentation 2019

Most importantly, an investment in AbbVie represents a yield of ~5.50%. It’s the first time since the spin-off that the company offers such a generous yield.

In the AGN acquisition presentation, management explains how the company expects to generate $2B pre-tax synergies that will be used to reduce debt and support growing dividends (page 4). This was a key component for me as I wasn’t sure at first if management could manage a $63B purchase (money coming from a combination of new shares issuance and debt) and keep its dividend growth policy alive.

This leads me to think the 5%+ yield is currently a market anomaly that will rapidly be resolved. Make sure to add ABBV to your watch list this month.

Enbridge Is Paying You For More Than 25 Years

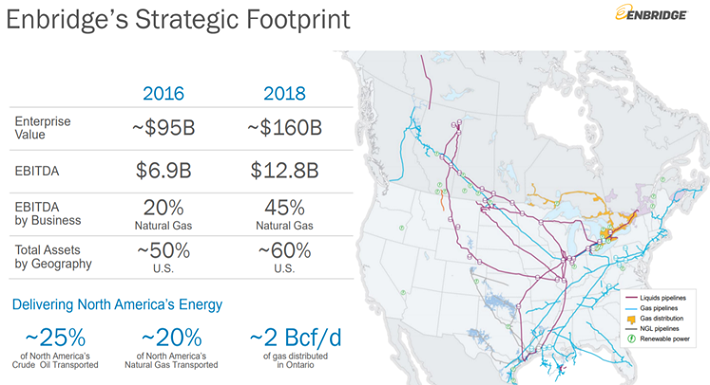

Enbridge is based in Canada and trade on both markets under the same ticker; ENB. It is an energy generation, distribution, and transportation company in the U.S. and Canada. Its pipeline network consists of the Canadian Mainline system, regional oil sands pipelines, and natural gas pipelines. The company also owns and operates a regulated natural gas utility and Canada’s largest natural gas distribution company. Additionally, Enbridge generates renewable and alternative energy with 2,000 megawatts of capacity.

Source: ENB JP Morgan Investor presentation June 2019

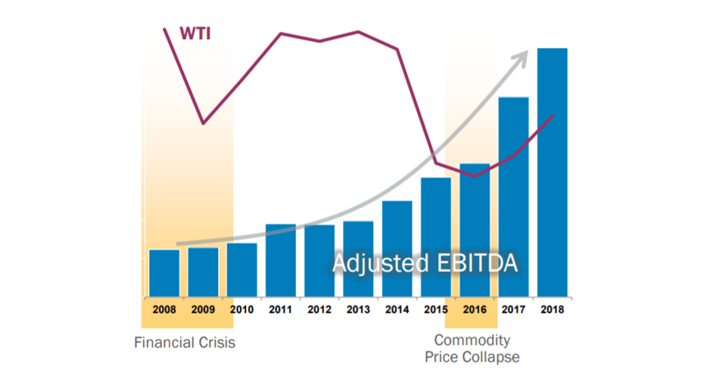

Enbridge clients enter into 20-25-year transportation contracts. The company is already well positioned to benefit from the Canadian oil sands (as its Mainline covers 70% of Canada’s pipeline network). ENB share price has been quite hectic throughout the years and this could raise some concerns. However, the company shows a very stable business model with consistent profit growth while the oil price keeps riding its roller coaster.

Source: ENB JP Morgan Investor presentation June 2019

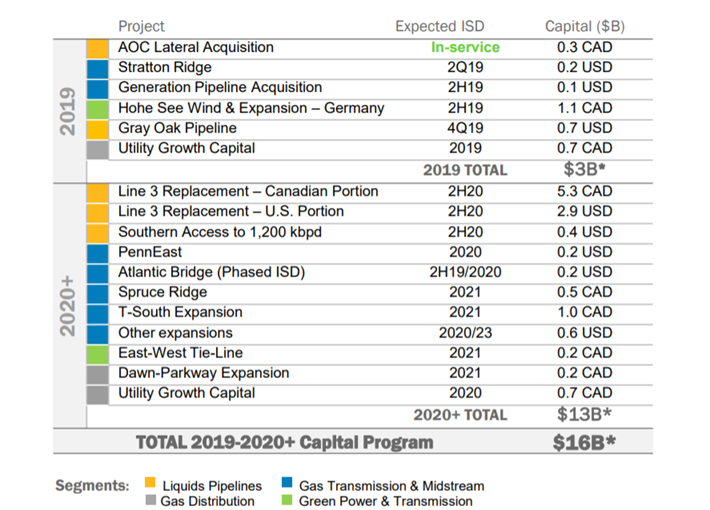

Now that the company has integrated its various partners (SEP, EEP, EEQ, and ENF), the “new” Enbridge shows a simplified structure that will help to get good credit ratings to finance its future projects. Speaking of which, management has several billion lined-up to grow the business in the upcoming years.

Source: ENB JP Morgan Investor presentation June 2019

While many of those projects could face regulatory challenges, management is not at its first rodeo. ENB is usually able to find a solution. Nonetheless, this doesn’t prevent its shares to move according to shocking news.

Enbridge As A Source Of Income

If you can stomach some share price fluctuation, you will be delighted by the company’s dividend profile.

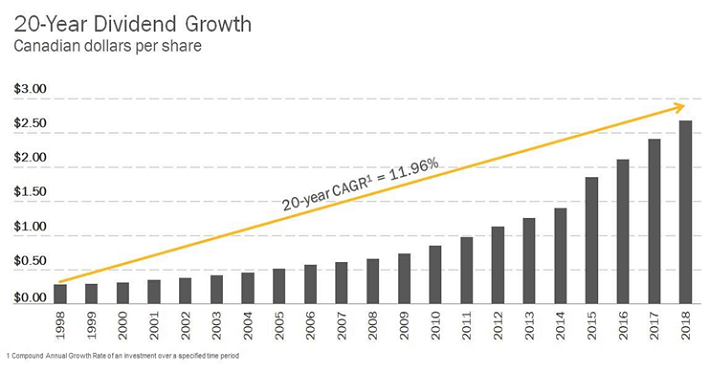

The company has paid a dividend to shareholders for the past 64 years and currently shows 24 consecutive years with a dividend increase. Most importantly, the past 20 years show an annualized growth rate of 12%.

Source: Enbridge website

Please note that the dividend is paid in Canadian dollar (converted in USD). Therefore, you will not enjoy the full dividend growth coming out of Enbridge. Nonetheless, with the current exchange rate, you have little to worry about.

You will enjoy a dividend yield over 5.50% while management intends to keep its dividend growth policy alive for several years.

Lazard Is A Complex Company With A Great Dividend

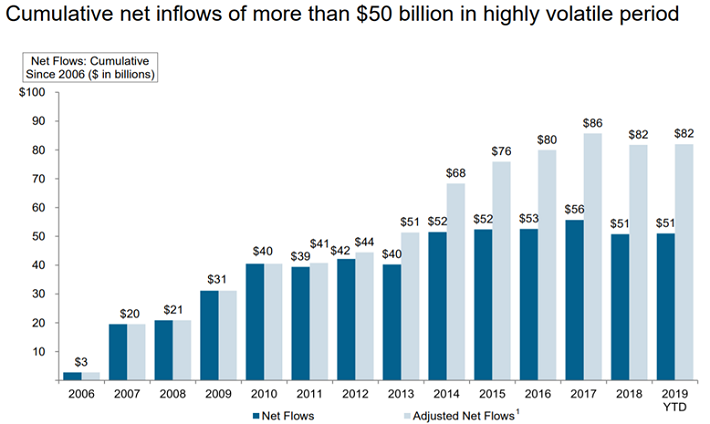

Finally, I decided to discuss one of my favorite underdog that is paying a 5% yield and comes with a “regular” special dividend on top of it. Lazard (LAZ) is often mistaken for a classic asset manager. With $235B in assets under management (AUM), we can’t say LAZ is a dominant player. However, Lazard has built an impressive reputation regarding alternative assets investment. 50% of its AUM is invested in “specialty” strategies such as emerging markets debt, infrastructure, and global robotics. Due to its performance and brand recognition, Lazard is able to show AUM growth on a consistent basis.

Source: Lazard 2019 presentation

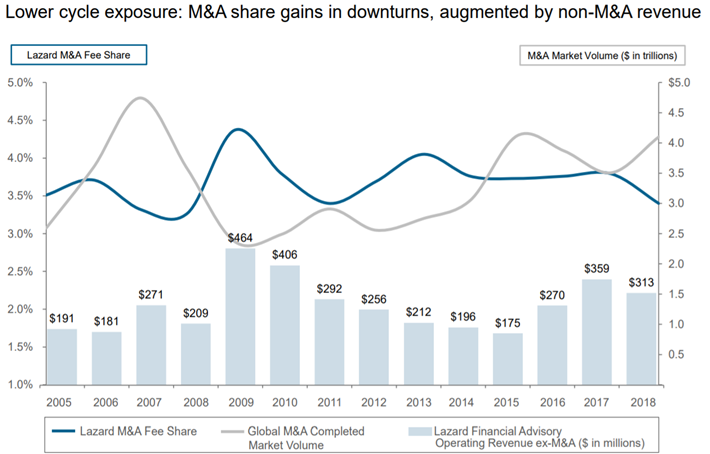

But the most interesting part of the business, in my opinion, is the “other half” of revenue coming from its advisory business. Lazard’s power resides in its quality advisory segment. Financial Advisory segment offers services regarding mergers and acquisitions, strategic advisory matters, etc. When the economy is going well, mergers & acquisitions trades require LAZ services such as when IBM (IBM) acquired Red Hat for $33.4B. When finance turns sour, LAZ expertise is also required such as when PG&E (PCG) filed for Chapter 11 or when Sears holdings sold its assets (source). In other words, if you are looking for a company generating stable cash flow whether the economy is good or bad, Lazard should be part of your top picks.

Source: Lazard 2019 presentation

Lazard as a source of income

Lazard offers a stable and increasing dividend of $0.47/share offering you a ~5.10% yield. On top of this generous payment, management pays a special dividend once a year based on performance fees. This is often seen among assets manager. Combined, you can certainly hope for a yield close to 7%.

Source: Ycharts

As it is the case with the other two companies, Lazard shares will test your patience. The stock is going up and down following the market’s moody perspective toward assets managers. However, the company has proven its strength by going through 2008 like a champion and by increasing its market share for both its asset management and financial advisory business. Please note that Lazard is registered as a partnership. This could have implication in regard to your taxes.

Final Thoughts – Invest Now, But Carefully

At the beginning of this article, I mentioned how important it was to keep your money invested (I’m personally 100% invested in equity… all the time). However, this doesn’t mean to invest in any stocks you read about during your morning review. As the market is trading at an all-time high, it is crucial to remain cautious and identify red flags telling you to stay away (here’s three of them). I tend to discard companies showing what I call a weak dividend triangle:

Revenues: A business is not a business without revenue. What is the difference between a company making growing revenue from a company showing stagnating results? Competitive advantages.

Earnings: You can’t give money if you don’t make money, right? Then again, this is a very simple statement. Still, if earnings don’t grow strongly, there is no point of thinking that the dividend payment will increase indefinitely.

Dividends: Last, but definitely not the least, dividend payments are the *obvious* backbone of any dividend growth investors. But I don’t mind the dollar amount or the yield, I solely focus on dividend growth.

The above-mentioned companies meet my investing principles and all three should be in your retirement account if you are looking for additional income.

Disclaimer: I hold shares of ABBV, EBN, and LAZ in my DSR portfolios.

Sure Dividend is published as an information ...

more