2020 US Winter Wheat Seedings

Market Analysis

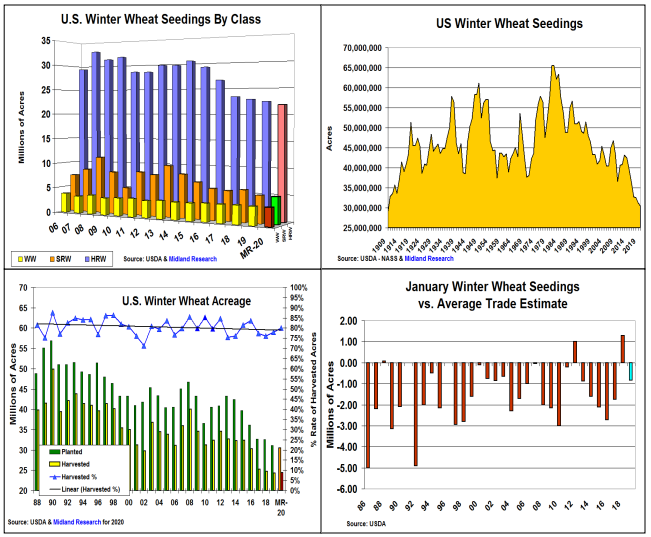

Heavy rainfall delaying US spring wheat seedings & dryness in the Black Sea helped firm prices into summer. However, wheat prices retreated on Europe’s 17 mmt larger crop and Russia’s higher-than-expected output. Despite drought impacting Australia’s crop for 3rd year in a row keeping its harvest below 17 mmt, 2019’s world output recovered to 2017 levels & this year’s ending stocks are record large. A 10% larger 2019 US winter wheat crop lead by a 171 million bu. jump in hard red output (abundant S Plains rainfall) added more bu. Despite this bearishness, US soft red wheat prices have rebounded to last summer’s values. 880,000 smaller plantings & an unchanged yield produced the smallest US soft red crop since 2010’s wheat scab damaged crop at 239 million bu. The PNW had its 4th consecutive solid white wheat output with stable plantings & yields on 2019.

Given lackluster prices, US winter wheat seedings are likely to drop again this year. Last fall’s S. Plains dryness and expanded 2019 corn & sorghum fields (above normal soil moisture) slowed seedings & reduced wheat plantings. Because of these factors, 2020’s hard red seedings could be down by 600,000 acres with nearly half of this amount in Kansas.

Overall, a 21.86 million-acre hard red wheat area is expected. Soft red seedings may also slip by 100,000 acres to 5.1 million because of wet/cold fall weather delaying the Eastern US row crop harvest. US white winter wheat plantings are expected to remain unchanged at 3.5 million acres. Overall, US winter wheat seedings are likely to drop by 700,000 acres to 30.46 million acres (-2.2%). This is only 1.264 million acres above the USDA’s initial 1909 data seedings level of 29.196 million. If 2020’s WW harvested rate returns to trend at 80%, the US combined area could be 24.375 million acres, 48,000 more than last year. The other amazing fact has been the trade’s overestimating of the US initial winter wheat seedings. Only twice since the 1984/85 has the USDA’s January level been above the trade’s idea.

What’s Ahead

With the market’s focus on the US/China Phase 1 trade agreement in early to mid-January, the USDA winter wheat seeding report probably won’t garner much attention. However, if 2020’s plantings are 1 or more million acres lower than last year on January 10, wheat could strength post-report. Look to advance sales to 75% on strength to $5.75-$5.95 in March Chicago & $5.00-$5.20 range in March KC.