The Race We All Lose

In October 2015, former Federal Reserve Chairman Ben Bernanke took to the pages of the Wall Street Journal. Pedigree matters, a fact easily established by how easy it is for central bankers and former central bankers to have their thoughts published in any mainstream outlet of their choosing. Record doesn’t mean so much, performance on the job secondary at most to consideration of titles once held and official positions once occupied.

The topic of Dr. Bernanke’s musing was, ironically, his record as Federal Reserve Chairman. Never one to miss a chance at beating his own drum, whoever cooked up the title for the piece accurately captured Bernanke’s sense of his accomplishment. It was titled simply, How the Fed Saved the Economy.

There wasn’t anything as far as evidence save for one specific comparison. The US economy wasn’t nearly as bad off as Europe’s. The Europeans were reluctant to embrace QE, therefore Ben Bernanke is our hero. “Hey, at least we aren’t Europe” is a little too close to “jobs saved”.

Europe’s failure to employ monetary and fiscal policy aggressively after the financial crisis is a big reason that eurozone output is today about 0.8% below its precrisis peak. In contrast, the output of the U.S. economy is 8.9% above the earlier peak—an enormous difference in performance.

No, actually, it wasn’t an enormous difference in performance. As usual, as an Economist he was counting on the difference in sign to mesmerize away any legitimate thoughts about gradation. With so much time having past since the Great “Recession”, +8.9% wasn’t truly any better than -0.8%. They were at best different shades of atrocious.

In a twisted way, 2017 saw something of a role reversal if only to justify this latest sense of globally synchronized growth. Europe as the world’s second sickest economy, not quite matching Japan in that category, if it was breaking out to a substantial upside, a boom even, then that would be something special. And since the ECB in 2015 finally relented on QE, double plus good.

Europe’s supposed boom alongside China’s supposed resurgence was supposed to mean guaranteed economic fortitude felt everywhere. The US would be unable to resist and inflation hysteria crept toward the even more hysterical.

That was 2017.

In 2018, China’s economy has already slowed to a substantial degree and now Europe’s, too. Q1 2018 GDP was a meaningful step down from Q4 2017, a warning that at the very least the narrative on globally synchronized growth had some serious holes in it.

GDP in Q2 has proved no better, as Eurostat reports. It was, actually, slightly less than Q1.

(Click on image to enlarge)

Over the last two quarters, real GDP growth has been as non-existent as it was in early and middle 2016 in relation to that worldwide downturn. These have been some of the slowest quarters of the past four years, an impressive feat considering that none of the quarters among the past ten years have been truly robust. Half a year at these levels suggests considerable constraint.

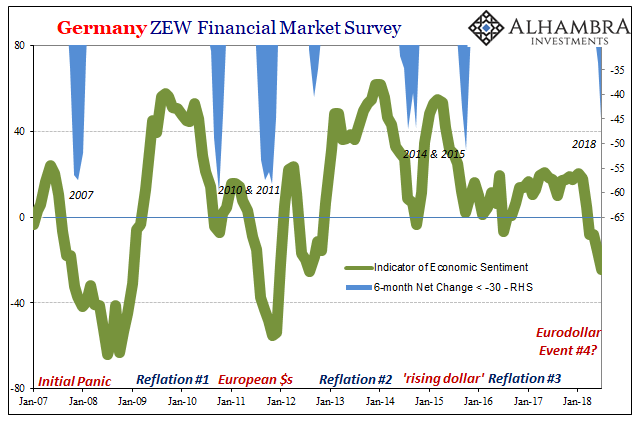

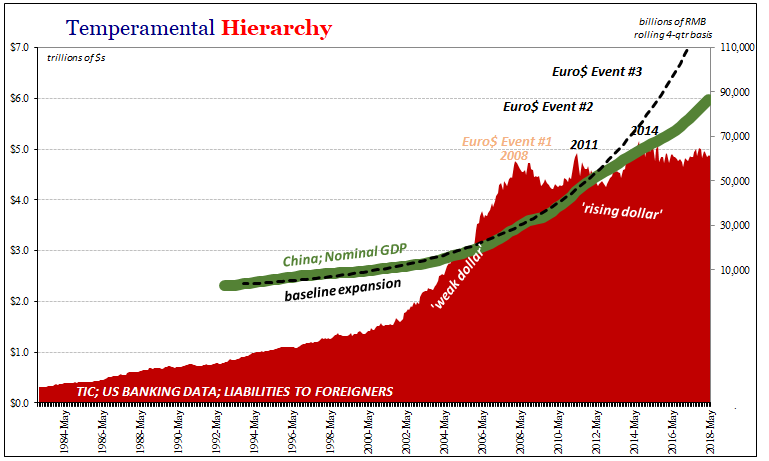

There’s economic trouble brewing in the world, and if Europe’s rebound was foretelling of a global one, what might we discern of Europe’s increasing retrenchment? The timing is particularly suspicious, though not in the way it will be classified all throughout. This is not trade war stuff, particularly since it appears Europe will have been largely spared.

What happened in January 2018 demands our immediate attention; first global asset liquidations and then the turn in the euro that suggests why there were liquidations in the first place. The ECB’s balance sheet continues to swell, and thus euro bank reserves, but eurodollars do not.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

The Germans are right to have become seriously concerned about the immediate future. And we can look past the resurrection of “decoupling”; as in the US is back to outperforming Europe and the rest of the world. At what point over the last ten years has “decoupling” ever held longer than the short run? Decoupling always becomes convergence, and never in the good way.

There is no escape because the US economy is not really separated enough from Europe’s. Bernanke was wrong on several accounts, but mostly in the race to become Japan. It has never mattered in what place anyone finishes, so long as everyone does we all lose. Again.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Disclosure: None.

Good article!