SPX, Gold, Oil And G6 Targets For The Week Of January 14

Supported by improving market breadth, the SPX uptrend continued. The futures tried on several occasions to break our upside weekly target at 2600, only to close 5 points below. A break above that level will likely trigger a run towards 2800:

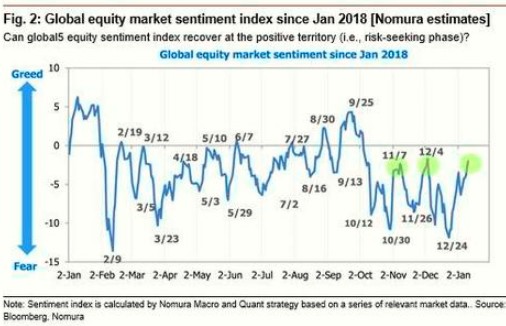

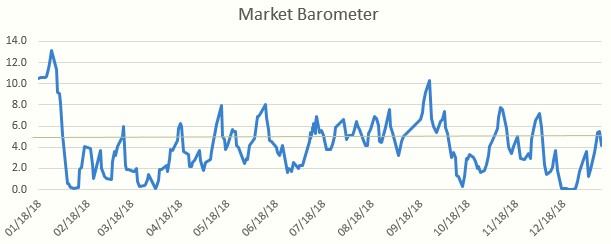

Speaking of market breadth and sentiment, we have no idea how many quant hours Nomura spends on their sentiment studies but it must have been well worth it, as they were able to achieve something strongly resembling our own market barometer:

The market barometer was referenced last year here, and gives an instant snapshot of the underlying strength/weakness of the market. The barometer reached its average level on Thursday, meaning that a sideways/down phase is due next.

Current signals*: Daily Long, Weekly Long

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX is 2500-2685.

Last week we decided to give Oil longs the benefit of the doubt, which resulted in a $3.50 gain. After breaking above our weekly upside target on Tuesday, Oil tagged the next resistance zone between 53.25 – 54 and is likely to start consolidating current gains.

Current signals: Daily Long, Weekly Long.

The projected trading range for Oil for next week is 49 – 55.5:

Gold traded flat, inside the parameters of the previous week’s candle, and is in the process of consolidating its gains after a prolonged run-up. A case can also be made for a symmetrical triangle being put in place, which is considered a continuation pattern. The high/low of January 4 defines the short/term support/resistance levels to keep an eye on.

Current signals: Daily Long, Weekly Long

The projected trading range for Gold for next week remains unchanged: 1270 – 1310:

USDCHF had a volatile week which started by testing our downside weekly target, breaking below it mid-week, then recovering and closing above it on Friday. After briefly breaking above parity last November, the USD is declining in a well-defined down sloping channel. Our key long/short pivot remains at 1.00.

The projected trading range for USDCHF for next week is 0.97 – 0.99:

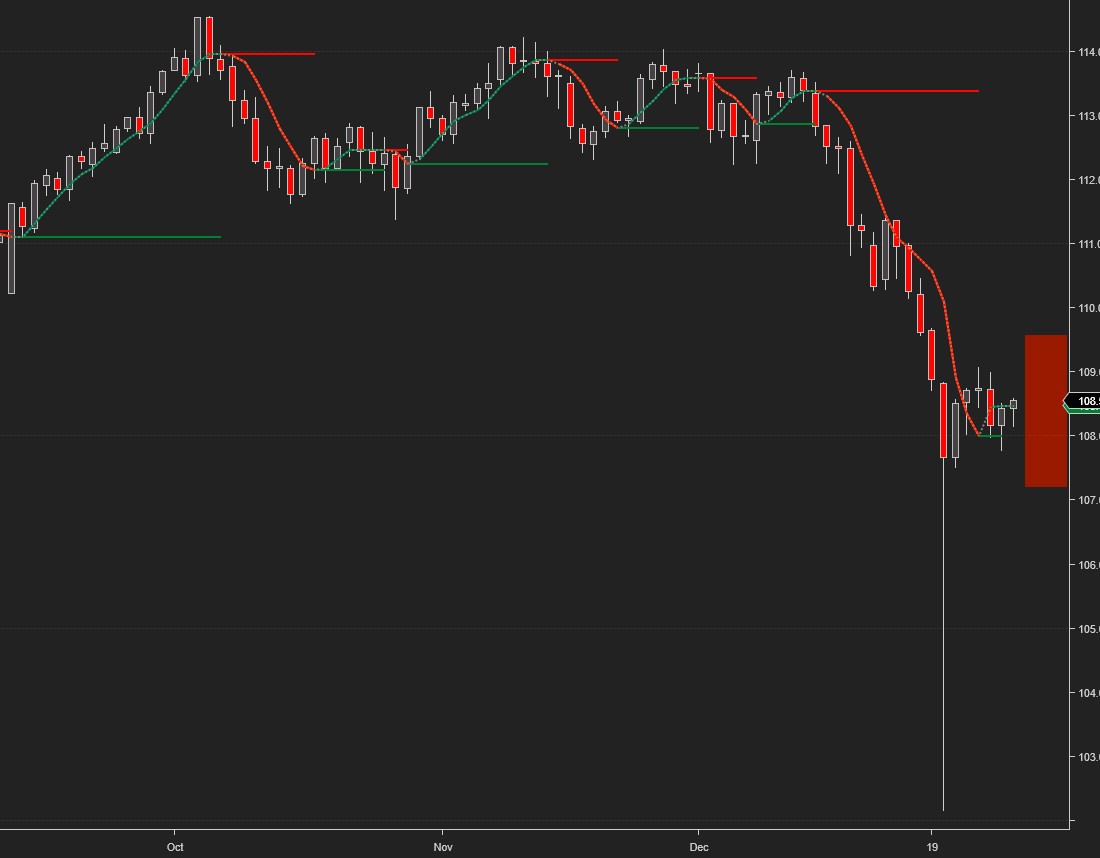

USDJPY traded flat, dancing above/below the weekly pivot line. The flash crash of January 3rd seems to have stopped the downtrend in place since mid-December ’18, but the USD needs to break above 109 against the YEN to signal a bullish change in trend.

Current signals: Daily Flat, Weekly Short.

The projected trading range for USDJPY for next week is 107 – 110:

EURUSD had a strong first half of the week when it managed to break above the upper weekly target at 1.15, but that proved to be short-lived as the EUR pulled back below that level on Thursday and Friday. Key resistance at 1.15 and support at the target angle are the major technical levels to watch for going forward.

The projected trading range for EURUSD for next week is 1.14 – 1.16:

GBPUSD traded flat most of the week but then managed to reach the upper weekly target on Friday. The daily and weekly uptrend remains in place.

Current signals: Daily Long, Weekly Long.

The projected trading range for GBPUSD for next week is 1.263 – 1.295:

USDCAD remained on a downward trajectory for most of the week until it found support and double bottomed at 1.318. It needs to break above 1.33, however, to signal that a bullish reversal is in place.

Current signals: Daily Flat, Weekly Short.

The projected trading range for USDCAD for next week is 1.31 – 1.34:

AUDUSD continues to be on a tear following the January 3rd flash crash and finished the week on the upper weekly target. There’s a heavy resistance band above between 0.735 and 0.745.

Current signals: Daily Long, Weekly Long.

The projected trading range for AUDUSD for next week is 0.708 – 0.73:

*Please note that the signals are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more