Solid Follow Through By Bulls

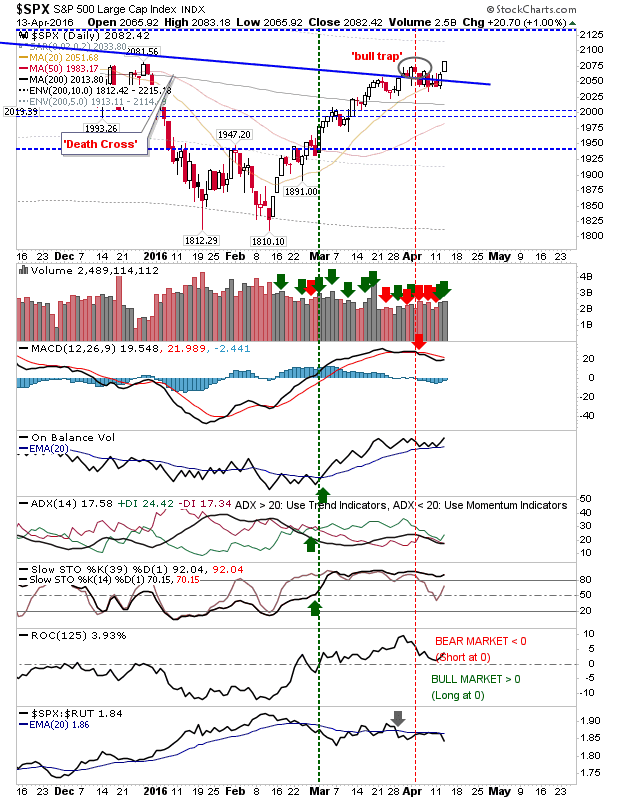

A good response from bulls with higher volume accumulation marking action of buyers and not just short covering.

Gains in the S&P were paired with further losses in relative performance (against the Russell 2000). However, other technicals are improving and the only other 'sell' trigger in the MACD could turn into a strong 'buy' by the end of this week.

The Nasdaq finally pushed into the 4900+ zone (taking my short position with it) as volume climbed in solid accumulation. Rate of Change bounced off the zero line in another tick for the bull column. As an added bonus, it also made relative strength gains against the S&P.

The Russel 2000 made a picture perfect tag of the 200-day MA, but will it play as resistance? More importantly, the relative performance went from a possible breakdown to a bullish breakout.

Today may have put to bed the indecision which has plagued the market for the past couple of weeks. This opens up for moves to new 52-week/all-time highs.

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!