Gold Prices Remain Vulnerable After Failing To Test 2018-High

(Click on image to enlarge)

![]()

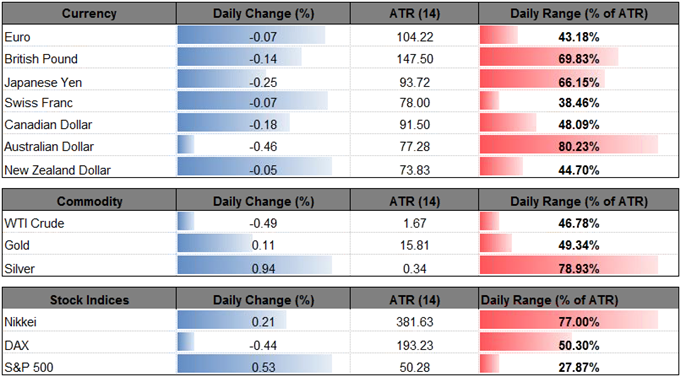

Gold prices have sold off following the failed attempt to test the 2018-high ($1366) and the precious metal may face a larger pullback over the remainder of the month as the U.S. Federal Reserve appears to be on course to deliver a 25bp rate-hike in March.

Beyond the Federal Open Market Committee (FOMC) Minutes, a number of 2018-voting members are scheduled to speak over the coming days, and the group of central bank officials may increase their efforts to prepare households and businesses for higher borrowing-costs as ‘the Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate.’ As a result, a batch of hawkish comments may continue to sap the appeal of the precious metal especially as U.S. Treasury yields sit near the yearly highs, and gold prices stands at risk of working its way back towards the February-low ($1307) as they carve a fresh series of lower-highs.

XAU/USD Daily Chart

(Click on image to enlarge)

- Downside targets are coming back on the radar for XAU/USD following the string of failed attempts to close above the $1359 (61.8% expansion) hurdle, while the Relative Strength Index (RSI) highlights a bearish tilt.

- A closing price below $1328 (50% expansion) opens up the $1312 (61.8% expansion) to $1315 (23.6% retracement) region, which sits just above the monthly-low ($13070), with the next region of interest coming in around $1297 (23.6% retracement) to $1302 (50% retracement), the former-resistance zone.

![]()

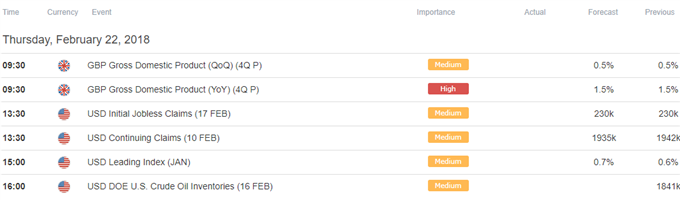

The British Pound remains under pressure following a batch of lackluster U.K. data prints, and GBP/USD appears to be on track to test the monthly-low (1.3765) as the pair extends the bearish sequence from earlier this week.

Fresh comments from Bank of England (BoE) officials have helped to mitigate the recent decline in the pound-dollar exchange rate as Governor Mark Carney and Co. endorse a hawkish outlook for monetary policy, and it seems as though the central bank will continue to normalize monetary policy in 2018 as the U.K. economy approaches full-capacity.

However, the Monetary Policy Committee (MPC) looks to be in no rush to implement higher borrowing-costs as BoE Chief Economist Andrew Haldane reiterates that future adjustments to the benchmark interest rate would be ‘gradual,’ and waning bets for an imminent rate-hike may generate a more meaningful correction in GBP/USD as the near-term outlook remains clouded with mixed signals.

Keep in mind, the broader forecast for Cable remains constructive as both price and the Relative Strength Index (RSI) preserve the upward trends carried over from 2017, but the recent string of lower highs & lows brings the downside targets back on the radar especially as the momentum indicators exhibits a similar behavior.

GBP/USD Daily Chart

(Click on image to enlarge)

- GBP/USD may continue to consolidate over the coming days as remains stuck in a wedge/triangle formation after failing to break above the 1.4310 (61.8% expansion) to 1.4350 (78.6% retracement) region.

- A close below 1.3970 (50% expansion) opens up the Fibonacci overlap around 1.3830 (61.8% retracement) to 1.3870 (78.6% expansion), which sits above the monthly-low (1.3765), with the next downside region of interest comes in around 1.3690 (61.8% expansion) to 1.3700 (38.2% expansion).

(Click on image to enlarge)

Comments

No Thumbs up yet!

No Thumbs up yet!