Gold, Oil And G6 Targets For The Week Of November 5

Once again, the SPX didn’t disappoint and continued following last week’s scenario with uncanny precision price and time wise. First, the futures dropped to the projected low target on Monday, bounced off and then proceeded to advance 150+ points, briefly exceeding our upside weekly target, only to pull back and close on Friday just 5 points below it:

With less than two months remaining until Dec 31, it’s time to revisit the year-end targets. Surprisingly, even after the October sell-off (and assuming that the lows are in), the high target range of 2880 - 3050 is still in play for the time being. This however is dependent on a very strong year-end rally, similar to the January-February rally but twice as long. A more likely scenario is an average upswing, giving a 2780 – 2880 target, in tune with the 2018 yearly harmonic range.

Some of the short-term market breadth indicators we follow have reached overbought levels, suggesting that a sideways/down phase will follow.

Current signals: Daily Buy/Hold, Weekly Sell, Monthly Sell

Daily Sell pivot for Monday at 2700.

The projected trading range for next week for SPX is 2665-2785.

Oil remains on a sell signal. After finding support at the lower weekly target on Tuesday and Wednesday, the downtrend continued the rest of the week. In doing so, Oil is fast approaching the lower channel of the uptrend which started in 2016, at around $59, which is the likely target of this down-swing.

Current signals: Daily Sell, Weekly Sell.

Daily Buy pivot for Monday at 64.15

The projected trading range for oil for next week is 61.5 – 66.5:

Gold dropped to our low weekly target on Wednesday, reversed immediately, and finished the week flat. It still trades above 1220, which is a key bullish reversal level.

Current signals: Daily Buy, Weekly Buy

Daily Sell pivot for Monday at 1230.

The projected trading range for Gold for next week is 1215 – 1255:

USDCHF started the week with a strong rally but couldn’t sustain a break above the weekly upside target, and pulled back within the range.

Current signals: Daily Buy/Hold, Weekly Buy

Daily Sell pivot at 1.00

The projected trading range for USDCHF for next week is 0.996 – 1.0125:

EURUSD couldn’t reach any of the projected targets and finished the week flat.

Current signals: Daily Sell/Hold, Weekly Sell

Daily Buy pivot for Monday at 1.1401

The projected trading range for EURUSD for next week is 1.127 – 1.15:

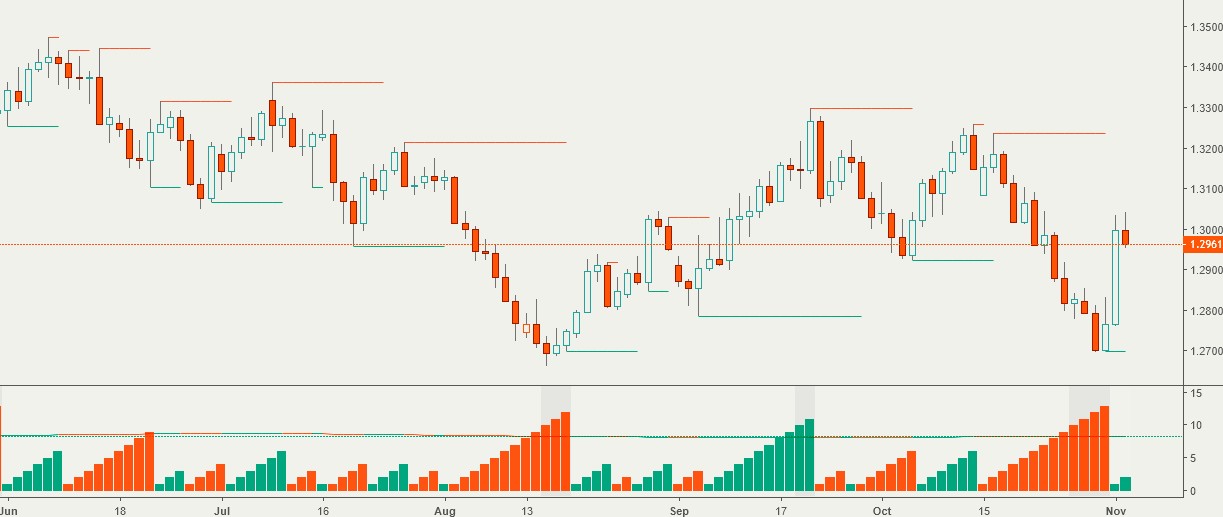

GBPUSD remained on a sell signal until mid-week when it bounced off the lower weekly target and staged a strong rally to finish the week at the upper weekly target.

Current signals: Daily Buy, Weekly Sell/Hold

Daily Sell pivot for Monday at 1.289

The projected trading range for GBPUSD for next week is 1.28 – 1.305:

USDCAD continued trading flat for the third week in a row, and the weekly targets remained unchanged.

Current signals: Daily Buy/Hold, Weekly Buy

Daily Sell pivot for Monday at 1.305

The projected trading range for USDCAD for next week is 1.295 – 1.32:

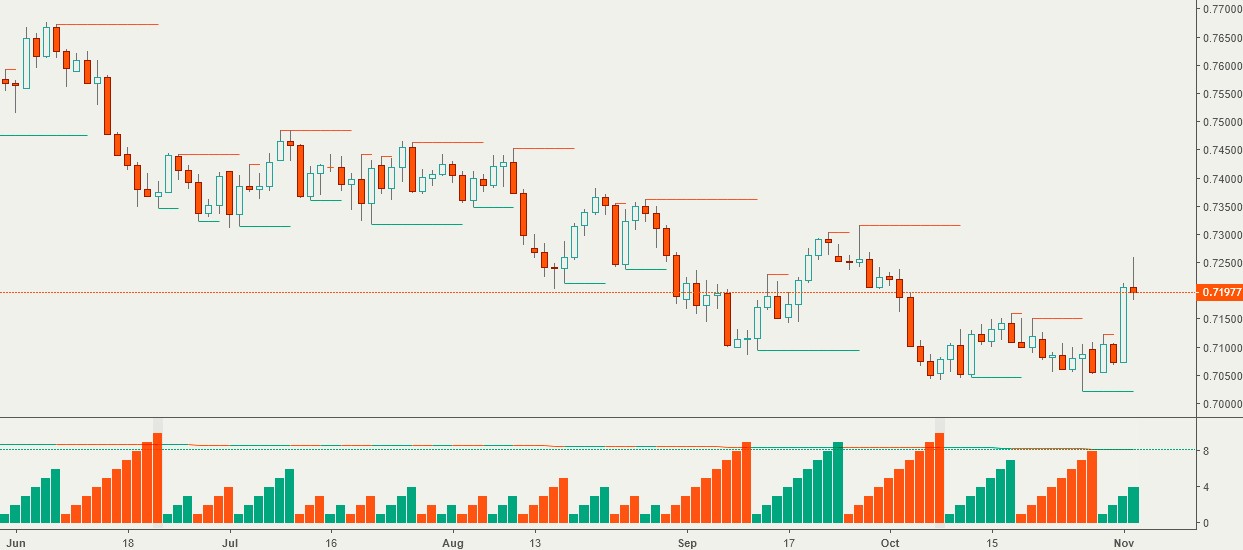

AUDUSD remains in a long-term downtrend and, although a powerful counter-trend rally on Wednesday propelled it briefly above the weekly upside target, it couldn’t hold onto the gains and finished the week a few pips below it. Similar rallies have failed before, and it would be premature to conclude that a change in trend is taking place before the previous swing high at .73 is broken to the upside.

Current signals: Daily Buy, Weekly Sell/Hold

Daily Sell pivot for Monday at 0.715

The projected trading range for AUDUSD for next week is 0.705 – 0.73:

*Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more