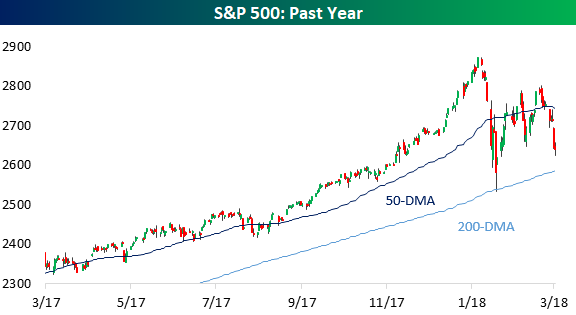

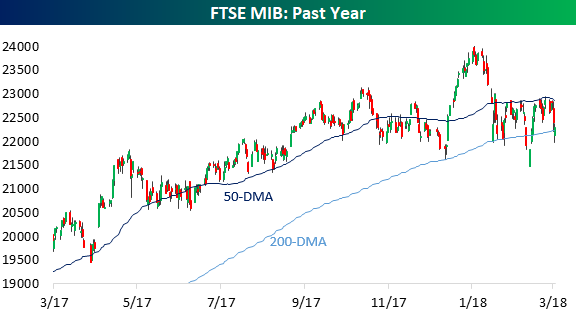

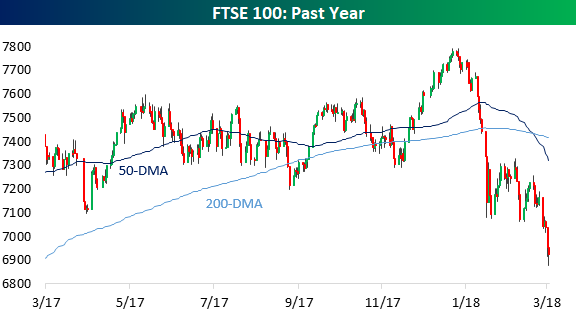

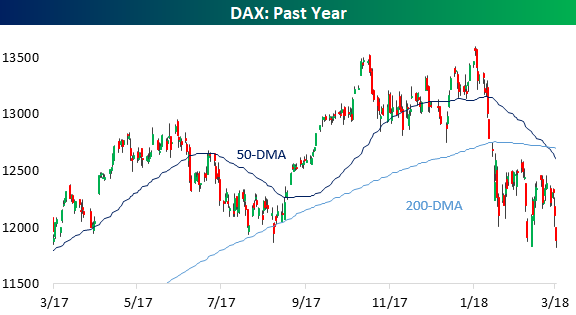

Global Indices Below 200-DMAs With Death Crosses To Boot

It’s been a week to forget for global equity indices. In the charts below we chart local currency prices for indices in the US (S&P 500), Europe (Stoxx 600), Italy (FTSE MIB), Spain (IBEX 35), the UK (FTSE 100), Germany (DAX), Japan (Nikkei 225), and Australia (ASX 200). All are now below their 50-DMAs and the US is the only index hanging on to its 200-DMA. Adding to that technical damage are a number of death crosses. This bearish technical indicator is triggered when the 50-DMA passes below the 200-DMA when both are downward sloping. The Stoxx 600, FTSE 100, and DAX.

As if death crosses and moves below long-term averages weren’t enough, the Stoxx 600, IBEX 35, FTSE 100, and DAX are all at 52-week lows on a closing basis. The Nikkei closed the week with its second-largest decline since the 2016 US Presidential election, and US equities have dropped on 4 of 5 trading days in 3 of the past 4 weeks. The weakness of the price action across global equities is consistent and broad-based.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Comments

No Thumbs up yet!

No Thumbs up yet!