General Examination

It seems like a very quiet weekend – – maybe people are just exhausted from a brutal Q1 – – so I thought I’d just thumb through a few ETFs with you and share some thoughts.

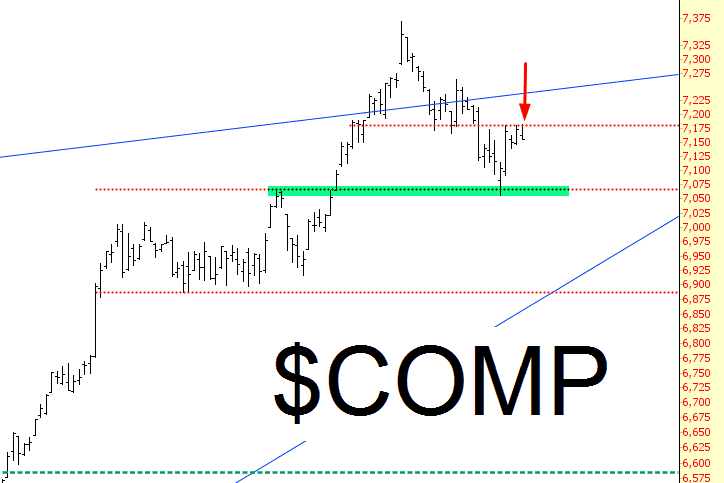

First up is the Dow Jones Composite, which is an amalgamate of the Industrials, Utilities, and Transportation indexes. We’ve got a small topping pattern on this, and last weeks’ strength simply brought it to the underbelly of resistance. What I’d expect at this point is continuation of weakness, with the big test being that green tinted area below.

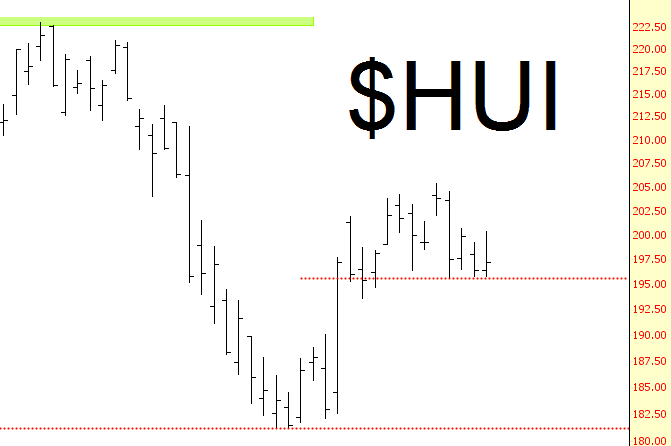

A quite important chart to me is the gold bugs index, which came tantalizingly close to breaking down on Friday morning but failed to do so. My long JDST position really needs HUI to break below the red support line I’ve drawn. If we push above last week’s high at about $205, forget it.

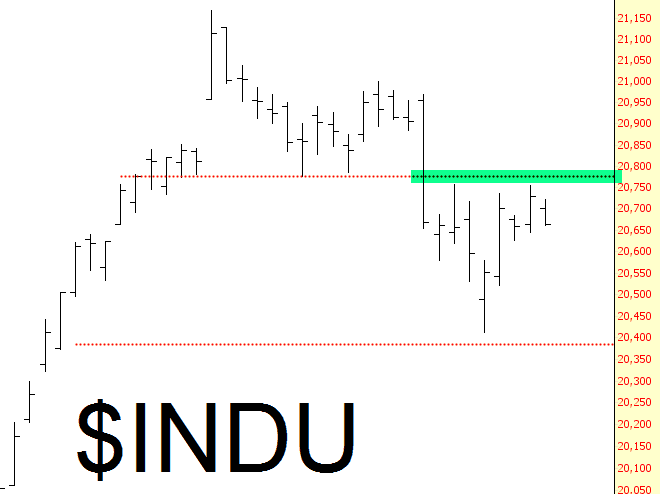

Not surprisingly, equities are an upside-down version of what precious metals are doing. You can see a pattern quite similar to COMP in the Dow Industrial 30 chart below, and we need to stay beneath the green tint to retain any hope for the bears. My dream scenario, of course, would be for gold miners AND equities to fall, but I’m not sure if that’s going to happen.

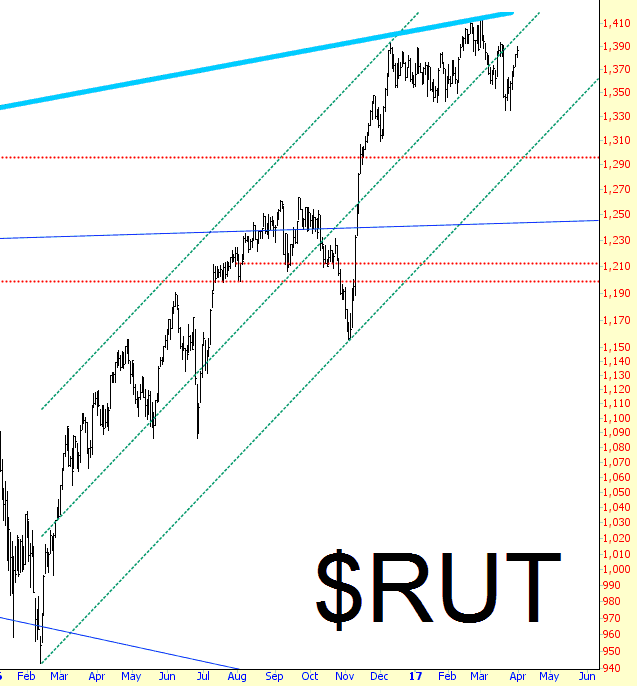

For more perspective, let’s take a step back to view the small caps. The Russell has been trapped in a range for months now, hardly moving since Thanksgiving. It’s relatively volatile, certainly, but there’s neither an uptrend nor a downtrend. We are, however, in the lower half of its channel, and my expectation is for it to challenge the lower bound of that same channel.

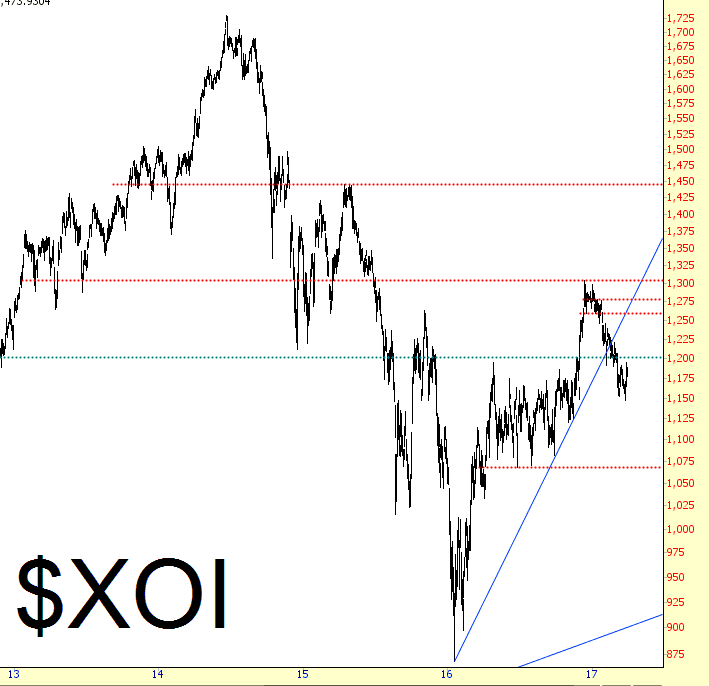

Besides gold, the other commodity I watch closely is crude oil. The oil and gas index, shown below, has been in its own private bear market for years now. My view is that we’ve entered a new leg down, and as long as we stay beneath that 1200 level, the odds are that we’ll simply keep hammering our way lower. I am long ERY to benefit from this.

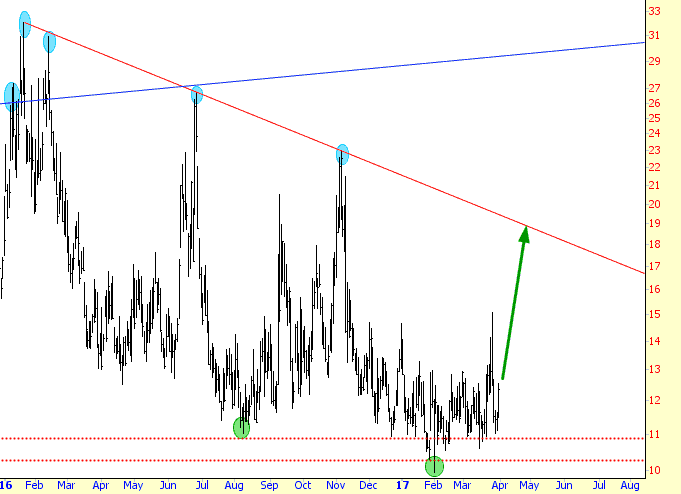

Lastly, my conviction about the VIX remains the same: until such time as we get a ‘surge’ to that trendline (and we’re sure due for one), I’m going to maintain a heavy short portfolio.

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!