UK Job Market Falters Ahead Of Election

Digging into the latest UK jobs numbers, the current picture may not be quite as bad as the headline figures suggest. But with forward-looking hiring indicators deteriorating, and given the risk that Brexit uncertainty persists into 2020, there's a clear risk the jobs market deteriorates further over the coming months.

Just how bad is the state of the UK jobs market at the moment? This is perhaps the most important question when it comes to the Bank of England rate outlook – and the recent weakness was a central reason behind two committee members deciding to vote for an interest rate cut last week.

Looking at the latest official jobs numbers, the news isn’t great. The headline measure of employment fell by 58,000 in the three months to September, albeit this was better than expected.

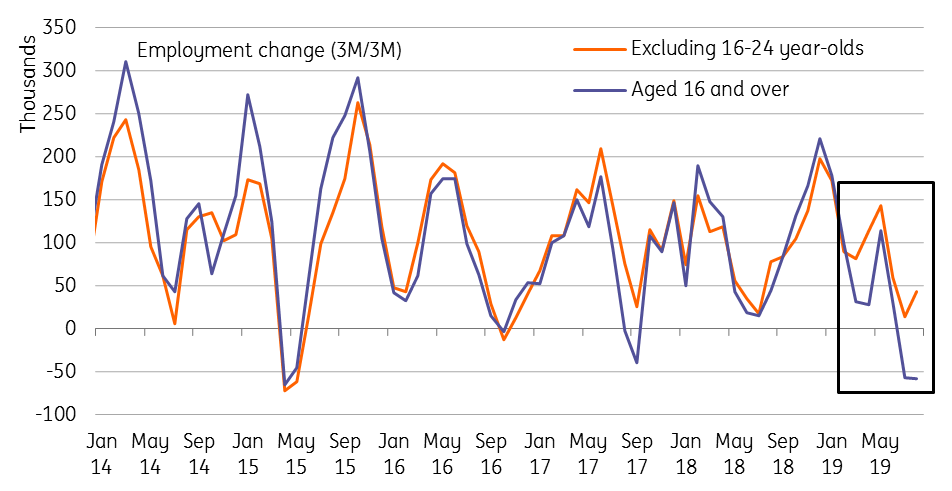

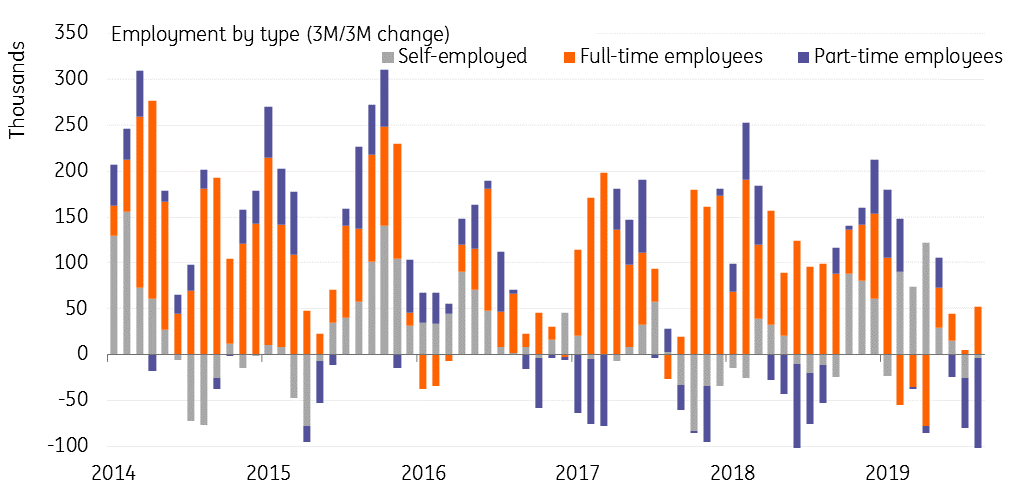

Dig a little deeper, however, and the picture is a little more blurry. The recent fall in employment has been predominantly driven by 18-24 year-olds, and once that group is stripped out, the job's growth is still positive. A large chunk of the fall has also been led by part-time employees. It’s not clear whether these two factors are linked, but both can be reasonably volatile parts of the jobs data.

Younger people driving the weakness in jobs growth

(Click on image to enlarge)

Source: ONS, ING calculations

Part-time employees have led the decline in jobs growth

(Click on image to enlarge)

Source: Macrobond, ING

Either way, the outlook for the jobs market looks challenging. The level of vacancies has been consistently falling over recent months, while the PMIs are pointing to reduced hiring appetite – and in some cases, redundancies. With the investment outlook likely to remain clouded as we move into 2020, regardless of the election outcome, we expect the challenges facing the jobs market to persist.

That said, it’s still early days and the jury is still out on whether this merely reflects a jobs market that is no longer tightening, or whether it is something more serious. Either way, this raises some question marks over wage growth – a key pillar in the Bank of England’s hawkish rationale over recent years. At 3.6%, pay growth has fallen back but still looks pretty respectable.

Given that some of these things are structural rather than cyclical (the impact of reduced EU migration and demographic factors), we’d expect the trend to continue for the time being.

Partly for that reason, we think it’s still probably too early to be penciling in Bank of England rate cuts just yet. However it’s clear that the jobs market holds the key, and a further material deterioration could easily see policymakers inch closer to easing policy in 2020.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more