Sierra Wireless (SWIR): Buy The Dip On This Long-Term Winner

Technology stocks rallied today, along with the broader marker. Chinese stocks rebounded and comments by FED vice-chair Fisher suggest that the rate hike could be postponed past the September date that many analysts are expecting. This led to dollar weakness and a broad-based rally in equities.

The Internet-of-Things (IoT) will become increasingly important as the world becomes ever more connected. While most people think of phones and computers, the future of wifi connected devices will include washers, dryers, refrigerators, thermostats, meters, etc. It is estimated that 26 billion devices will be on the Internet of Things by 2020. Many believe it will be a transformational shift in the way we live our everyday lives, ideally increasing efficiencies and saving time, money and energy.

Our family recently took a road trip in a motorhome and stopped at a laundromat in Portland, Oregon. But it was not typical laundromat, as it had a bar, cafe, game room, couches and high-speed wifi. It was the owner’s MBA project that became a reality. In addition to the amenities mentioned above, the washers and dryers also ask if you would like to receive a text when they are done. Sure enough, I received a text when the laundry was almost ready (5 minutes left) and another when it was done. This is an example of how the Internet of Things can make life just a bit more convenient.

The IoT sector has received plenty of hype over the past few years, so a correction in the sector that got ahead of itself was warranted. My favorite company in this space is Sierra Wireless (SWIR). They offer the industry’s most comprehensive portfolio of 2G, 3G and 4G embedded modules and gateways, seamlessly integrated with their secure cloud and connectivity services. Sierra Wireless has more than 950 employees globally and operates R&D centers in North America, Europe and Asia.

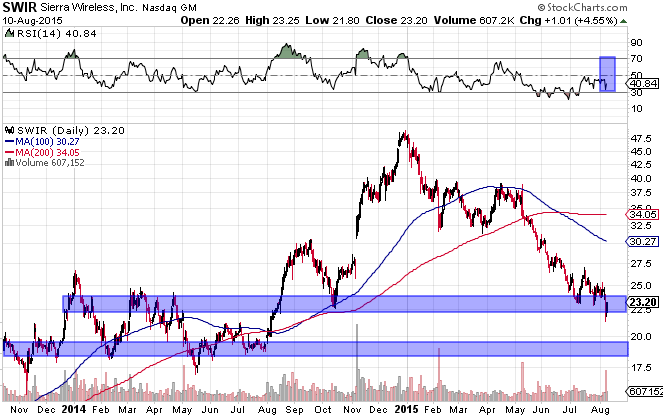

The share price for SWIR had gone up more than 500% in just two years from 2013 to 2015. It has since corrected from $48 to $22, a retracement of more than 50% of the prior gain. I believe this offers investors an excellent opportunity to buy the dip on a company that is positioned to be a long-term winner in this space.

Sierra Wireless posted second quarter earnings on Friday that led to a sharp sell off in shares of more than 10%. This decline forced the share price to dip below $21.50, the lowest level in over a year.

But was the sell-off warranted?

I don’t think so and I decided add shares of Sierra Wireless to the TS Portfolio at $22.50.

Take a look for yourself and decide…

Record revenue of $158.0 million, an increase of 17.0% compared to Q2 2014

Non-GAAP earnings from operations of $10.7 million compared to $3.7 million in Q2 2014

Adjusted EBITDA of $13.1 million compared to $6.8 million in Q2 2014

Non-GAAP diluted EPS of $0.26 compared to $0.08 in Q2 2014

GAAP RESULTS

- Gross margin was $50.9 million, or 32.3% of revenue, in the second quarter of 2015, compared to $43.3 million, or 32.1% of revenue, in the second quarter of 2014.

- Operating expenses were $46.8 million and earnings from operations were $4.1 million in the second quarter of 2015, compared to operating expenses of $49.6 million and a loss from operations of $6.3 million in the second quarter of 2014.

- Net earnings were $4.1 million, or $0.12 per diluted share, in the second quarter of 2015, compared to a net loss of $8.2 million, or $0.26 per diluted share, in the second quarter of 2014.

NON-GAAP RESULTS

- Gross margin was 32.4% in the second quarter of 2015, compared to 32.2% in the second quarter of 2014.

- Operating expenses were $40.4 million and earnings from operations were $10.7 million in the second quarter of 2015, compared to operating expenses of $39.8 million and earnings from operations of $3.7 million in the second quarter of 2014.

- Net earnings were $8.6 million, or $0.26 per diluted share, in the second quarter of 2015, compared to net earnings of $2.6 million, or $0.08 per diluted share, in the second quarter of 2014. The non-GAAP tax rate in the second quarter of 2015 was 19.6%.

- Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) were $13.1 million in the second quarter of 2015, compared to $6.8 million in the second quarter of 2014.

GUIDANCE

Q3 revenues and earnings are expected to be in line with the second quarter, not offering much growth in a market that is supposedly growing rapidly. Of course, this does not include any contribution from the announced acquisition (June 2015) of MobiquiThings. The acquisition of this leading mobile virtual network operator based in France, will allow Sierra Wireless to expand its wireless connectivity and value-added services for European customers. In 2015, MobiquiThings is expected to generate revenue of approximately €3.0 million and breakeven Adjusted EBITDA.

Investors could also benefit if SWIR is acquired by a larger company at a hefty premium. Cisco Systems is a likely suitor, but others believe there would be powerful synergies from SWIR merging with Blackberry.

Regardless of whether or not Sierra Wireless is acquired, I believe the market is currently undervaluing the company’s potential and offering investors an excellent buying opportunity around $23/share.

Conservative investors may prefer to wait and see if SWIR can bounce decisively above the current support level this week. I am fine edging into a position at current prices as I believe shares were unfairly sold off on Friday, despite strong financials. And SWIR had a nice steady advance today, ending up 4.5%.

I am buying shares as a long-term hold and don’t necessarily expect massive returns by year end. But over the course of the next 12-24 months, I believe SWIR will easily climb back above $50/share, more than doubling the money of anyone buying at today’s prices.

If you would like to receive our future articles direct to your inbox, plus view the Technology Speculator portfolio, please enter your email below. Membership remains free for the first 1,000 people to subscribe and we are over half way to that number already. After 1,000, there will be a small monthly fee to receive the newsletter and research.

While our focus is precious metals, we cover agriculture, energy, technology and other sectors as well. If you would like to receive trade alerts whenever we are buying or selling, plus access to the ...

moreComments

No Thumbs up yet!

No Thumbs up yet!