Salesforce: Outstanding Growth And Reasonable Valuation

Value investing is not just about buying stocks with low valuation ratios. Investing in high growth companies with reasonable valuations can be even more profitable in the long term.

In the words of Warren Buffett himself:

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Salesforce (CRM) is an outstanding growth business, and the stock looks like an attractive proposition for investors looking to buy a wonderful company at a fair price.

An Impressive Growth Business

Salesforce is the undisputed leader in customer relationship management, and the company has successfully leveraged on its strength in that market to expand into new opportunities in areas such as customer service, marketing automation, e-commerce, analytics, and artificial intelligence.

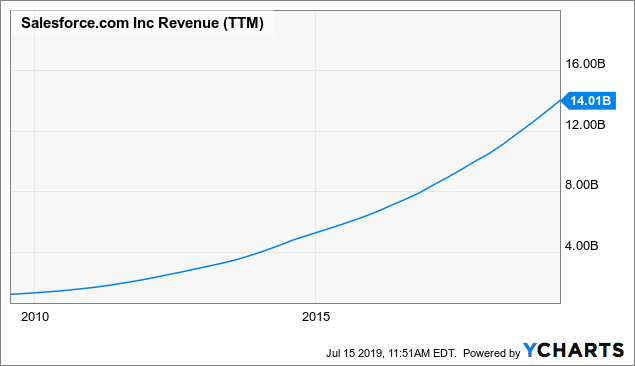

Revenue growth has been nothing short of spectacular over the long term. In the year 2010, the company made $1.3 billion in annual revenue, and it has already exceeded $14 billion in revenue on a trailing 12-months basis for the current year.

(Click on image to enlarge)

Data by YCharts

The numbers for the first quarter confirm that the business keeps firing on all cylinders. Total revenue reached $3.74 billion, up 24% year-over-year and growing by 26% in constant currency terms. Operating cash flow reached $1.97 billion, up by a vigorous 34%. In a sign of confidence, management also raised guidance for the rest of the year.

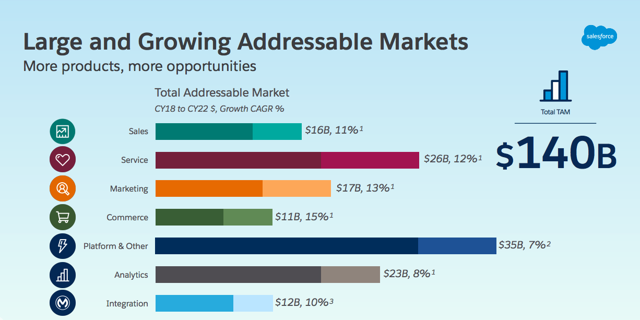

One of the most attractive traits of Salesforce as a growth stock is that management has done an impressive job at expanding the company's growth opportunities into different areas over the years. The company estimates that the size of the total addressable market could be worth as much as $140 billion, and the size of such a market is expected to continue increasing at a solid speed in the years ahead.

(Click on image to enlarge)

Source: Salesforce

When investing in growth stocks, the sustainability of growth rates is a crucial consideration. Salesforce has proven an impressive capacity to sustain rapid revenue growth and expand its future growth opportunities over the long term.

Discounted Cash Flows

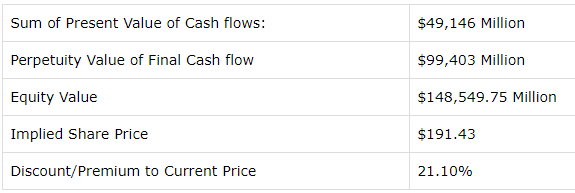

The discounted cash flow analysis of Salesforce's stock is based on the following assumptions.

- Current free cash flow is $3.4 billion

- The annual growth rate is 18% annually over 5 years

- The growth rate slows down to 12% in the five-year period after the rapid growth phase.

- The terminal growth rate is 3%

- The required rate of return is 9%

Under these assumptions, we reach a fair value estimate of $191.43 per share for Salesforce, which implies a discount of 21% versus the current stock price. The average price target among the analysts following the stock is currently $183, so the valuation estimate is roughly in line with estimates.

(Click on image to enlarge)

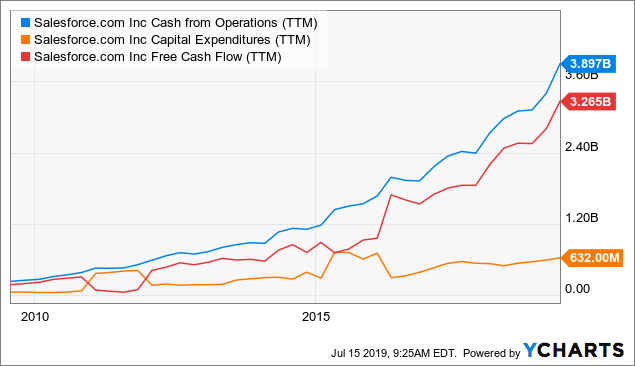

Taking a look at cash flows over the past decade, it's important to note that operating cash flow is rapidly increasing, while capital expenditures are relatively flat. Since free cash flow is operating cash flow less capital expenditure, this dynamic should allow Salesforce to produce rapid growth in free cash flow over the years ahead.

(Click on image to enlarge)

Data by YCharts

The business model allows for expanding free cash flow margin as the company gains size over time, and I wouldn't be surprised to see Salesforce outperforming the growth assumptions in the discounted cash flow analysis. In such a scenario, the stock would obviously be more undervalued than what the numbers above imply.

However, the main point in discounted cash flow analysis is not accurately estimating free cash flows, which necessarily carries a large margin of error. The idea is assessing if the stock is reasonably valued based on conservative cash flow assumptions, and Salesforce is in fact conservatively valued for such a dynamic growth stock.

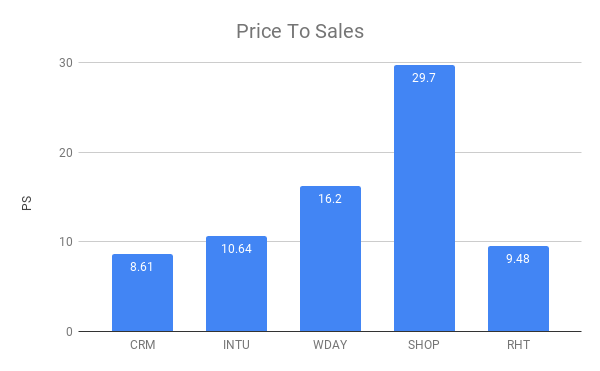

Price To Sales Ratios

Salesforce's stock is trading at a price to sales ratio of 8.63, this is not cheap at all in comparison to the broad market, but software companies typically trade at valuation premiums due to the industry's attractive growth prospects.

The table below compares Salesforce versus Intuit (INTU), Workday (WDAY), Shopify (SHOP), and Red Hat (RHT). These companies have different strategies and growth rates, so the comparison is not completely straightforward. But it's still worth noting that Salesforce is reasonably priced in comparison to other successful software companies.

(Click on image to enlarge)

Data Source: Seeking Alpha Essential

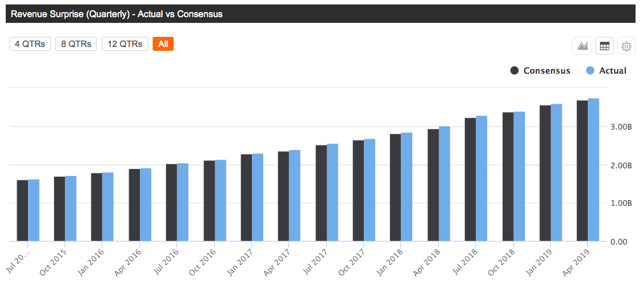

Importantly, valuation is a dynamic as opposed to a static concept, and Salesforce has an impeccable track record of outperforming revenue expectations over the long term. The chart below shows the average revenue estimate and the actual reported sales number for Salesforce since July of 2015, and the company has not missed sales estimates even once.

(Click on image to enlarge)

Data Source: Seeking Alpha Essential

Fundamental momentum can be a powerful return driver for stock prices. When a company delivers revenue numbers above expectations and Wall Street analysts increase their forecasts for the company going forward, then the stock price needs to increase for the valuation to remain constant.

We can see in the chart below how revenue estimates for Salesforce in the current year have significantly increased over time, and this has been a vigorous tailwind for the stock price.

(Click on image to enlarge)

Data by YCharts

As long as Salesforce can maintain its track record of outperforming revenue expectations, this could be a strong tailwind for the stock price.

Multi-Factor Analysis

Valuation needs to be analyzed in its due context. A company with strong financial performance and vigorous business momentum deserves a higher valuation level than a company producing mediocre financial performance and declining fundamental momentum.

In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors, such as financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the PowerFactors ranking the better the backtested performance.

As of the time of this writing, Salesforce has a PowerFactors ranking above 95, so the company is in the top 5% of stocks in the US market according to the PowerFactors algorithm. In other words, valuation levels are compelling when analyzed in the context of other quantitative return drivers for Salesforce.

The Bottom Line

There are some important risks to consider when evaluating a position in Salesforce's stock. The recent acquisition of Tableau (DATA) for $16 billion makes a lot of sense from a strategic perspective, and it could open the door to promising growth opportunities in the years ahead. But the price paid for the transaction is quite aggressive, so management will need to make sure that it can smartly capitalize on its opportunities in order to justify the acquisition price tag.

Software stocks have also substantially outperformed the market in recent years. Investing in the top players in an outperforming industry is the right thing to do, but the sectors that deliver the biggest gains on the way up can also suffer more pain when markets pull back. Momentum cuts both ways in the stock market, and you need to accept above-average volatility when investing in growth stocks.

Those risks being acknowledged, Salesforce is an impressive growth stock, and valuation looks very reasonable for such a high-quality business. If the company continues growing at full speed and outperforming Wall Street expectations as it has done in recent years, current valuation levels should allow for attractive returns going forward.

Disclosure: I am/we are long CRM, WDAY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more