Curaleaf Q1 Financial Results Show Major Improvements Across The Board

Curaleaf Holdings, Inc. (CURLF), a constituent in the munKNEE Pure-Play MSO Pot Stock Sub-Index, reported its financial results for Q1 ended March 31, 2021 yesterday.

Q1 Financial Highlights

(All financial information is provided in U.S. dollars unless otherwise indicated.)

- Total Revenue: increased 13% to $260M

- Retail Revenue: increased 14% to $187M

- Wholesale Revenue: increased 12% to $73M

- Gross Profit: increased 17% to $128M

- Gross Margin: increased to 49% from 48%

- Adj. EBITDA: increased 16% to $63M

- Net Income/Loss: loss reduced 51% to $(17)M

- Net Loss/Share: loss reduced to $(0.03) from $(0.05)

Q1 Operational Highlights

- Raised net proceeds of $240.6 million in a public offering and net proceeds of $49.9 million from a tack-on to the existing secured credit facility.

- Closed the quarter with 102 retail locations and 1,992 wholesale partner accounts.

- Launched Select Squeeze, a THC-infused beverage enhancer, to date the widest cannabis product launch in the nation, available in 14 states.

Management Commentary

Joe Bayern, Chief Executive Officer stated:

- "Curaleaf delivered record first quarter 2021 financial results with total revenue exceeding the high-end of our guidance range as we extended our U.S. leadership, all while creating a new foundation for future international growth opportunities.

- The stronger than expected first quarter performance drove record adjusted EBITDA as well as approximately 640 basis points of improvement in gross margin year-over-year...

- Curaleaf launched a range of innovative new products to our retail and wholesale channels during the quarter, including our new Select Squeeze THC-infused beverage enhancer which marked our most successful product launch ever...

- With our revenue projected to increase to $305 million to $315 million in the second quarter, we also expect to generate significant improvements in terms of achieving positive net income and positive operating cash flows in the back half of 2021."

Boris Jordan, Executive Chairman commented:

- "...The recent approvals of adult-use cannabis in New Jersey and New York , which are states where Curaleaf has a leading market share, will unlock vast new markets, worth an estimated $2B to $5B in sales respectively.

- We raised approximately $300 million in new capital during the first quarter to help support our ability to scale for new adult-use markets while also allowing us to be opportunistic for highly attractive assets that further strengthen our position as the global cannabis market leader."

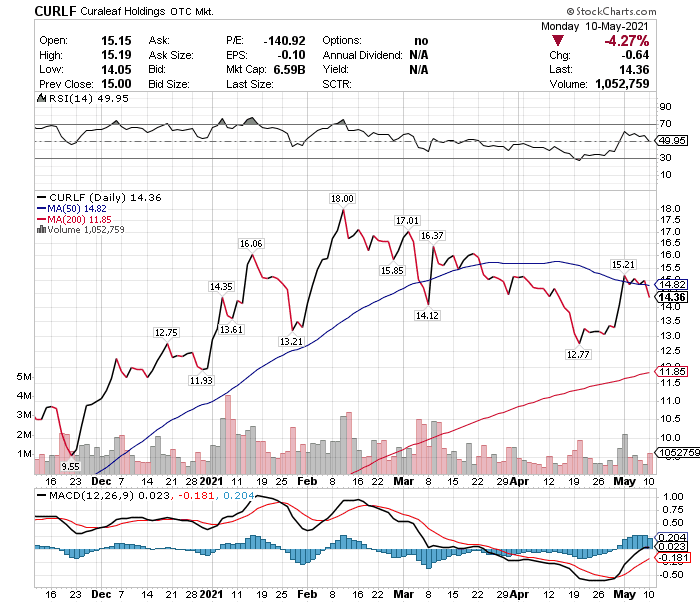

Stock Performance

As the chart below illustrates, Curaleaf appreciated 26% over the 3-month Q1 period but has has declined 5% since then.

If you found the above analysis of interest check out the other recent quarterly reports from Hexo, Columbia Care, Ayr Wellness, Tilray, Aurora, Canopy, Green Thumb, TerrAscend, Trulieve, Rubicon, Harvest Health, Aphria, Valens, Cronos and Organigram.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more