Market Thoughts: Historic Market Timing Calls

Each day I scan and synthesize market-moving news. I look at macro themes, currency moves and global economic indicators that support or challenge my thinking on the Big Picture and help me take the mood of the market. I like to assemble these data points so I can turn them into operational trade ideas for my clients in my Live Trading Room. Some may even make it into my Brokerage-Triggered, Trade Alerts!

My job is to identify Inflection Points, and then to ‘operationalize’ them so as to call out actionable trades for clients. Last week was an exceptional week of Market Timing Calls – from my Bond Short Call the day before a 3-sigma standard deviation move in Rates/Bonds, to my Short Gold Call the day before the parabola broke. But I am most proud of my ability to see and trade the Growth-into-Value Rotation that I saw coming before ‘Monday’s Momentum Massacre’.

‘One Of The More Stunning Trades In Modern Market History’

This is what Nomura’s McElligott said after Monday’s Momentum Massacre. That translated into a truly insane 8.5-sigma event for the “Pain Trade”.

(Nomura, BBG)

“The shock of yesterday’s US Equities factor reversals will go down in infamy alongside the August 2007 ‘Quant Quake’ and the Fed/March/April 2016 ‘Market-Neutral Unwind’ as one of the more stunning trades in modern market history”, McElligott writes

And yet HILARIOUSLY, nobody watching financial TV or Joe Schmoe retail investor looking at just simple Index returns in isolation (or even a more sophisticated investor looking at the Vol complex yday) would have had ANY idea of the calamity occurring under the surface, as it was all about a blowout in sector- and thematic- dispersion which then acted to offset / “mask” the “top down” moves.

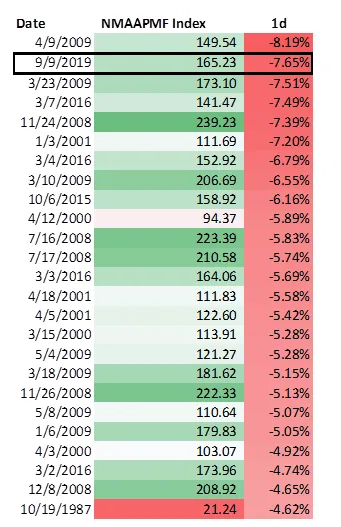

The catalyst? The selloff in duration from the prior week. Yeah, the Short Bond call I made turned out to be not only well-timed but the impetus for an unwind in treasuries that caused the sell-off in Momentum stocks which I also called and which turned out to be the second-largest single-session draw-down in history going back to 1984:

Forward returns for this Momentum Index are “horrific” according to McElligott…

But, forward returns for the Value proxy are awesome following a one-day (99.5th percentile) surge like that which we had Monday: +27.1% median return in six months and +83.3% return in 12 months.