US & China Trade: Who Is “Winning”?

US-China trade tensions are an obvious threat to supply chains and corporate profitability. Businesses are trying to adapt to the new environment with third party countries seemingly benefiting from the impasse at the expense of both China and the US.

So far so good for the US?

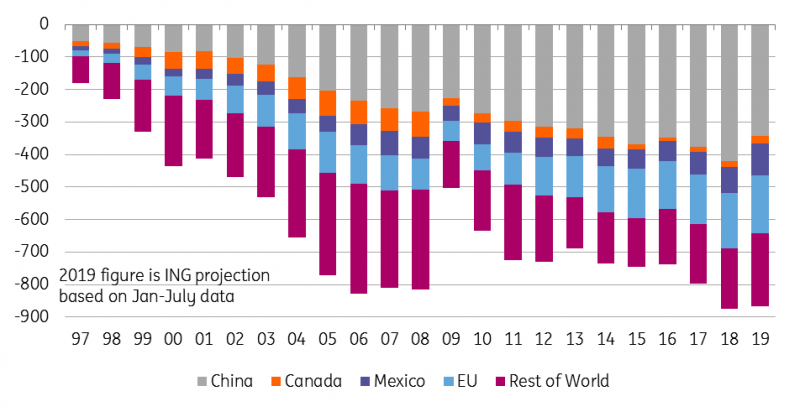

One of President Trump’s election campaign promises was to get better trade deals for the US. China has been the focus of his attention as he seeks improved access for America companies while protecting intellectual property rights. On the face of it the policy appears to have been a success for the US. The US goods deficit with China has shrunk 11% for January-July 2019 versus the same period in 2018. This means the US is on track to experience its smallest goods trade balance with China since 2012.

US goods trade balance breakdown (USD bn)

(Click on image to enlarge)

Source: Macrobond, ING

In reality, both sides are losing...

However, the chart above shows that the US goods deficit overall is not narrowing to anywhere near the same extent. Instead, the US deficits with Mexico and the EU look likely to hit new highs in 2019 while the deficits with Canada and the “rest of the world” are on course to widen out versus 2018. This hints at some substitution of Chinese goods imports for imports from other countries.

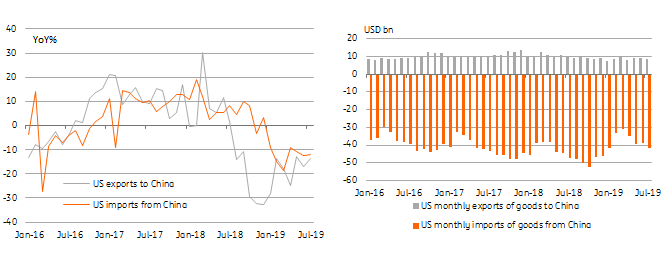

President Trump has suggested that unless China agrees to the US demands “China’s supply chain will crumble and businesses, jobs, and money will be gone!” Unfortunately for the US, the charts below suggest that American companies are feeling pain too. There has been a reduction in goods imports from China, but there has been an even bigger percentage decline in US exports of goods to China (as measured in US dollars). This will be due in part to the tariffs China has placed on some US imports, but also the general slowing of the Chinese economy with possibly some currency effect too.

This may seem a confusing outcome given the narrowing of the trade deficit. It is because of the value of US imports from China dwarf the value of US exports to China - the smaller percentage change still yields a much bigger dollar outcome. The net effect of the trade war is that both sides have been hurt.

US-China trade YoY% and monthly flows in USD bn

(Click on image to enlarge)

Source: Macrobond, ING

US businesses are looking for solutions

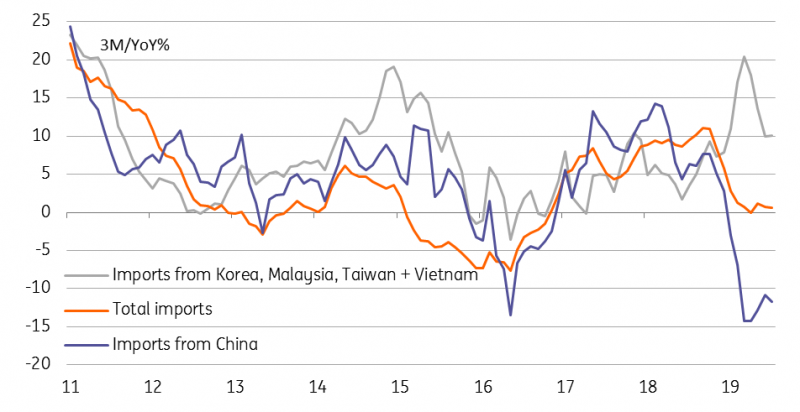

Given the scale of demand for Chinese intermediate goods within US supply chains, there are clearly going to be challenges for US companies domestically too. Higher tariffs put up costs of Chinese products imported into the US, some of which is likely passed onto consumers, but the net overall result is still likely to be a hit to US corporate profitability. Businesses are looking for ways to limit the financial impact and this typically involves trying to find alternative suppliers, either domestically or from abroad. This takes time, but there is clear evidence that US firms have increasingly been sourcing alternatives from other Asian countries.

US import growth from China versus other Asia & World

(Click on image to enlarge)

Source: Macrobond, ING

Looking for alternative supplies...

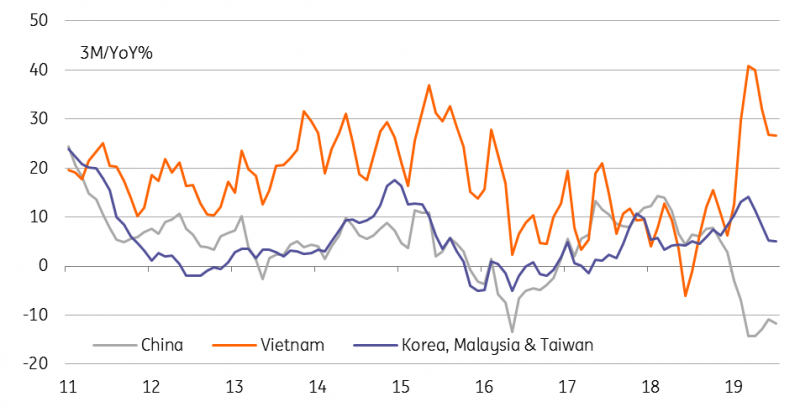

The chart above shows that US imports from Korea, Malaysia, Taiwan, and Vietnam have accelerated sharply over the past year, which coincides with the steep drop in imports from China, supporting the substitution effect hypothesis.

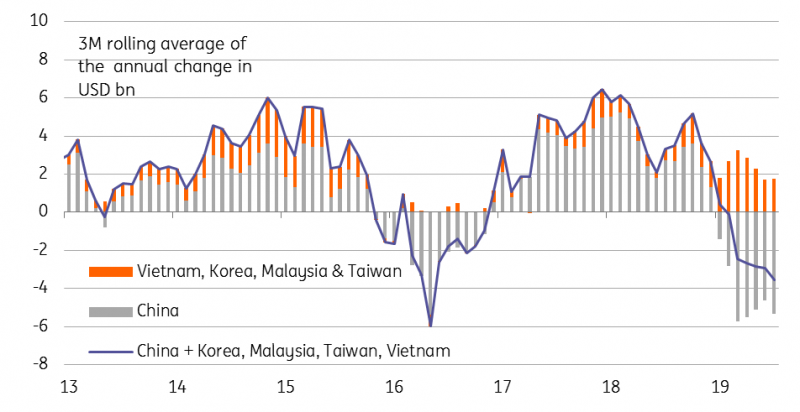

We have to remember that the US historically has imported far more from China than other Asian countries so we need to also look at the 12M change in USD levels (chart below). The substitution effect since late 2018 is again clearly evident, but it shows us that the dollar value drop in imports from China has not been fully offset by higher dollar value imports from Korea, Malaysia Vietnam, and Taiwan. Currency effects at the margin may have an influence, but only the Korean Won has underperformed CNY since 2018. We also have to consider that some of this slack may have been picked up by Mexico and the EU given expanding US deficits with those trade partners.

Change in the USD value of imports into the US from China versus other Asia

(Click on image to enlarge)

Source: Macrobond, ING

... or workarounds...

Of course, it is possible that the economic pain China is feeling from the trade war has been mitigated by some businesses trying to “workaround” the tariffs. This is typically done by exporting to an unsanctioned country where some “value-added” is created before being shipped onto the final destination – thus avoiding the tariff.

This is a tried and tested formula with one of the more extreme examples being Russia. It takes time to find alternative suppliers from different countries or to develop domestic ones. When sanctions were first imposed on imports from the EU, Russia companies used business relationships to import EU products via 3rd party countries, including Belarus. This put up costs but ensured supply chains could continue functioning until alternatives were found.

If that has indeed been happening as a result of the US-China stand-off, the most likely avenue is Vietnam. While US imports from Korea, Malaysia, and Taiwan have certainly increased, it is from Vietnam that they have surged.

Growth in US imports from selected Asia countries - Vietnam the outperformer

(Click on image to enlarge)

Source: Macrobond, ING

Chinese, but "made in Vietnam"?

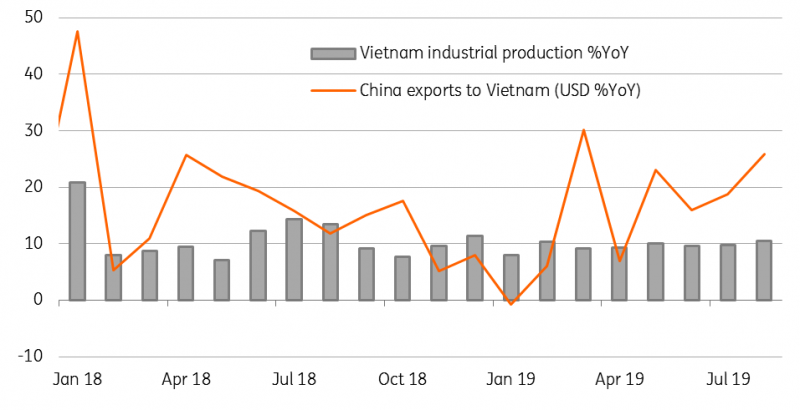

It is difficult for an economy to build extra production capacity and related supply chains in a short period of time to substitute even part of the production from China. Vietnam’s manufacturing production growth was quite flat at around 10% year-on-year in 2019. It was even slower in 2018. It is hard to believe that the surge in Vietnam’s exports to the US (in US dollar terms, remember) has all come from production within Vietnam.

The obvious response is that it hasn't. Chinese exports to Vietnam have displayed a strong upward growth trend in 2019, which is in contrast to the slowdown in 2018, and also in contrast to the moderately flattish growth of Vietnam’s production.

China exports to Vietnam growing much faster than Vietnamese manufacturing output

(Click on image to enlarge)

Source: Bloomberg, ING

FDI is starting to flow

But this kind of re-routing could be temporary as Chinese companies start shifting production lines to other economies given the fear that poor US-China trade relations and prolonged use of tariffs could be the new norm. For example, it has been widely reported that a Chinese manufacturer of bluetooth earphones plans to move production of Apple AirPods to Vietnam for an investment of US$260 million.

The longer the trade disruption lasts more Chinese manufacturers will likely go down this route to tap the new opportunities. And, those emerging economies that receive these FDIs will benefit from the China-US trade war and could experience better economic growth.

Level of US manufacturing output and employment versus 2007 peak

(Click on image to enlarge)

Source: Macrobond, ING

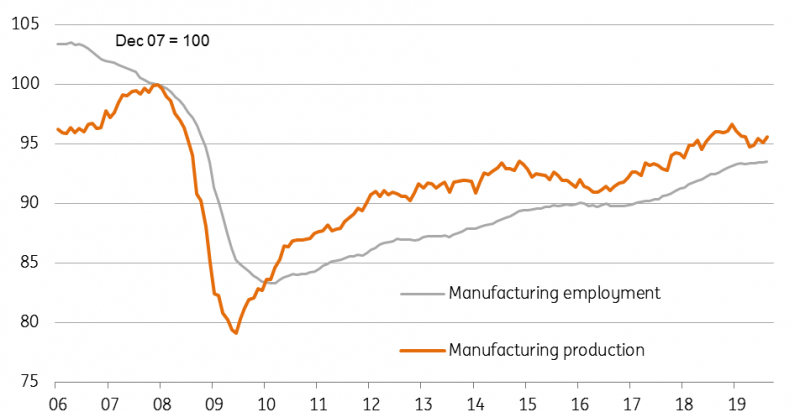

US manufacturers still waiting for the boost

President Trump would ideally prefer US manufacturers to benefit, but with US manufacturing output down 1.1% year-to-date and 4.4% below the peak levels of December 2007, there is little evidence yet that domestic manufacturing is picking up the slack in any meaningful way. The caveat to this statement is that this is very much a headline figure and it is possible that some US manufacturers are receiving orders for some of what was serviced by Chinese imports at a time when demand for US manufactured goods is falling overall. This downturn in itself may be in large part caused by worries over the lingering effects of the trade war.

With durable goods orders pointing to a contraction in domestic capital expenditure in coming quarters and the manufacturing ISM in negative territory, there seems little prospect that we will see a near-term build-up in domestic US manufacturing potential. Maybe one solution to the impasse is if China was instead to move some of its production to the US, but this looks highly unlikely to happen in the near-term given the current political stand-off. Despite their respective claims, the US and China look set to both remain losers from the trade war.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more