As China's Banking System Freezes, SHIBOR Tumbles To Lowest In A Decade

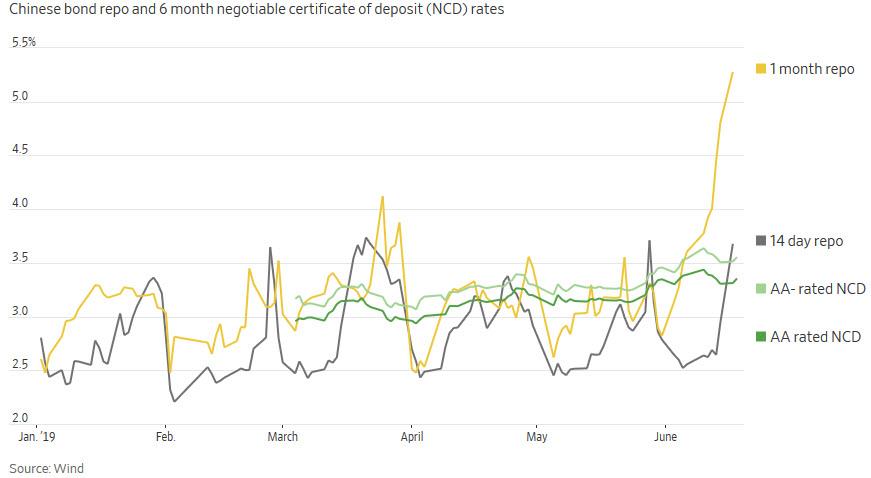

One trading day after we reported that China was "Hit By "Significant Banking Stress" as SHIBOR tumbled to recession levels, and less than a week after we warned that China's interbank market was freezing up in the aftermath of the Baoshang Bank collapse and subsequent seizure, which led to a surge in interbank repo rates and a spike in Negotiable Certificates of Deposit (NCD) rates...

(Click on image to enlarge)

... China's banking stress has taken a turn for the worse, and on Monday, China's overnight repurchase rate dropped to its lowest level in nearly 10 years, after the central bank’s repeated liquidity injections to ease credit concerns in small-to-medium banks: The rate fell as much as 11 basis points to 0.9861% on Monday, before being fixed at exactly 1.000%.

(Click on image to enlarge)

Seeking to ease funding strains after the Baoshang collapse and to unfreeze the financial channels in the banking sector, the PBOC has been injecting cash into the financial system to soothe credit risk concerns in smaller banks following the seizure of Baoshang Bank, which sent shockwaves through China’s markets.

Also helping drive the rate lower is China’s move to allow brokerages to issue more debt, said ANZ Bank's Zhaopeng Xing, quoted by Bloomberg. As a result, at least five brokerages had their short-term debt quotas increased by the People’s Bank of China in recent days, according to filings.

The improved access to shorter-term debt will cut costs for brokerages compared with alternative funding sources such as bond issuance. The flipside, of course, is that the lower overnight funding rates drop, the greater the investor skepticism that China's massive, $40 trillion financial system is doing ok, especially since the last time overnight funding rates were this low, the near-collapse of the global financial system was still fresh and the S&P was trading in the triple-digits.

Commenting on the ongoing collapse in SHIBOR, Commodore Research wrote overnight that "low SHIBOR lending rates are supposed to be supportive and accommodative in nature — but rates are now at the lowest level seen this decade andare very likely an indication that China is facing significant banking stress at the moment. It is extremely rare for the overnight SHIBOR lending rate to be set as low as 1.00%. This previously had not all been seen this decade, and the last time it occurred was during the financial crisis in 2008 - 2009."

Meanwhile, as the world's biggest financial time bomb ticks ever louder, traders and analysts are blissfully oblivious, focusing instead on central banks admitting that the recession is imminent and trying to spin how a world war with Iran would be bullish for stocks.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more