Vanguard Mid-Cap ETF: In For A Strong 2020

If you want to outperform the market, I think you have to find sectors or investments that have been under-owned and underperformed for several years. The most likely way to beat the market is to invest smartly in things that will have a reversion back to the mean. One glaring sector I have found in my research that needs to be highly owned is the mid-cap sector, and a great way to get invested in it is the Vanguard Mid-Cap ETF (VO). For one, the expense ratio is especially attractive for this fund – sitting at 0.04%. It’s not free (yet), but it is very close.

As I mentioned in the Lead-Lag Report last week, one sector I think will outperform this year is financials. This will be on the back of the Treasury yield rising throughout 2020 as we get back to some synchronized global growth, and rising yields help the bottom lines of financials. That is one reason to get invested in the Mid-Cap space – the VO itself holds about 21.6% financials, according to the Vanguard website. The regional banks that are inside of this investment are set to take off in 2020, as I think that there is also the potential for the regionals to start to consolidate, much like BB&T and SunTrust announcement last year. The rest of the makeup of VO is attractive as well, with 16.4% industrials, 15.9% technology, and 11.5% consumer services. This is a well-diversified holding, ready to break out further.

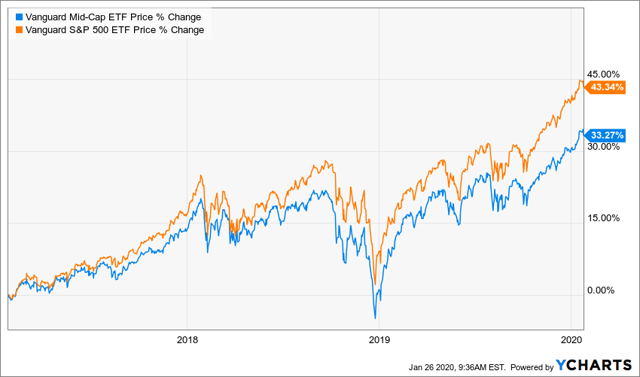

In the last three years, the mid-cap space has underperformed compared to the overall Vanguard S&P 500 index (VOO) to the tune of about 10% (see chart below). I think that VO plays catch-up in 2020, especially with business confidence rising early this year. One reason is that the risk-return characteristic we are used to – higher risk, higher return – has not held for the mid-cap space for so long. The holdings are inherently riskier, given the size of the holdings. You would think that in a bull market like we have seen that they would outperform their large counterparts.

Of course, there have been a few giants that have boosted the S&P 500 returns over the years (Amazon (AMZN), Netflix (NFLX), Alphabet (GOOG) (NASDAQ:GOOGL), Microsoft (MSFT) anyone?). But I think that the time is excellent for the mid-cap space and the runway is getting brighter. U.S. GDP numbers should come in relatively healthy this year, especially as the trade war between them and China starts to ease. That, combined with one of the most robust consumer base we have had in some time in the U.S., should prove beneficial for VO.

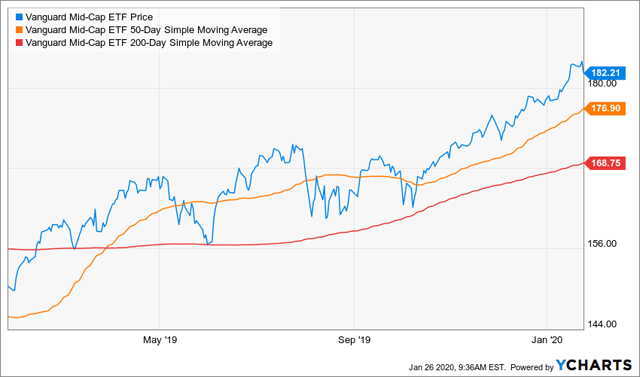

From a technical analysis standpoint, it is a decent time to get into the ETF now as well. Although we have had a small pullback, there is strong support at the $178 level, and then down to the 50-day moving average sitting just under $177. Below that, there is another level of support at around $170. So, there are a lot of areas this ETF could hold if there were a pullback in the market. On the other hand, momentum tends to favor momentum, and this is in a clear uptrend at this point.

After struggling to break out for most of 2019, we finally had some conviction in November, and VO broke through a significant resistance level of $170. So while you may want to see how the stock fizzles in the next week or two, do not miss the boat on the sidelines as mid-caps move faster than large-caps. If earnings season goes well through the end of Q1 here, we could be seeing more significant upside in the next 12 months.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclosure: This writing is for informational purposes only and does not ...

more