USD/JPY Is Now Rocketing Towards 2020 Highs

USDJPY is already trading perfectly from Jan 04, 2021, when we highlighted the bottom and potential reversal. For that article click here.

Later on Feb 16, 2021, we updated the chart, where we warned about bullish confirmation. For that article click here.

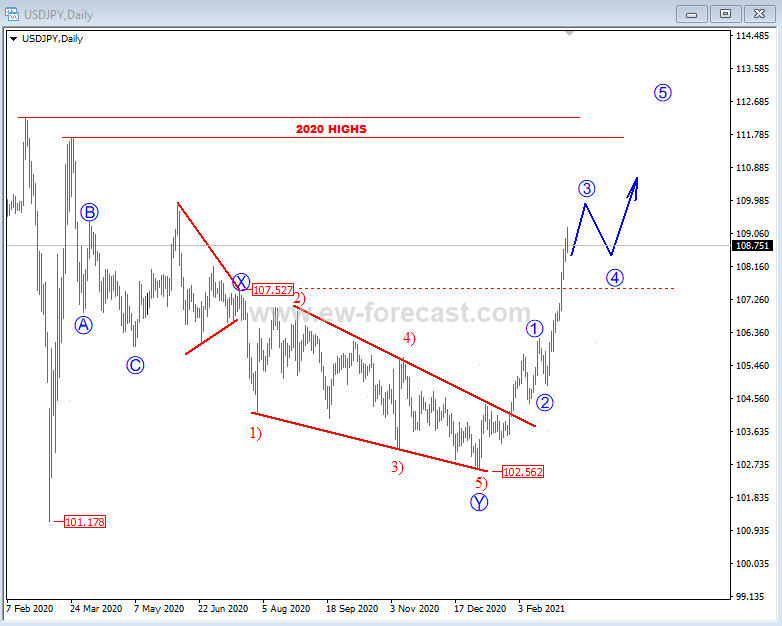

Today we want to update the most traded currency pair: USD/JPY. The pair has been in a downtrend since March 2020, which resulted as a correction of the impulse that occurred during the COVID-19 crisis as during a risk-off environment the yen becomes a safe haven causing USDJPY to lose approximately 900 pips.

Despite the move down being quite choppy, we identified an ending diagonal which in Elliott Wave terms is an indication of an imminent and strong reversal.

The reversal didn’t take much to come. As you can see from today’s chart it was also strong as expected. Once again the Elliott Wave Theory managed to provide us an edge to trade the live markets managing risk wisely. Diagonals are very good EW structures to trade, as they are very easy to identify and the outcome is always the same. The wave count suggests that we are in an impulsive bullish sequence, meaning that the move up from the January lows should be in five waves, ideally and probably towards 2020 highs. So far the aggressiveness of the move confirms the bias, as we were in a third of a third which is very well known for being an explosive move.

Trade wisely and stay tuned for the next update!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.