Hartstreet LLC: Possible Acquisitions In The Permian

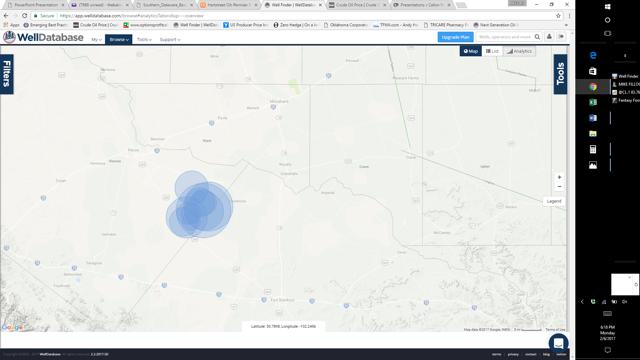

Concho recently stated there was little acreage in the Permian to acquire at a reasonable price. This shows that operators are focusing on the area, due to very good well results and a stacked payzone. We believe consolidation will continue. The upcoming driving season may push Permian operator valuations higher, and this could also increase activity in the basin. The Delaware Basin is extremely profitable, and with the expectation of costs decreasing faster than in Midland, we believe Delaware Basin economics could match or surpass valuations on a per acre basis. The chart below provides the activity in Reeves County.

|

Name |

Well Count |

CUM Gas |

CUM Oil |

|

OXY USA WTP LP |

72 |

7,548,237 |

5,708,539 |

|

COG OPERATING LLC |

37 |

9,882,762 |

4,789,985 |

|

OXY USA INC. |

19 |

1,813,180 |

1,625,167 |

|

THOMPSON, J. CLEO |

14 |

4,792,593 |

2,331,952 |

|

PATRIOT RESOURCES, INC. |

12 |

1,819,197 |

1,628,389 |

|

CENTENNIAL RESOURCE |

11 |

2,607,557 |

1,009,181 |

|

ROSETTA RESOURCES OPER |

8 |

2,237,934 |

795,618 |

|

PARSLEY ENERGY OPERATIONS |

7 |

925,050 |

475,207 |

|

PRIMEXX OPERATING CORPORATION |

7 |

1,407,558 |

682,560 |

|

BRIGHAM RESOURCES OPERATING |

6 |

1,643,668 |

887,248 |

|

WILLIAMS, CLAYTON ENERGY |

6 |

1,107,492 |

795,378 |

|

JAGGED PEAK ENERGY LLC |

4 |

708,073 |

716,827 |

|

Apache Corporation |

3 |

247,327 |

217,298 |

|

DIAMONDBACK E&P LLC |

2 |

131,310 |

87,188 |

|

ARRIS OPERATING COMPANY LLC |

1 |

493,279 |

82,474 |

|

ELK RIVER RESOURCES, LLC |

1 |

246,786 |

218,139 |

|

MDC TEXAS OPERATOR LLC |

1 |

843,243 |

193,400 |

|

SAMSON EXPLORATION, LLC |

1 |

194,673 |

156,401 |

|

Total |

212 |

38,649,919 |

22,400,951 |

(Source: Welldatabase.com)

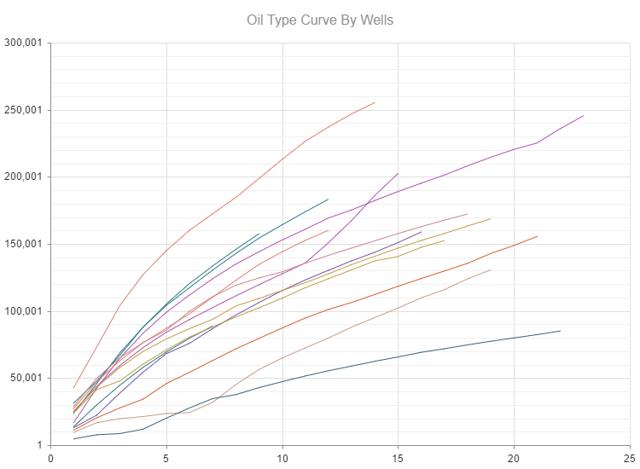

The first private operator with a significant footprint in Reeves is J. Cleo. In October of 2016, it sold 35,000 net acres to OXY for almost $40,000/adjusted acre. It has some of the best results in the southern basin and bigger players are probably considering this acquisition.

(Source: Welldatabase.com)

J. Cleo's individual well results are provided above. Of the 14 completions, two are above or near 250K BO. One did this in just 14 months. The most important variable is time. The most recent wells are outperforming older locations. We expect this to continue as operators get more comfortable with the geology.

(Source: Welldatabase.com)

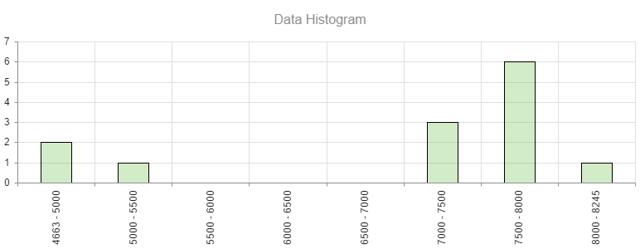

J. Cleo is increasing lateral lengths, like we have seen with many other operators. We expect most operators to move closer to two mile laterals in 2017. This should increase total production. Given the southern Delaware has seen less traffic, there is much more upside to results.

(Source: Welldatabase.com)

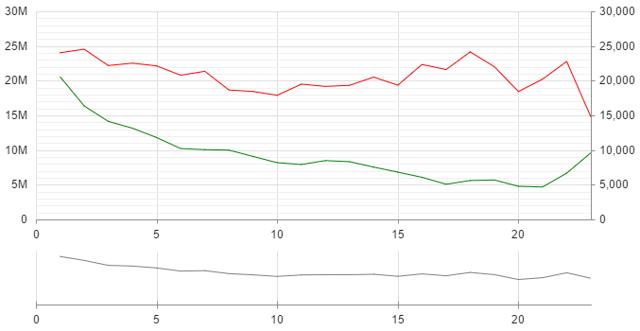

The type curve shown in the graph above. J. Cleo well economics is provided below. It is an overall outperformer. We expect well costs and LOEs to decrease this year.

|

EUR: |

210,813.07 |

|

|

Months: |

23 |

|

|

NRI (%): |

75% |

|

|

Selling Price: |

$50/Bbl |

|

|

Initial Capital Expense: |

$7,000,000 |

|

|

Lease Operating Cost (monthly): |

$91,658 |

|

|

Total |

NRI |

|

|

Total: |

$10,540,653.52 |

$7,905,490.14 |

|

Recovered: |

$10,540,653.52 |

$7,905,490.14 |

|

Total |

NRI |

|

|

Total: |

($9,108,134.00) |

($9,108,134.00) |

|

Recovered: |

($9,108,134.00) |

($9,108,134.00) |

|

Total |

NRI |

|

|

Total: |

$1,432,519.52 |

($1,202,643.86) |

|

Recovered: |

$1,432,519.52 |

($1,202,643.86) |

(Source: Welldatabase.com)

J. Cleo well with an average $1.2MM to payback. Once natural gas revenues (no NGLs) are figured, economics are positive at $227,726.14. It has an average EUR of 210,813 BO in just 23 months. This is very good average well performance.

(Source: Welldatabase.com)

J. Cleo's acreage may some of the most sought after in the US with respect to private operators. These production results have upside as well costs continue lower. Operators continue to implement better designs. Longer laterals, closer perf clusters, increased source rock stimulation, and increased sand and fluids usage per foot. The host of other intervals untested provide upside that is not currently in today's valuation. We will see acreage prices increase significantly in the coming months, and this should be no surprise. OXY is an excellent possibility to acquire J. Cleo's footprint in the southern Delaware. Other operators may be interested including any of the midcap Midland Basin E&Ps, or larger names like XOM, COP, and CVX.

Disclosure: Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access ...

more